TV makers can join the ranks of companies benefiting from the stay-at-home trend forced by the pandemic. Shipments of TVs jumped by 16% Y/Y in Q3 2020, according to the latest update of the DiScien Major Global TV Shipments and Supply Chain Report, available to subscribers through DSCC. The report covers shipments of the top 15 global brands: Samsung, LGE, TCL, Hisense, Sony, Skyworth, TPV (Philips), Sharp, Xiaomi, Vizio, Haier, Panasonic, Changhong, Konka, and Toshiba.

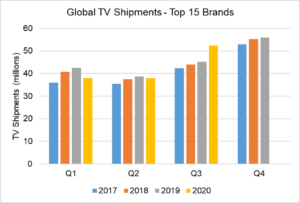

Global TV Shipments of Top 15 Brands by Quarter, 2017-2020

Q3 shipments totaled 52.5 million, a 16% increase over last year and the best Q3 since at least 2016. The strong Q3 brought YTD shipments to the positive column, now up 2% Y/Y at 128.3 million units.

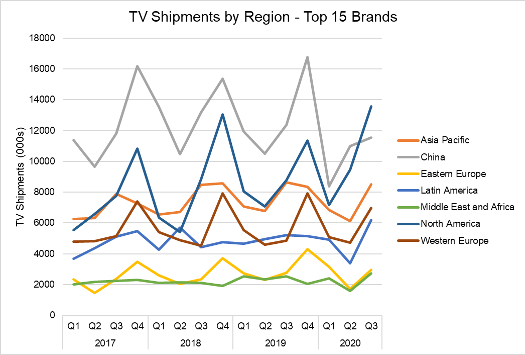

The picture of shipments by region shows that the demand was driven almost entirely by the developed markets in North America and Western Europe, as shown in the next chart here. The chart of regional shipments by quarter shows that most regions have a peak in demand in Q4, with the exceptions being regions that are at least partly south of the equator: Asia Pacific, Latin America and Middle East and Africa.

Shipments in Q3 in North America surpassed even the Q4 demand in the last three years, up 55% Y/Y to 13.6 million units. This follows a Q2 2020 which was also up 34% Y/Y. North America TV shipments YTD are now up 26%. Western Europe was a bit slower to join the party, as Q2 shipments were only up 2% Y/Y, but Q3 shipments increased 44% Y/Y to 7.0 million units. Western Europe TV shipments YTD are now up 12%.

TV Shipments of Top 15 Brands by Region, 2017-Q3 2020

In contrast China, which has largely been unaffected by the pandemic since Q1, has seen TV shipments stall. Apparently, the Chinese can go about their daily lives normally, and are not stuck at home watching TV. TV shipments in China were down 7% Y/Y in Q3 to 11.6 million, and YTD shipments are down 11%.

Latin America has also been hard-hit by the pandemic, but this has not translated into increased TV shipments. While shipments in Latin America increased 19% Y/Y, at least a part of this may be attributed to re-stocking inventory depleted in Q2, when shipments decreased 32% Y/Y. Combining Q2 and Q3, Latin American TV shipments were down 6% Y/Y, and YTD shipments are down 2%. Eastern Europe and MEA showed a similar pattern, up Y/Y in Q3 but flat or down YTD.

The DiScien Major Global TV Shipments and Supply Chain Report covers TV shipments from the top 15 global brands and provides shipment information by screen size, resolution, and region, allowing users to analyze market demand, brand dynamics and product trends by region. DSCC Weekly Review readers interested in subscribing to the this report should contact [email protected].