Samsung Electronics delayed the launch of its 99-inch microLED TV launch, because production cost increases as the screen becomes smaller according to Korean sources.

Samsung uses microLEDs that are 50x20um and inserted onto 9.7″ PCB modules. A display can be made without size and shape restrictions by connecting the modules as long as it fits the 9.7” module scheme. Samsung Electronics said it would release a 110″ microLED for home use at the beginning of this year, and that it would release the 99″ model in the first half of the year. The 88/76-inch model would be added within the year. However, the 99″ model has not yet been released. Samsung Electronics explained that “there is a lot of demand for 110-inch micro LEDs, so we are responding first”, but the reality is that the ‘price’ is the main cause of delays in the launch of new microLED products.

The price of a 99″ product should be lower than that of the existing 110″‘s, 170 million won ($95,700) price, but the smaller the screen size at the same resolution has a higher cost. That is different from OLED where the LG Electronics’ 88″ 8K OLED price is 47 million won ($41,000) and the 83″ 4K OLED TV price is 10.9 million won ($9500).

Why Does it Cost More?

In order to make a small product while maintaining the same resolution (4K level) as a 110″ microLED, more than 24 million chips must be transported to a smaller PCB than is used in a 110″ product. The pitch becomes tighter, and the yield is reduced. The cost increases when the number of repair processes to replace bad sub-pixels increases. Even with a 99.9% yield, 25,000 microLED chips must be replaced. Therefore, the price of the smaller product is higher than the larger product, so Samsung Electronics chose not to launch the smaller product.

It is the reason that ultra-large products over 100″ came out first. Samsung Electronics introduced ‘The Wall’, a 146″ commercial microLED display in 2018, and a 110″ micro LED for home use last year. The market is quite small as Samsung Electronics’ commercial (B2B) and household (B2C) ?LED product shipments are projected at 400 to 500 units, up from 100 last year.

In the future, Samsung Electronics plans to reduce the microLED process steps by applying ‘R (Red) G (Green) B (Blue) One Chip’ transfer technology. RGB one-chip transfer refers to a technology that implements RGB on a single chip.

In the past, ‘RGB individual chip transfer’ was used to transfer individual RGB pixels to the substrate. When RGB is made into one chip, the chip size is larger than that of conventional RGB pixel chips, so transfer is easier (relatively). In addition, the RGB one-chip method reduces the number of transfers to the substrate by two-thirds and shortens the process, making it possible to improve the yield. The number of repair processes can also be reduced, thereby lowering product cost. In addition to the RGB (3) one-chip method, Samsung Electronics is also known to be reviewing the ‘RGBRGB One-Chip’ (Multi Die) technology that makes RGBRGB (6) into one chip.

Samsung Electronics placed an order for microLED equipment from its partners in the first half of the year, but that order was placed 1-2 months later than expected. These devices are for micro LED products to be released next year.

By using 20 ?LEDs, in their Crystal LED displays, Sony may be avoiding the issue. (BY)

Barry Young is the CEO of the OLED Association

Analyst Comments

The problems of LED costs being ‘per pixel’ rather than ‘by area’ are long standing and I gave a lot of background on them in 2017 (What LED Has to Do to Be Truly Disruptive) and in 2019 (LED Doesn’t Scale Like LCD). I’m also reminded that when I started in the display industry, it was based on CRTs and it was said when I joined the industry that ‘LCDs will kill the CRT in five years’. It took over twenty years to happen, although at all times, the view was that it would take five. I don’t think that microLED will take 20 years to become successful as a mass and high volume product, but it is now five years or so since Sony launched its Crystal LED display and about 10 years since it first showed a microLED TV. It keeps looking as though microLED is ‘a few years away’ as a volume product.

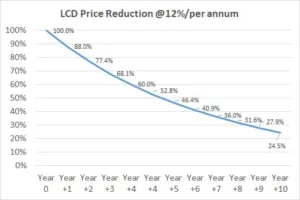

One of the challenges for all competitors to LCD has been the relentless driving down of TFT LCD cost over the last two decades. The technology has been a ‘moving target’, with around 12% per year, every year. However, the scaling of LCD substrates has (probably) stopped and it’s hard to see where dramatic cost reductions would come from. Frame sequential LCD (where the red green and blue components are displayed sequentially, eliminating colour filters) was seen as the big potential technology for cost reduction, but it struggles with high speed and high frame rates have become popular.

LCD price scaling – at 12% per year cost reduction, any competing technology has to be a quarter of today’s cost in ten year’s time.

Samsung is using PCBs for the LED modules, but Korean sources also said a few days ago that Samsung is looking at using LTPS for the 9.7″ modules. That could help with yield and some other challenges of microLED, such as driving, but is going to keep cost relatively high.

Making RGB LEDs is not trivial. Up to now Red and Blue/Green LEDs have been made using different technologies. That complicates driving as well as manufacturing. An alternative way is to use QDs or phosphors to convert the light from blue LEDs but that also has challenges, although Nanosys and GE are optimistic that they have potential solutions. (BR)