Global TV panel shipments will reach a new record level this year, of 265 million units, says IHS. The increase represents a 5% YoY rise, despite the strengthening dollar against other currencies. IHS also expects a 9% increase in area shipments for the year.

Consumer demand will be high for large and UltraHD TVs (UltraHD panels are forecast to reach 15% penetration this year, with 40 million units shipped) in 2015. This is causing TV makers to be concerned about the possibility of tight panel supply – even though the rising dollar is cutting import prices on sets.

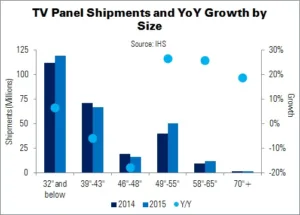

Changes in the production mix are resulting from the trend towards larger sizes. 27% YY growth is expected for 49″ – 55″ displays this year, and 26% growth for 58″ – 65″ units. Sub-40″ displays will only grow 2%, however.

Global set makers like Samsung and LG Electronics are sticking to their aggressive shipment plans – but panel makers like Samsung Display and LG Display face challenges to increase volume to meet area demand. “These two Korean panel makers could experience a tightening of capacity in the second half of 2015, because of planned production-line adjustments”, says IHS’ Yoonsung Chung.

Other panel makers, especially in China, are set to increase their 2015 TV panel business targets. However, as the gap between panel and set shipments widens, there is a fear of inventory build-up. Slowing TV sales and the strong dollar have raised the possibility of brands lowering business targets. TV panels are mainly manufactured in East Asia, and comprise the largest portion of TV material costs. Hence, when the dollar is strong, TV brands suffer.

UltraHD TV panel shipment targets are also expected to reach a new high this year. The 40 million figure mentioned above represents 108% YoY growth. Korean panel makers will lead the market, with a 57% share, followed by Taiwanese and Chinese makers at 27% and 12%, respectively.