NSR has examined the UltraHD market and shared its forecast for the future, in a new report. There is a debate ongoing about the long-term prospects for the format, with some expecting it to become as widespread as current HD services, and others predicting a repeat of 3D TV.

NSR expects that the reality lies somewhere in the middle. SD and HD channels will remain dominant, and UHD will be used for premium content such as live sporting events.

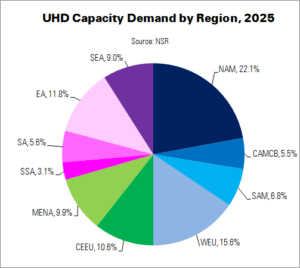

By 2025, NSR expects platforms in all regions to offer a ‘small handful’ of UHD programming via leased satellite capacity, totalling just under 150 TPEs. Around half of this capacity will be leased in North America, Western Europe and East Asia (mostly Japan and South Korea). The removal of SD channels will free up capacity for more UHD content.

OTT will have a ‘huge development’ on the future of UHD in developed markets. The earlier accessibility of OTT content on platforms like Netflix has created additional competition, and is spurring DTH, IPTV and cable platforms to speed up their UHD trials. However, the longer-term impact of OTT will be to reduce overall revenue opportunities for pay TV platforms. Greater OTT competition will restrict pay TV subscriber growth, especially in North America, Europe and East Asia. The higher bandwidth requirement for UHD versus HD, even with HEVC encoding, will also impact adoption.

This means that, in developed regions where there will be limited subscriber growth, there will also be reduced revenue opportunities, making it more difficult to lease UHD capacity and acquire content and equipment. While UHD is expected to slightly increase ARPUs, the overall breadth of content will remain low.

In contrast, developing regions are driven by new (but low ARPU) subscribers. Customers in these areas tend to be price-sensitive and avoid premium services. The ‘vast majority’ of subscribers would pick a large bundle of SD channels, rather than a single UHD channel for the same price. This preference, along with a ‘challenging environment’ for up-converting ARPUs, will limit long-term UHD channel growth. Low disposable income levels will remain the main barrier to UHD adoption.

In the long term, capacity pricing declines will help pay TV platforms to lease more capacity for UHD channels. However, ARPU growth will remain restrained by the impact of OTT. Increasing ARPUs will need to be balanced against the possibility of driving customers to cut the cord.

NSR does not expect UHD to drive a new, untapped revenue stream, but to deliver modest benefits to satellite operators and pay TV platforms alike.