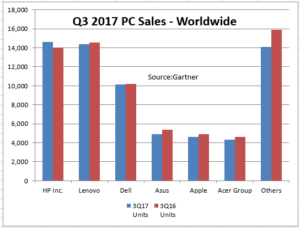

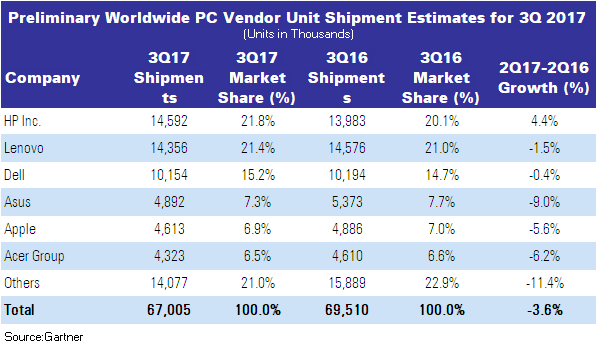

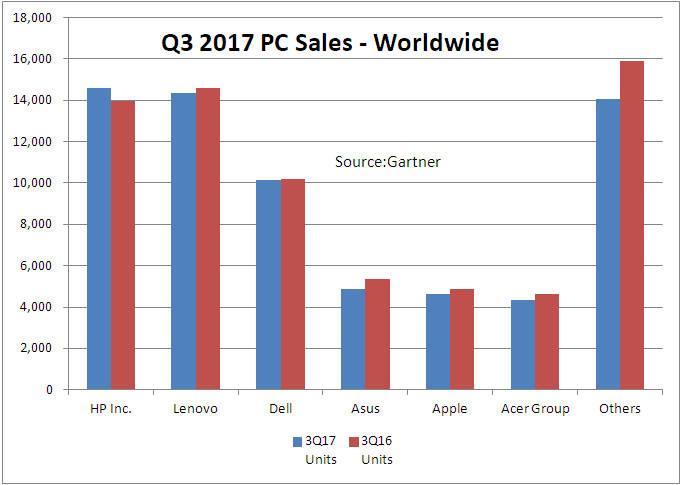

According to Gartner, worldwide PC shipments reached 67 million units in the third quarter of this year, which is a 3.6% fall from the previous quarter. This is now the 12th consecutive quarter of declining PC shipments. In the quarter, HP and Lenovo took the top spots in the PC market based on shipments. However, HP saw an upward trend, as it has experienced five consecutive quarter of global PC growth, while Lenovo is in a downward trend with declining shipments in eight of the last 10 quarters.

HP experienced growth in all key regions, except the US market and the company experienced double-digit growth in Latin America, while in Asia/Pacific it secured positive growth for the fifth consecutive quarter. Lenovo experienced its steepest decline of PC shipments in the US, based on the same quarter in 2016, since it acquired the IBM PC business division in 2005. Lenovo is still facing the dilemma of market share gains versus profitability. Dell’s worldwide PC shipments were slightly down compared with the same quarter a year ago, as it registered its first shipment decline since the first quarter last year.

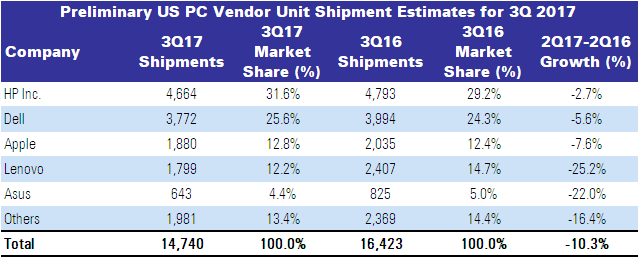

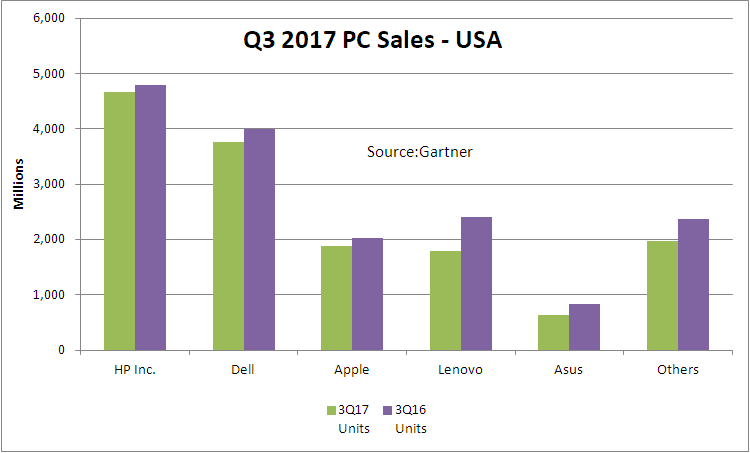

For the US, PC shipments reached 14.7 million units in the third quarter of 2017, which is a 10.3% drop compared to the same quarter in 2016. It was the fourth consecutive quarter of declining PC shipments.

PC shipments in EMEA reached 19 million units in the third quarter of 2017, which is a 1.1% drop compared to the same quarter in 2016. Eastern Europe is experiencing flat to small unit declines as demand is not improving, and there is no obvious impact yet from the Windows 10 migration in the business segment.

In Asia/Pacific, PC shipments reached 24 million units in the third quarter of 2017, which is down 2.1% compared to the same period last year. While consumer demand remained low, PC demand in the business segment remained steady, especially for notebooks. In China, the PC market is estimated to have declined by 5% in the third quarter of 2017, with more stability in the business market, particularly in large enterprises, than in the consumer space.

Mika Kitagawa, principal analyst at Gartner believes that while there were signs of stabilisation in the PC industry in key regions, including EMEA, Japan and Latin America, the relatively stable results were offset by the US market, which saw a 10% drop, compared to the same quarter in 2016. She also noted that business PC demand, led by Windows 10 upgrades, continued to drive PC shipments across all regions, but its refresh schedule varies by region.

Kitagawa also pointed out that there are ongoing component shortages, with DRAM shortages getting particularly worse during the third quarter of the year compared with the first half of 2017. Also, weak back-to-school sales were further evidence that traditional consumer PC demand drivers for PCs are no longer effective, although business PC demand is stable in the US, but demand could slow down among SMBs due to PC price increases due to component shortages.

Worldwide PC shipments declined 3.6% in 3Q17

Worldwide PC shipments declined 3.6% in 3Q17