It is time to evaluate display technology trends for 2023. The flat panel display market slowed down considerably in 2022 as demand declined after two years of outstanding growth in demand driven by Pandemic need.

In 2022, the market has been experiencing negative growth, in units, revenue and area shipments. All major application markets including TVs, monitors, notebooks, tablets and smartphones are undergoing decline in revenue and unit shipments. The global economic outlook is still uncertain. The rate of inflation increase is slowing down but a fear of recession is still there.

As I said this time last year, in such uncertain times, product differentiation, newer technologies, higher performance and lower prices will help to drive demand. In 2022, in spite of negative growth in units and revenue for all major applications, advanced products with higher display performance based on miniLED, quantum dots (QDs), and OLED experienced positive growth and increased market share. The flat panel market is expected to recover in 2023. Panel suppliers have cut utilization rates drastically and have delayed or cancelled new capacity plans. Inventories are starting to ease up, and retail prices have come down especially for large size TVs. This will help in demand recovery in 2023.

MiniLED Display: Strong Growth

MiniLED-based displays have been introduced by top consumer brands such as Samsung, LGE, TCL, Apple and others for TV, monitors, notebooks, tablets and auto applications. Cost is still a challenge. LED costs are coming down. Suppliers are also increasing the number of dimming zones per driver IC, improving transfer throughputs and transfer yield rates and integrating supply chains to reduce costs and improve performance. Drastic panel price reduction for LCD in the first three quarters of 2022 will contribute to reduced costs for MiniLED-based products in 2023.

- TVs: MiniLED QD TVs have increased share and shipments with higher display performance, higher resolutions (4K and 8K), larger screen sizes (higher production from 10.5 Gen fabs)) and more product options in 2022 and are expected to increase share and shipments again in 2023. However, the category is still lagging OLED TV shipments.

- Monitors: MiniLED QD monitors have been successful with gaming features (4K gaming at 120Hz): with low response time, auto low latency mode and variable refresh rates from many suppliers.

- Notebooks & Tablets: Apple’s iPad and Macbook Pro based on MiniLED are big contributors to this category expanding sales in 2022 and 2023. Apple is expected to shift to OLED for these IT products in 2024, impacting MiniLED growth in this category in future years.

Technology innovations for MiniLED based display will open up new opportunities for demand growth but cost will be very critical.

Quantum Dot: Growth in Shipments and Shares

Quantum Dot display technology is continuously evolving with new materials and new processes. It is enhancing LCD, OLED and MicroLED and progressing towards next generation self-emissive display.

Most of the top TV manufacturers such as Samsung, LGE, Sony, TCL, Hisense, Vizio, and Skyworth have already adopted QD (QDEF) display technology in their TVs. It has enabled LCD technology to reinvent itself and has created growth opportunities in the TV market with higher shipments and shares. Drastic panel price reduction for LCD can lower QDLED TV costs increasing shipments and share further in 2023..

QD-OLED: Increasing Sales

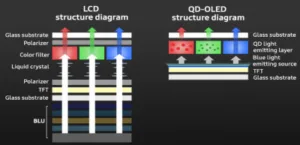

Samsung Display has introduced 65-inch and 55-inch QD-OLED (QD) TVs and 34-inch monitor panels at CES in 2022. Sony and Samsung Electronics are offering QD-OLED TV and Samsung Electronics and Dell Alienware are offering gaming monitors. QD-OLED technology of blue OLED display with printed quantum dot layer color conversion and sub-pixel level dimming, display can achieve expanded color gamut, higher color volume, and color luminosity.

However, there are still many challenges. Blue emitting materials still have efficiency and lifetime issues. UDC has announced that they expect to meet preliminary target specs with their phosphorescent blue by year-end, which should enable the introduction of their all-phosphorescent RGB stack into the commercial market in 2024. The use of phosphorescent blue can help to reduce multiple layers, increase efficiency and lifetime. It can also help to reduce costs and expand existing capacity by reducing the number of blue layers. QD-OLED products sales are increasing. SDC is expected to add 77” TVs and 49” monitors in 2023 using MMG configuration. Further new QD OLED investments are expected in 2023.

QD OLED architecture – Source: Samsungdisplay.com

QD OLED architecture – Source: Samsungdisplay.com

Quantum Dot and MiniLED: Coming to AR/VR/MR

Meta has introduced the “Meta Quest Pro”, a high-end mixed reality device, in 2022. Meta Quest Pro uses dual LCDs (2.48”), with miniLED backlight and QD technology. This is the first time Meta has introduced a QD and MiniLED dual LCD-based device. LCD is the leading technology in the VR market. Advanced LTPS TFT LCD is generally used for VR for high resolution displays. It has already achieved more than 1200PPI. Companies are targeting 2000 to 2500PPI resolution in the next two to three years. Local dimming backlights with miniLED can lower power consumption and optimize the image for higher contrast. Fast response LC (liquid crystal) with high-speed backlight switching can offer a clearer image. There is a surge in interests and investments in AR/VR market due to the recent focus by industry leading companies such as Meta, Microsoft, Apple and others.

OLED: Growth in Shipments with Improved Price and Performance

OLED is going through major technology developments in the face of fierce competition which will help increase share and improve price performance.

WOLED TV: Higher Performance & Higher Supply

LG Display (LGD), the leader for OLED TV panels has been continuously improving its WOLED technology, increasing size offerings, expanding capacity and increasing shipments especially in the premium/high-end TV market. LGD has introduced its most advanced OLED panel with EX technology: 30% higher brightness (by applying deuterium), 30% increase in reliability and 34% narrower bezel. Next generation OLED from LGD is expected to have micro lens array, high mobility oxide, high efficiency, real-time compensation and be bezel-less.

OLED IT: Growth with New Product and Capacity

OLED display competes with miniLED in the high-end notebook and tablet market. MiniLED has had a dominant share in 2022. RGB OLED capacity is expected to increase for IT applications in 2024-2025 as many suppliers including Samsung Display are planning to start 8.7 Gen AMOLED fabs for the notebook and tablet market. Suppliers are also bringing major improvements to OLED performance such as tandem RGB OLED stacks, phosphorescent blue OLED emitters, color filter on encapsulation (CoE), rigid plus TFE (Thin Film Encapsulation) substrate, LTPO/Variable refresh and many other technology enhancements. At the same time new G8.7 substrates, IGZO backplanes and rigid plus TFE architecture will help to reduce costs. This will enable OLED to increase share in 2023 and future years for IT markets. Apple is also expected to adopt OLED for IT starting from 2024.

OLED Flexible: Increasing Shares

The global smartphone display market experienced a strong decline in 2022, due to macroeconomic factors, high inventories and a slowdown in the China market. Brands focused more on premium products to improve revenue. Higher sales of advanced smartphone products, especially Apple’s iPhone 14, helped the growth of flexible OLED with more advanced technologies such as LTPO (LTPS + Oxide TFT). Apple’s iPhones and Samsung’s Galaxy products are already using LTPO which has big advantages in lower power consumption and variable refresh rates. LTPO display is expected to have strong growth in 2023 and future years. LCD has been losing share but it is still the dominant technology for global smartphone displays due to lower cost. The smartphone display market is expected to recover in 2023.

OLED Foldable: Growing

According to industry data, foldable smartphone shipments increased in 2022, when the total global smartphone market declined. New product introductions, innovative designs, increased reliability, better features, higher performances and competitive pricing are helping to drive foldable smartphone demands.

Samsung has introduced 4th Gen foldable smartphones, the Z Flip4 and Galaxy Z Fold4, in 2022. Most of the mainstream brands have joined the foldable smartphone market and have been expanding their product line ups. With more robust innovative form factors, better price performances and technology advancements, foldable phones are forecasted to follow a growth path in next five years, but they will occupy a small percentage share of the total global smartphone market.

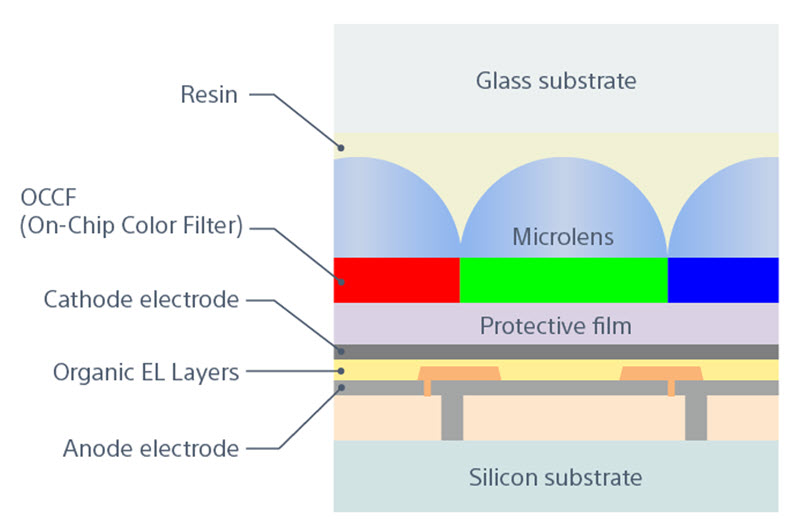

OLED on Silicon (SiOLED): Poised for higher adoptions

OLED on Silicon (OLED microdisplays) generally have higher pixel density than AMOLED. SiOLED microdisplay can be used for both VR and see-through AR. MicroOLED displays can be generally categorized into RGB OLED and White OLED (WOLED). However high resolution RGB OLED microdisplays still face challenges due to a challenging FMM deposition process. White OLED uses color filters to generate the image which can achieve high PPI (4000PPI). However, color filters absorb a very high percentage of the emitted light that limits maximum brightness for microOLED. Sony has been using microLens technology to increase the peak brightness of OLED microdisplays.

According to industry data and expectations, Apple is expected to introduce new Reality Pro Product (2H 2023) which will have dual microOLED plus one AMOLED display with a pixel density of >3000 PPI. Apple’s adoptions of technology will help SiOLED to gain a higher share in future.

OLED microdisplay Source:Sony-semicon.com

OLED microdisplay Source:Sony-semicon.com

MicroLED: Progressing

MicroLED display technology is making steady progress towards commercialization. The technology still faces several complex manufacturing challenges, which will take time to resolve. The success of commercialization and mass production will depend on the ability to scale up for volume production with competitive price performance.

In the year 2023, the flat panel display market is expected to recover. Still. the market outlook is uncertain due to macro-economic factors. In such uncertain times, product differentiation, newer technology, higher performance and lower prices will help to drive demand. (SD)

Sweta Dash, President, Dash-Insights

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insights.com