Back at CES in 2010, I met in a hotel suite with a firm that had a new approach to TV that struck me as significant, useful and important. A friend had gone to work for the firm and wanted me to know about its approach to ‘TV in the Cloud’. The technology hasn’t taken over the world of TV, but it could, still, take over much of it. So I was pleased to see a panel discussion between the proponent of that approach, ActiveVideo, Commscope and with participation by Omdia.

The session was organised by DTVEurope and was moderated by Stuart Thomson of that publication. The subject was “TV as an App” a topic that was also recently talked about by Mark Zuckerberg of Meta a few days ago. The speakers were

-

Chris Linden – COO of ActiveVideo

-

Phil Cardy – VP Product Management of Home Networks at CommScope

-

Luke Pearce – Omdia Senior Analyst, Media and Entertainment

I see lots of this kind of event, but, as I mentioned, I have been watching what ActiveVideo has been doing for a long time. The company was the first to put to me the idea of running the front end of a TV (or STB) in the cloud and sending the interface to the set over the internet as a simple video stream. The advantage is that you can run any level of sophistication in the TV front end and be independent of the processor in the set. You can also get a consistent user interface on any set, box or device that can display the video. The firm told us at the time that you could run many different users from a relatively small number of servers. It’s more efficient than running each user with a separate CPU and GPU.

However, the company didn’t take over the world, and several years ago I spoke to some who had looked at it and found that one of the challenges was that there was a cost involved with getting that stream from the server to set or box. Now, that is not a problem for a TV service provider or ISP who is generating revenue from the user to cover the cost, but didn’t make much sense for a TV maker who had no financial relationship with the customer.

In 2013, Liberty Global adopted the CloudTV software platform and then in 2015, Arris and Charter acquired ActiveVideo which, by then was providing the Charter ‘Spectrum Guide’. In 2019, the firm launched AppCloud which could use the public cloud as the back end with a lightweight client that could work on any GPU-enabled device with an IP connection.

Commscope is a supplier of communications technology and networking equipment for those that distribute content as well as those that receive it. The company developed from supplying cable infrastructure. In 2016, after an IPO in 2013, the company bought Arris and Ruckus Networks.

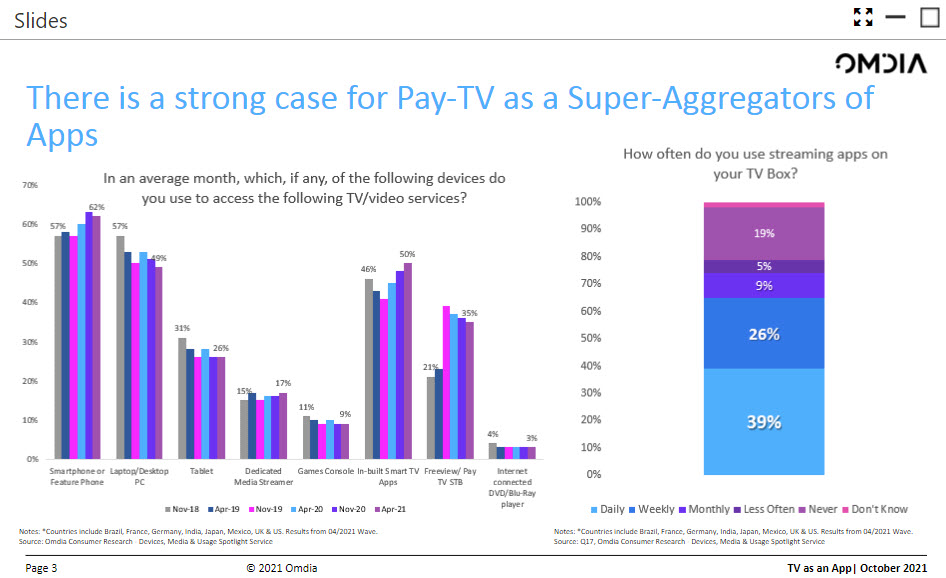

Pearce of Omdia started by ‘scene setting’ in TV. Netflix is now bigger than Pay TV and growth in streaming video is accelerating both in the number of users and providers. Users are accessing more and more services and the average in the US is now seven. That means that searching for content and logging what has been watched is becoming increasingly frustrating. That means that the top players in the future will be ‘super aggregators’ that turn all these services into a comfortable experience. Those super aggregators could be Pay TV operators, but need to provide content across devices, using apps. Although STBs are still significant, users like SmartTV ‘app-like’ experiences. 65% of viewers are using their STBs for streaming content either daily or weekly. That means that PayTV operators need to work with streaming suppliers.

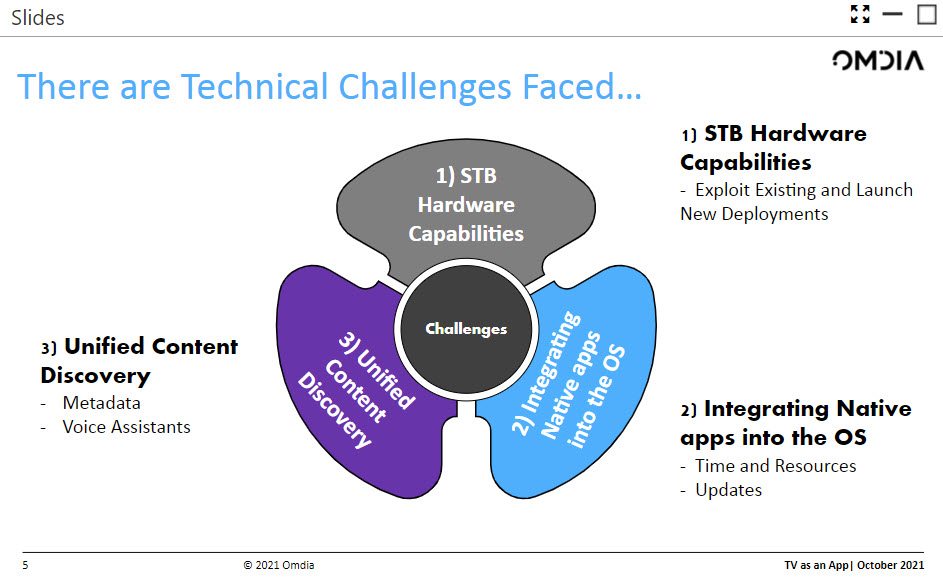

Streaming services can ‘piggy-back’ on the PayTV subscription base. PayTV apps need to be able to work across devices and integrating native apps into the box OS can be a significant advantage for regional and niche markets. Maintaining access to this regional and local content can be critical for maintaining PayTV subscriptions. Unified content discovery is also important. but tricky to achieve especially for voice operation.

Using the cloud can help reduce the local hardware burden. The cloud can also leverage data from across different services including analytics and provide a consistent user experience across different devices.

Do Service providers have to move to apps? Pay TV used to see it as competition, but now PayTV has to offer an ‘app’ kind of experience to avoid being left behind. The strength of PayTV operators can also depend on exclusive or original content. Cardy suggested that operators should not underestimate how much Amazon and Netflix spend on the user experience ‘UX’ and discovery. Scale is a huge challenge. Many people don’t watch live TV any more. The viewing experience is just about accessing content.

The current installed base of STBs can constrain what can be done. Supporting recent codecs is very important, and GPUs are needed for 3D graphics and some old STBs don’t have GPUs. Memory can also be a big constraint – more RAM in every end point ‘costs real money’ as the apps are getting bigger and none is getting simpler. Cardy said that STBs from the last five years are probably good enough at the moment, but anything older is likely to struggle. Linden pointed out that operators often have mixed inventories with a range of GPUs and RAM profiles and that makes it tricky to support consistent experiences.

Unsurprisingly, Linden emphasised the value of developing the UX in the cloud and rendering the UX using a GPU on the device. He pointed out that the big screen in the living room is ‘valuable real estate’ – it’s where content publishers want to be.

Cardy pointed out that Android TV can be a help in getting a consistent interface across different boxes, but operators lose some control to Google and they don’t like that. (later, in questions, the amount of capital behind Android TV is huge. STBs have to have a life of up to five and even seven years and operators need to be sure they can get a full life out of the boxes). Broadband is now genuinely ubiquitous and TVs are ‘always connected’. Latency is typically quite low and networks are fast and more reliable than they were. That helps in allowing the use of the cloud.

Turning to issues of content, the big companies are buying a lot of content and using that content to drive scale – and that trend is likely to accelerate. Getting local content and advertising-supported content is important, especially for younger customers, Linken said. Pearce added that if you have that content but can’t integrate with the major streaming apps, you can lose clients who don’t want to have to buy an add-on stick or device.

After a discussion that established that there are no real technical barriers to developing the experience in the cloud and there are real advantages in terms of speed of reaction to new services. Unsurprisingly, Linden said that “the cloud is a win for content providers, operators and consumers”.

Cardy pointed out that issues such as ‘single sign-on’ for a range of different services (we’ve seen reports that the Sky Glass set is seeing some issues with this) and good parental controls are important. He said that operators and service providers don’t want to be a ‘dumb provider’, they don’t want just to have a collection of apps and want to be able to “add value”.

Thomson asked about TV experiences beyond simple video streaming and Cardy pointed out that people want to be able to use their TVs for apps such as video conferencing and it’s simply not viable to do that natively on every STB platform.

Thomson also asked if you can really deliver the same quality of experience with cloud-based services? Cardy pointed out that the BBC now has UltraHD content on ‘the red button’ in the UK and that means that the content is streamed. Start-up and exit times are quick and in many cases the cloud experience is better than using an STB.

Thomson – moving apps to the cloud with migration – who benefits most? Service provider, technology consumer or publisher? Linden – consumer benefits most from wider content availability. That also helps publisher and also minimises versions. Operators benefit by delivering same experience everywhere.

In questions, Linden said that the use of the cloud is different regionally, with Europe and Asia first and Latin America coming later. Pearce highlighted that some markets such as China and India are ‘mobile first’.

Netflix and Amazon Prime are the ‘default apps’ and it takes time to integrate other apps. How do they all get onto boxes? That’s a challenge for STBs, but consumers do expect them to be rolled out quickly. Disney has done a good job at rolling out quickly. HBO Max has a hybrid approach – it has a native app on major devices and has a ‘lighter’ version for less well-distributed platforms. On the one hand ‘the house is almost full’, but on the other hand, there are many new app providers coming and there is becoming real competition between different apps. (BR)

Analyst Comment

Although there was brief discussion of non-video streaming apps, I was slightly surprised that the session didn’t include more on the development of game playing services using the cloud. That’s a big potential market that is enabled by a good cloud-based approach. (BR)