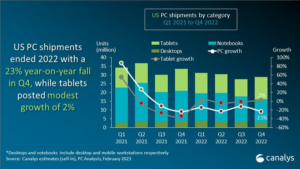

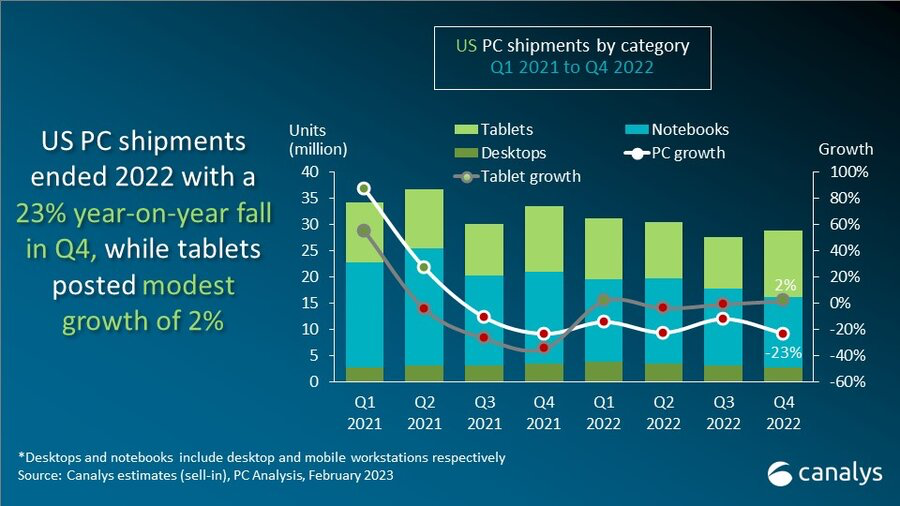

PC shipments in the US experienced a significant decline in Q4 2022, with a 23% drop year on year to 16.1 million units. This decrease in demand has been attributed to high inflation and economic uncertainty. Notebooks saw a 24% decline, desktops experienced a 22% fall, and tablets managed to grow by a modest 2% due to discounting and promotions during the holiday season. Throughout 2022, US PC shipments fell by 18% while tablet shipments remained flat compared to 2021.

Analysts at Canalys anticipate that the PC market will continue to face challenges in 2023, with subdued demand and inventory corrections causing PC shipments to fall by an additional 12% and tablet shipments to decline by 15%. The market research firm believes that the US PC market is currently in a phase of extended decline as it contends with inflation and stabilizing demand post-pandemic.

Commercial shipments faced a particularly significant decrease in Q4 2022, as businesses grappled with higher interest rates and budget cuts. The growth in hybrid working during 2021 and early 2022 has slowed, leading to a decrease in the procurement of new devices. Analysts also expect continued PC shipment declines until Q4 2023 and a 12% overall decline in 2023. However, the firm also sees potential for recovery later in the year, driven by improving business sentiment and normalized inventory levels. By 2024, the PC market is expected to accelerate due to increased consumer spending, Windows 11 upgrades, and education demand.

In the American desktop and notebook market, HP led the way in Q4 with 4.6 million shipments, but Dell surpassed them in overall 2022 shipments. Lenovo came in third place for both the quarter and the full year. Apple experienced the smallest decline among top vendors in 2022, and Acer secured a spot among the top five for overall shipments during the year.

Regarding the US tablet market, Apple dominated with a 42% market share in 2022, shipping 5.8 million iPads in Q4. Amazon’s tablet shipments slightly declined in Q4, but they still achieved a 6% growth overall in 2022. Samsung maintained its third-place position, experiencing a 15% growth in Q4. TCL had a remarkable 79% growth throughout 2022, while Microsoft’s tablet shipments declined by 42% in Q4, but the company still managed to remain among the top five vendors for the year.