So we have a position where, as Norbert outlined recently, the hot new application, virtual, mixed or augmented reality is not really going to drive the display business, which tends to be driven by the demand for area of display. I have often described the LCD makers as the ‘LCD farmers’. The same as farmers, the display makers like to think in hectares (or acres).

They are also like farmers in other ways.

- When the price of beef goes up, farmers increase their investments in cattle.

- That increases the supply of beef, once the cattle are grown.

- So that means that the price of beef goes down again.

- The farmers reduce the number of cattle.

- The supply of beef goes down and the price goes up.

- Go to 1.

That kind of cycle has been seen in the agriculture business for centuries, or even millenia. There really is probably not a solution, in a free market and a similar cycle applies to the LCD industry and is known as ‘the crystal cycle’.

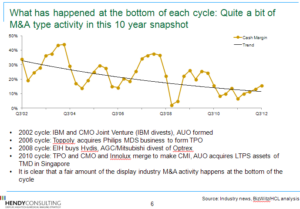

This chart showing the ‘crystal cycle’ was shown by Ian Hendy at the Electronic Display event in Nuremburg in March 2016. Image: Hendy Consulting

When the price of LCDs is high, the makers that depend on the markets for finance (i.e. AUO and LG Display, for example, rather than Samsung which can raise the necessary money itself) can raise money to invest, so they build fabs, and once they come to market, the capacity of the industry goes up and prices come down. One of the reasons that Samsung did so well in the market for many years was that it could work on a different timing because of its ability to raise money internally. That meant that it was better able to time its new fabs to the time when prices were good. (I remember Ross Young, now of DSCC, pointing this out at a DisplaySearch US FPD Conference around 10 years ago – “Don’t tell them”, I said, “If they all change. we may have endless over-supply!”).

Historically, the growth in flat panel area has come initially from notebooks (a new application, enabled by LCDs), then monitors (converting from CRT) and TVs (again converting from CRTs) and, to some extent, tablets. Once the CRT business was replaced, growth slowed, driven just by economic growth and larger sized displays and, to some extent smartphones (although the area is not so big for smartphones. You have to make a lot of smartphones to use as much glass as a 55″ TV).

Unfortunately, notebook volumes have stabilised, monitor volumes have declined, TV volumes are growing only slowly and tablet demand has flattened. Now, prices of panels have been fairly firm, as the Korean and Taiwanese LCD makers reduced their investments in LCD capacity, but the Chinese investments, although decided, have not yet come into effect. (One of the complications of the industry is that capacity takes a couple of years or so to come into play, so there is a big lag between decisions and implementation). Anyway, that Chinese investment is about to start to appear.

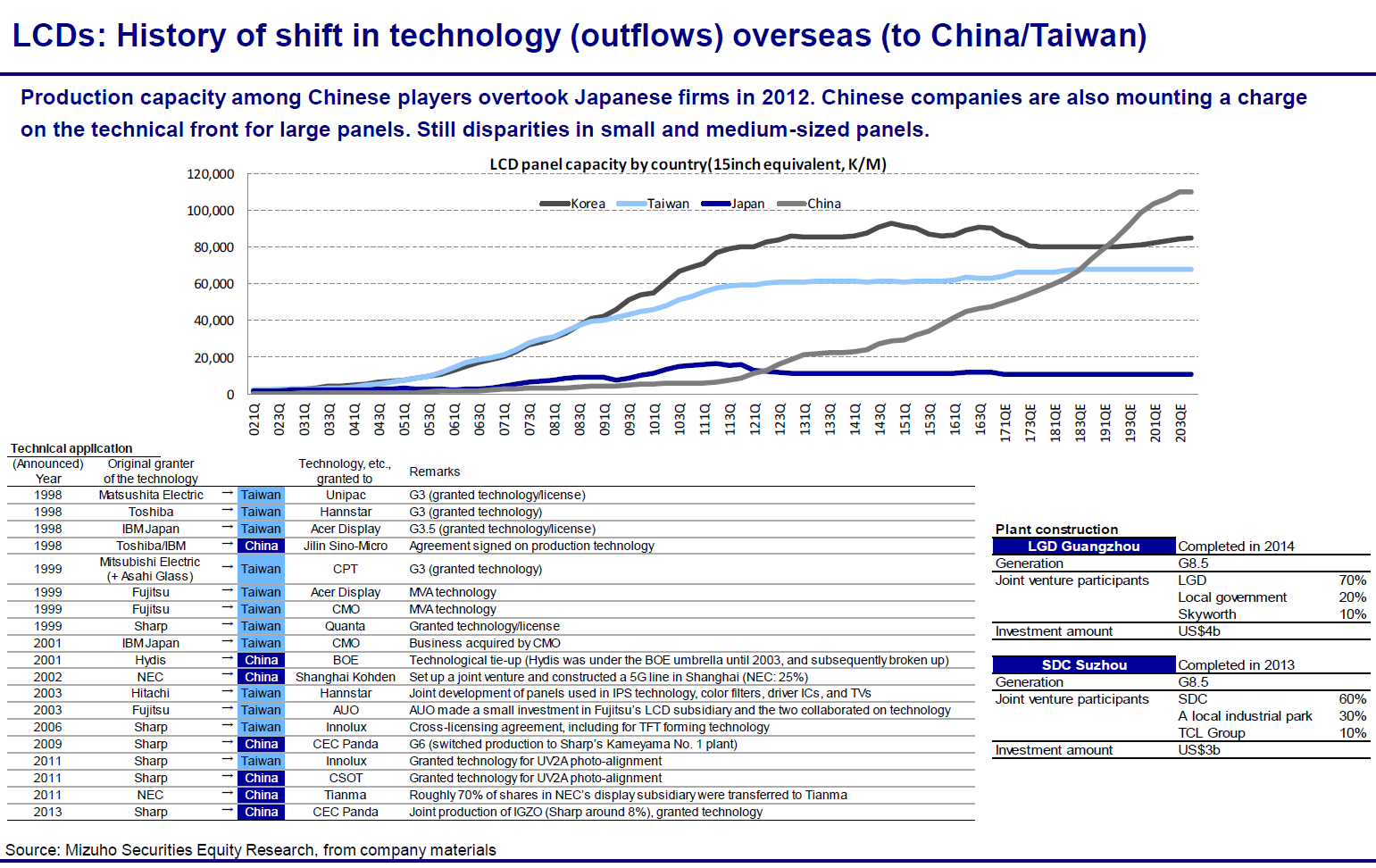

This was a big topic at the recent SID Business Conference and Yasuo Nakane ( Global Head of Technology Research, Equity research department of Mizhuo Securities in Japan) presented the following chart, which highlights how much new capacity is coming in China. What are those hectares of glass going to be used for? Well, the basic answer is TVs. The new fabs are mostly around G10, which are optimised to make panels at around 65″ and 75″.

The dramatic development in Chinese LCD production is clear. Image: Mizhuo Securities. Click for higher resolution

The dramatic development in Chinese LCD production is clear. Image: Mizhuo Securities. Click for higher resolution

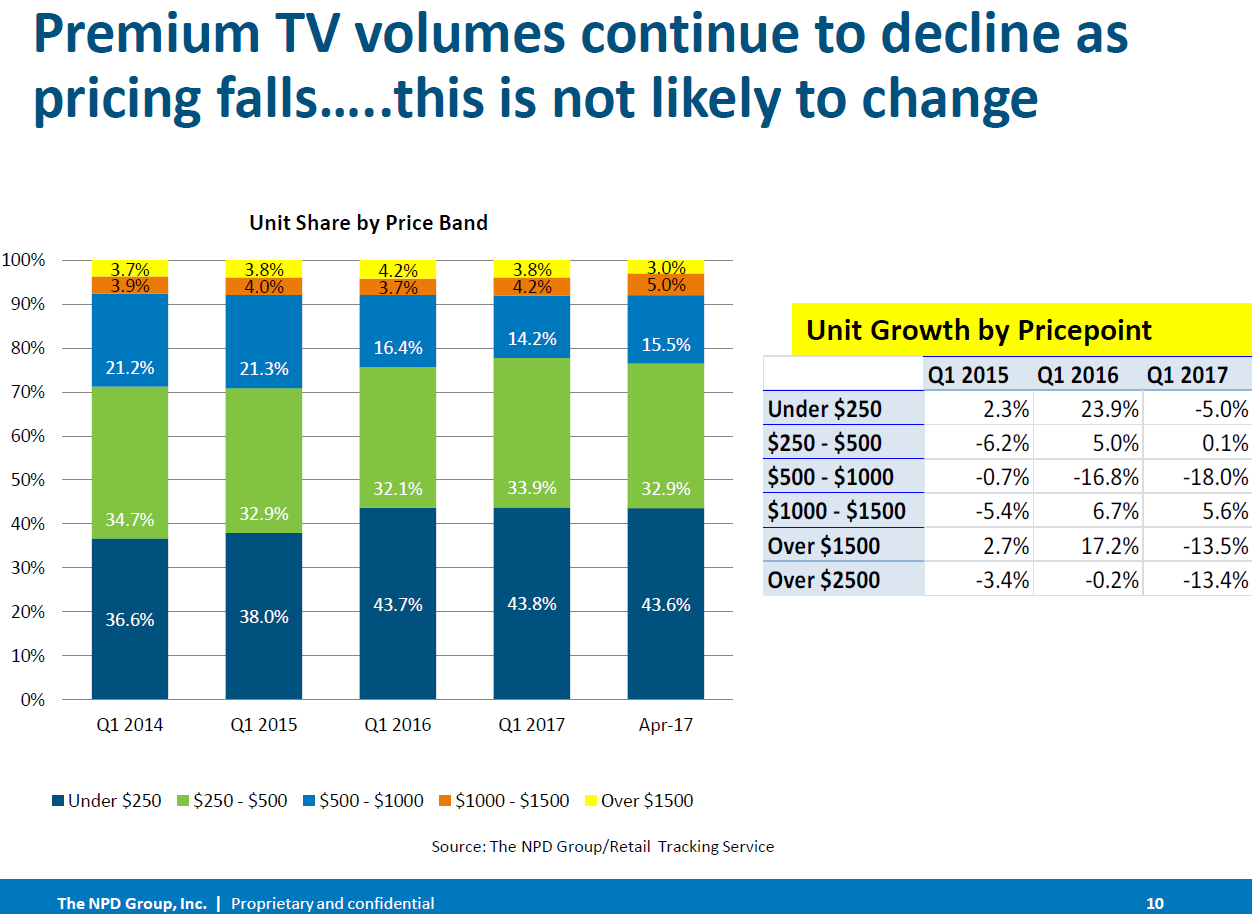

So, there is lots of new capacity coming for large TVs and although the market for large TVs is growing in China, the main market remains US TV buyers. At the same event, demand-side analyst, Stephen Baker of NPD pointed out that most of the US TV volume (76.5% by volume) is sold at prices below $500 and that the premium segment of the market at $500+ is declining in 2017. Only 8% of TVs in the US were sold for more than $1,000 in April 2017.

TV pricing in the US Retail Market – Image:NPD

TV pricing in the US Retail Market – Image:NPD

So, Baker said, you won’t sell that many really big (>55″) TVs in the future.

Hmmm…

Another analyst with many years in the business and I exchanged looks – and agreed that what will happen in the market is that prices will simply come down to whatever level is needed to absorb the capacity of the industry. The reality of the LCD business is that fabs only have a chance of becoming profitable (or at least reach their lowest cost point) by getting good yields. Good yields only come from running fabs and making a lot of LCDs. So, once you have a new fab, you are not going to simply leave it unused. You have to run it to stabilise the processes and get good yield.

So, watch out for some very low prices on 65″ and up TVs over the next couple of years! – Bob Raikes