I recently wrote an article, based on a conversation with an employee of Merck at the SID Display Week in Los Angeles. This was picked up by other news channels and my conclusion that major changes in liquid materials were extended by some others to suggest that LCD TV is dying. That’s not the case.

Merck reached out to me after the call as they did not agree with my comment that LCDs for TV will not see major development in the future.

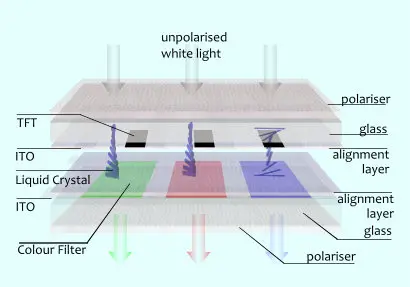

I was specifically talking about the development of the LC layer itself. That’s just part of the sandwich that is known as the ‘cell’. The cell includes the glass, the liquid crystal material, the controlling transistors, the colour filter, the electrodes and the polarisers, so there’s plenty of technology. The cell is what most TV makers buy from LCD panel makers and they then add control circuitry, backlights, TV processing, smartTV functions, audio and casings to make complete TVs. An LCD TV is about much, much more than the cell, but the cell does control some critical aspects of performance such as contrast, speed/response time and viewing angles.

Even if cell development stopped today (which it won’t), LCD TV development will continue with a huge amount of effort going into miniLED backlights, optical components including quantum dots, phosphors and films, as well as interfaces and all the immense amount of circuitry that goes into video processing and the control of the TV.

LCD TV Will Continue to Dominate

Further, LCD TV is going to continue to dominate the flat panel industry for many years to come. TV applications are 70% of the total area of the flat panels made and 90% of the TVs going forward over the next few years will use LCDs. Although enthusiasts love OLED and it clearly has better image quality in many viewing conditions, the cost of materials to make OLED panels is just too high. 80% of the global TV market is priced at <$500 and you can’t buy an OLED panel in the foreseeable future that will allow cost to drop to reach that price level.

Furthermore, even if the material costs allowed OLED to compete with LCD, nobody is going to invest tens of billions of dollars in new fabs to make those OLEDs when the fabs already exist to make the LCDs. Many of the LCD fabs are already or will in a few years, be paid for, so there will be little or no capital cost.

Merck is Still Developing its LC Materials

As Merck emphasized to me on its call to me, the firm continues to develop its LC materials to meet its customer needs. It is the major supplier of the materials in the market and has built a big business on the back of its expertise and materials. On the call, the firm highlighted the UB Cell technology that BOE showed at Display Week in a TV application and which really impressed me and a lot of others.

Merck explained that its LC material database includes 20,000 or so ‘singles’ or chemicals. The mixtures used in LCD TVs typically contain 8-10 different singles in a particular combination to meet the panel maker’s requirements for performance (efficiency, speed, temperature etc). Part of Merck’s success has been that it is able to develop these mixtures to meet the makers’ needs.

In discussing the UB Cell from BOE and, briefly, the IPS Black technology that LG Display has been promoting, Merck confirmed that the kind of material that it is supplying to BOE for the UBCell technology is also available to other makers. However, it is only really useful for factories that already focus on IPS-type panels.

Positive or Negative Delta Epsilon

In talking about the different types of LC architecture, Merck describes makers as using ‘positive delta epsilon’ material or ‘negative delta epsilon’ material – that is to say IPS/FFS or VA, respectively, for their large area TV panels. Broadly, that means whether the LC molecules are parallel to the glass (IPS/FFS) or perpendicular to it (VA). For a discussion of delta epsilon see this Wikipedia article.

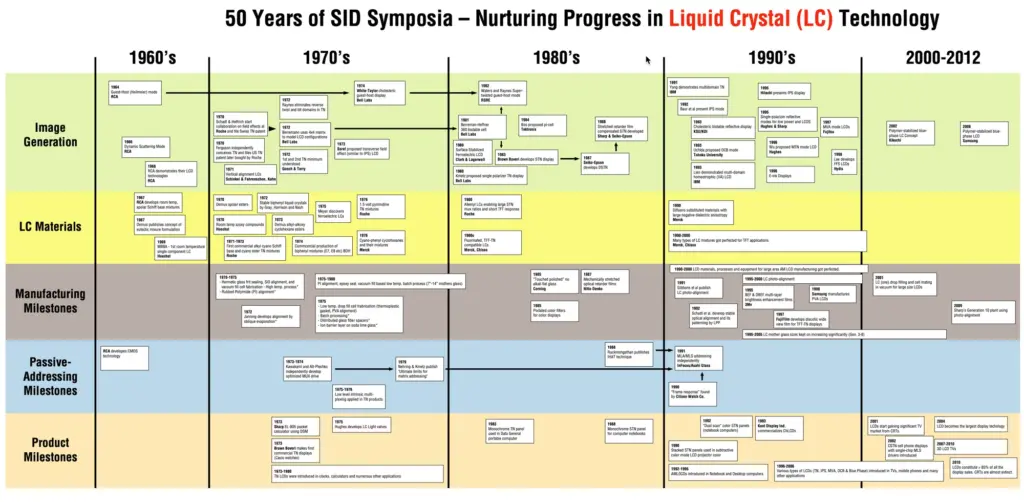

In fact, the firm is dismissive of the idea of ‘different LC modes’. Now, that struck me as interesting partly because the reason for the call was that I had said in my original article that it seemed to me that we might have got to a turning point in the industry where new LC modes were not being developed. Over the decades, I have seen TN, STN, ferroelectric, cholesteric, blue phase, OCB, bistable nematic and probably other modes to add to the VA (including MVA, PVA, PS-VA), IPS and FFS modes that are currently the mainstream.

Nobody will Build Fabs to Replace LCD

I said earlier that nobody is going to invest the amount needed to replace LCD with OLED. However, neither are they going to replace the existing fabs with new LCD fabs. LCD will continue to rule the roost until another technology comes along that is disruptive in terms of not only the materials and unit costs, but, crucially, in terms of investment cost. That’s a key driving force for the work that is going on in EL quantum dots (which were being shown privately by Sharp at Display Week) and in microLED as well as in organic transistor backplanes. Firms are looking at ways of disrupting the market without the vast cost of building an OLED fab. However, it can be very hard to displace an incumbent technology.

So, looking ahead, the future for LCD panel production is going to be based on exploiting the factories that have already been built (or are in the process of being built) that are optimized for either VA or IPS/FFS or, as Merck put it “using ‘positive delta epsilon’ material or ‘negative delta epsilon’ material”. On that basis, it seems unlikely to me that a new LC mode is going to be developed to add to these two key modes. I still believe that there is going to be no new major change to a new LC mode for TV LCDs.

That doesn’t mean that new formulations and technologies will not be developed by Merck and others to improve the transmission, speed and contrast of the panels, but it seems that they will be based on the current LC modes of VA and IPS/FFS.

From my point of view, a slowdown in the technology would not be surprising at this stage of industry maturity and if you check the SID timeline here and reproduced below, you’ll see that the number of major and notable innovations has slowed over time.

Bob Raikes is semi-retired from the display industry, but still edits the 8K Association newsletter and contributes to Display Daily.