China’s extended reality (XR) market in 2023 witnessed a stark contrast: Virtual reality (VR) plummeted, while augmented reality (AR) smart glasses thrived, according to a recent announcement by Counterpoint.

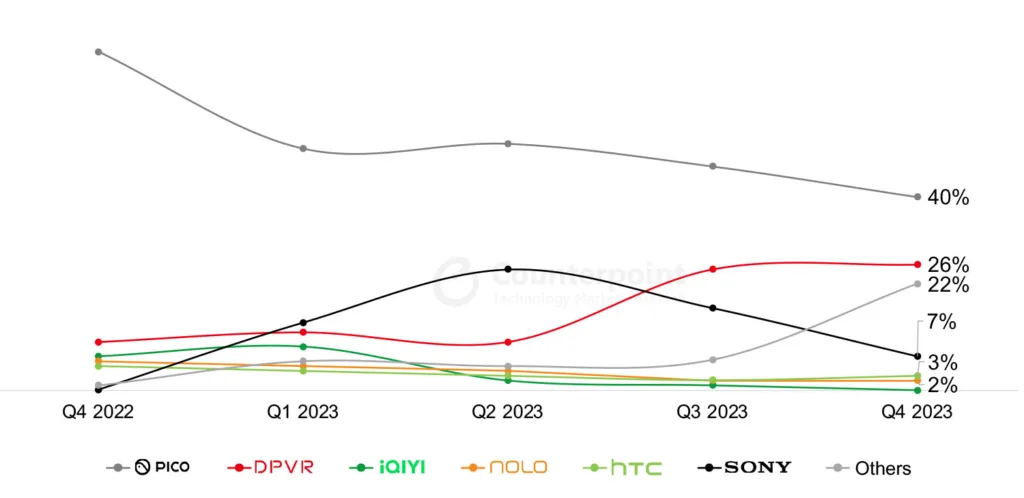

VR shipments in China dropped dramatically by 61% year-over-year in 2023, with a particularly sharp 65% decline in the second half. This downturn was driven by reduced consumer interest and decreased investment from major players, such as ByteDance, which impacted its Pico VR’s market performance. Sony also saw its PSVR 2 shipments halve as momentum faltered. Despite the general market contraction, enterprise-focused DPVR saw shipments double, highlighting a niche resilience within the broader decline.

Conversely, the AR smart glasses market surged by 67% year-over-year, driven by continuous innovation, enhanced optical technologies, and aggressive marketing by leading OEMs like TCL-RayNeo and Xreal. These firms not only led the market but also posted significant sales growth, with TCL-RayNeo and Xreal up by 126% and 135% respectively.

Looking to 2024, Counterpoint says VR may see a revival with the entry of Apple’s Vision Pro, which, despite expected modest sales impact, could stimulate industry major Chinese tech firms to react. Meanwhile, AR is set to continue its upward trajectory.