LED displays, that is displays where the pixels are actually LEDs, not just LCDs backlit by LEDs, were everywhere at ISE this year as they had been at ISE and Infocomm last year. Somebody told me that there were 120 companies from China with LED displays at the event!

Now, LEDs are fantastic displays, but they were developed in a world of special requirements and project sales. Most LED displays have been different resolutions and shapes, to fit the spaces and applications, with little standardisation. The LEDs are made into arrays called modules and multiple modules are then put into cabinets. Cabinets are arranged in arrays to form complete displays. In that way, they are very flexible. However, it meant little or no standardisation. At Infocomm in 2015, one sales lady from a leading company told me that she had ‘never quoted the same thing twice’.

Moving towards a Commodity

Over the last couple of years there has been a trend towards trying to turn LED displays into more of a commodity product and this trend was again evident at ISE.

Over the last couple of years, a number of vendors have adopted 8:9 aspect ratio modules, rather than square ones. That means that modules can be put side to side to match the 16:9 aspect ratio of commodity displays. Some vendors (Leyard & Philips spring to mind, but there are others) have 16:9 modules that either are a quarter of the size of 55″ LFDs or the same size so that they can fit the same size. They also have HDMI interfaces to connect easily to standard devices.

The big bragging rights in LED have gone to those that can put the LEDs closer together, reducing the pixel pitch and starting to reach the kinds of sizes and resolutions seen on LCDs. Last year, Silicon Core and others had 0.9mm pitch, but this year there were displays down to 0.7mm. That’s getting close to a 55″ FullHD LCD which has a pitch of around 0.63mm (and there are promises of LED displays down to 0.2mm using chip-on-board technology which we covered in a recent Display Daily CSP LEDs Are the Next Step in Development)

So, the big remaining question is how do you get the prices of these fantastic displays down to reasonable levels? The key to this is getting to understand what is controlling the cost of such displays.

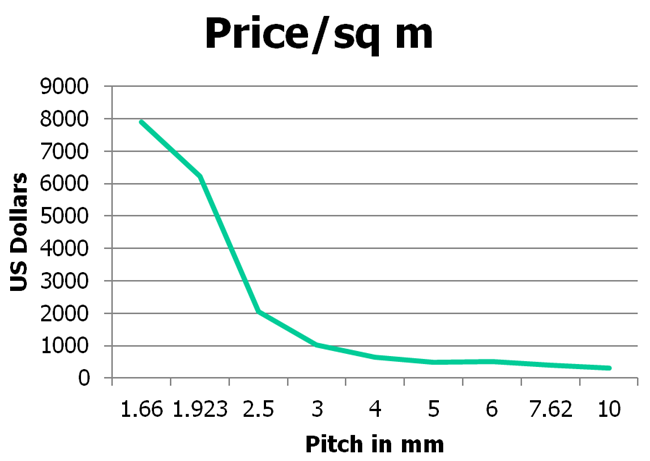

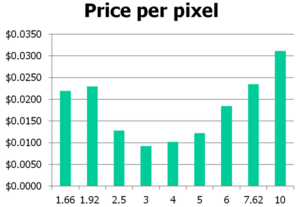

About a year ago, I was given access to the full price list of an LED display maker and that allowed me to get my analyst side working. One of the factors I looked at was ‘cost per pixel’. That was an interesting exercise and showed that the cost per pixel was minimised at around 3mm.

At larger pixel pitches, the cost tends to increase in mountings and the full system. However, at smaller pitches, the price went up as well. The interesting point is that the cost scales with the number of pixels, not the area. Converting that to a cost per square metre means that the price goes up exponentially as you reduce the pitch while maintaining the overall resolution in terms of pixel count.