After this article was published Merck’s Display Division contacted us and suggested that while we had heard the comments about LC development being stopped, this reflected just one of the company’s R&D facilities and not the overall company policy. The company said that it continues to invest in LC development for its clients. Our further comments on this topic are in a follow-up article, LCD TVs “WILL“ Continue to Improve.

Long time readers’ hearts will, no doubt, sink when they see that once again I think I have spotted an inflection point on the topic of liquid crystal (LC) displays.

The term ‘liquid crystal’ encompasses a lot of different chemicals and even within displays, over time there have been a lot of different core technologies from TN to STN to IPS and FFS and VA with variations. There have been others that didn’t make it into the mainstream such as ferroelectric, blue phase (once described in an SID keynote as ‘the future of our LCD TV strategy’ by a leading panel maker) and cholesteric. These days, VA dominates TV, while IPS/FFS does well in IT and smartphones. Each has some pros and cons but, broadly, VA has better contrast (up to 7,000:1 these days) while IPS/FFS has better viewing angles.

The most recent significant new LC material, from my perspective, was the development by Merck, with the aid of LG Display, of a new FFS compund that is used in LGD’s IPS Black technology and BOE’s UB LCDs. I wrote about this not long ago on Display Daily.

Display Week 2023

So at Display Week this year, I asked EMD (which is the US name of Merck KGaA and is by far the dominant supplier of LC materials), what they were doing to push LC materials for displays on to the next stage. They told me that they have no major R&D for LC materials in larger displays, although there is some work with reactive mesogens in the VR/AR field. They are developing LCs for privacy windows and antennas, but they told us that ‘there is no pull from clients’ for significant development in LC materials.

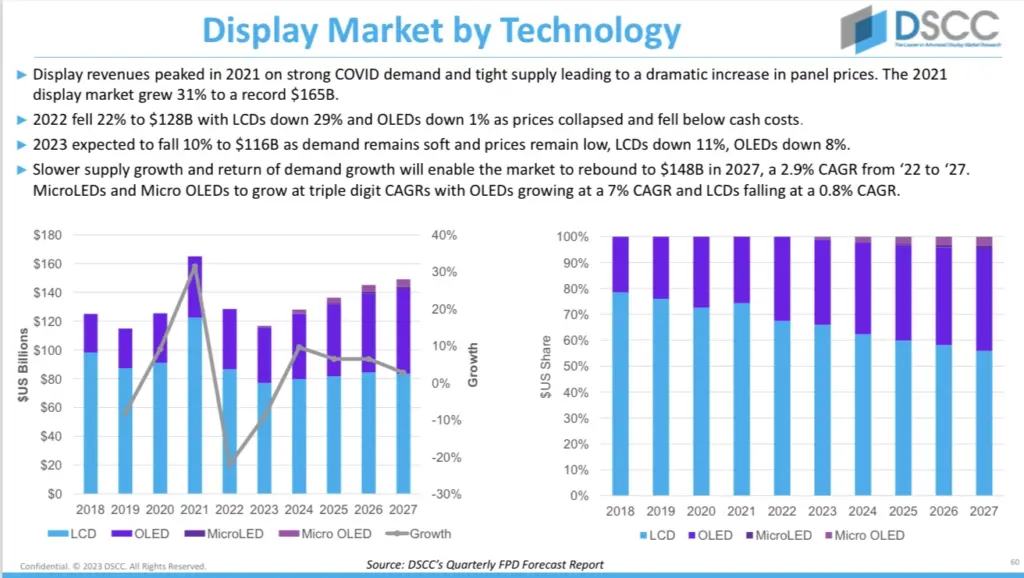

That shouldn’t have been a surprise to me – I have been talking about the switch to OLED and other emissive displays for the premium end (and later the mainstream) of the display market for a lot of years. Still, after decades of reporting on LC developments, it took a moment to sink in!

Those that have seen me give talks over the last ten years will have usually seen me refer to the ‘LCD Monster’ that for years killed competing technologies and then swallowed nearly all the revenues in the business. OLED was, and continues to be, the main threat to that dominance. (I plan to talk more about OLED at Display Week in another article).

I first saw an LCD in the R&D Laboratory of Marconi, when I was an apprentice back in January or February 1971. It was a very poor quality and crude device that had been made by hand in the Lab. The scientists at the firm really had little or no idea what to do with it. “Maybe we can use it for a kind of programmable equipment label?”, they suggested as it was too slow and had too little contrast for much practical use. To come as far as the industry has today is quite unimaginable.

Big Changes Since the ‘80s

In the early days of notebook PCs, the displays were initially monochrome and horrible slow. We moved to STN colour and they got a bit better, although they were still slow (anyone remember ‘mouse trail’ settings so that you didn’t loose the cursor?). When I was on the sales and marketing side of the monitor business, I remember seeing my first active matrix LCD in a monitor when I was working for a Japanese CRT monitor maker. It was clearly the future, although there was concern.that although you could add value to an analogue system like a CRT, that was going to be much harder with an LCD.

Still the rise of LCD through notebooks, monitors, TVs and smartphones and tablets was irresistible. For a while it looked as though the LCD monster would not only take all the current sales but might starve developers of other technologies of the resources they needed to develop. Fortunately, the pressure put on the Koreans by the ‘free money’ that the Chinese panel makers got to develop their LCD businesses caused them to invest heavily to stay ahead.

Anyway, there will be innovation in LCD still, but in the optical stack and especially in the backlights where miniLED can continue to deliver excellent performance. It the cost of miniLED backlights can trend down enough, they might get into the mainstream markets (although, in the rich US, 80% of TVs are sold for <$500 and just another 10% between that level and $1,000, so cost has to come down a fair bit).

Bob Raikes is semi-retired from the display industry, but still edits the 8K Association newsletter and contributes to Display Daily. He plans to be at Display Week for Display Daily and others.