Following the split between Samsung’s TV business and Sharp’s panel business, (Sharp Shuns Samsung TV Panel Business), further re-alignments are reported from the supply chain. As well as the Hisense (Hisense Joins Samsung on Sharp Block List) change, the need for Samsung to buy more panels from its own fabs means that it has fewer TV panels to sell than before, so is expected to reduce its supply to Sony, who will look at AUO and LG Display as possible suppliers, according to local sources.

Foxconn is understood to have radically upgraded its plans for the sale of Sharp own brand TVs globally in 2017 to around 10 million sets.

Analyst Comment

Back in July, in a Display Daily article, Ross Young of DSCC said that Samsung might close its L7-2 fab along with the L7-1 which it has recently closed and which is one of the factors in the current tight LCD panel supply, although a decision would be likely to be based on profitability. In a recent blog, David Hsieh of IHS argued that this is unlikely for three reasons:

- 75″ demand is increasing and this fab is well positioned to make those panels

- The L7-2 can make PLS (Samsung’s version of IPS) panels and these are used in high end monitors.

- The fab makes a lot of 40″ panels and is the only fab optimised for 40″ after the L7-1 closure. If Samsung stops completely, it will upset customers that also buy other panels from the firm.

On that basis, Hsieh sees the balance of probability being that Samsung will maintain the fab.

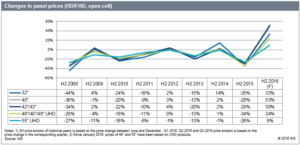

In the blog, Hsieh published this chart which shows the impact of price increases in the second half of 2016. The chart shows the change in prices for TV panels in the second half of each year.(BR)