Smartwatch – Since Apple announced its Apple Watch with a release date of “some time” in 2015, many asked why Apple would make such an announcement without having the device ready for shipment. This is a very good question indeed.

Apple, as one of the global top CE brands, does typically finish its tasks before going public with a product. So why not in this case? Some analysts see this as a sign that Apple fears losing too much ground in the up and coming wearable market. I don’t know if this is the real reason, but I know that the Apple Watch will not be released this Holiday Season. Many, including yours truly, have argued that the smartwatch market needs Apple to really take off.

NPD already has a tracking service for smartwatch sales indicating that the devices are strongly expected to peak around the holidays. This would make the above scenario a little more likely.

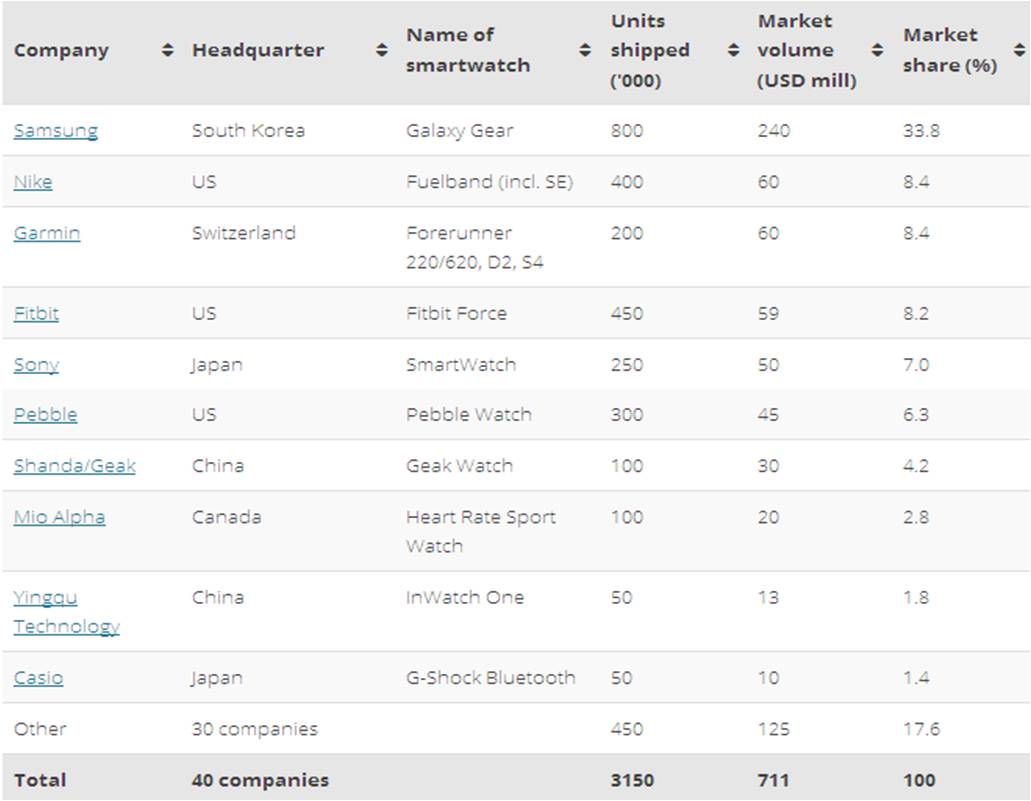

There is also the Smartwatch Group, a Swiss based consulting and media services group that published a smartwatch sales chart for 2013. The group saw the smartwatch market growing from 300,000 units sold in 2012 to over 3 million in 2014.

The table shows the fundamental issue with all data published so far. What is the definition of a smartwatch? While we all have a clear understanding what the term means, we have no agreement from the market research firms on what is counted where.

For example, the Fitbit Flex is obviously a fitness band, as it does not tell the time. This assessment would be based on the definition of a watch. On the other hand, the Fitbit Charge does the same thing as the Fitbit Flex but it also tells the time. Looking at the table above, we can see that the Fitbit Charge is not listed as a smartwatch, so is it counted in the sales numbers or not?

Without a clear definition of what is included and what is not, sales numbers are somewhat misleading, to say the least.

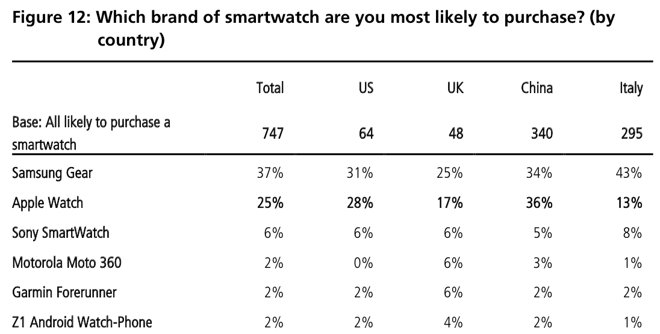

UBS has now released the results of an international consumer survey on how likely users are to buy a specific type of smartwatch. The results are summarized in the following table.

The survey showed that about 10% of consumers said that they are very likely to buy a smartwatch in the next 12 months. According to their math, this will account for 24 million Apple Watches sold in 2015, if the Apple owners follow the same trend. This number will grow to almost 68 million by 2018.

When we look at the above table though, we see that while the Apple numbers are great for a new product, it will not be enough to make them market leaders overnight. It will, however add credibility to the product category. Seeing Apple taking only 25% of the market in 2015, this would mean that the smartwatch market will sky-rocket from 3 million units in 2013 to roughly 100 million in 2015. For comparison, the Business Insider sees the smartwatch market grow from 20 million in 2014 to 35 million in 2015.

The numbers also indicate a trend among consumers which we also saw also after the introduction of the smartphone and tablet. Even with a wider availability of brands, consumers seem to focus on one or two brands that carry the load of the initial market adoption. If this consumer behavior is also true for the smartwatch, other brands will have to fight for years until they can secure any significant market share. Of course this is real life and anything can happen, I just wouldn’t bet against Apple and Samsung for now. – Norbert Hildebrand