To start off 2021, I will continue a tradition started two years ago of laying out some predictions for the year. I consulted with my DSCC colleagues for both topics of interest and for predictions and received contributions from Ross and Guillaume, but I write this column for my own account, and readers should not assume that anyone else at DSCC holds the same opinions.

While I’ve numbered these predictions, the numbers are for reference only; they are not in any particular order.

#1 – Cease-Fire but No Peace Treaty in US-China Trade War; Trump Tariffs Stay in Place

The trade war with China was one of the signature initiatives of the Trump Administration, starting with a series of tariffs in targeting US imports of Chinese products. A year ago, Trump signed an initial “Phase 1” deal that was intended to pave the way for a wider agreement between the two countries. Since then, the pandemic has upended economies around the world and disrupted world trade, but China’s trade surplus with the US is larger than ever. The Trump Administration shifted its focus from tariffs to sanctions in 2020, hitting Huawei with constraints that have effectively crippled its smartphone business and led it to spin off its Honor brand.

While we will see the end of the Trump presidency in January, we expect that the Biden Administration will maintain the substance, if not the tone, of Trump’s policies on China. Anti-China sentiment in the US appears to be a rare case of bipartisan agreement in Congress, and support for a tough line on China remains strong. While Biden is not likely to pursue new tariffs and may refrain from expanding the list of Chinese companies targeted for sanctions, he is also not likely to relax the measures that Trump put in place, at least not in his first year in office.

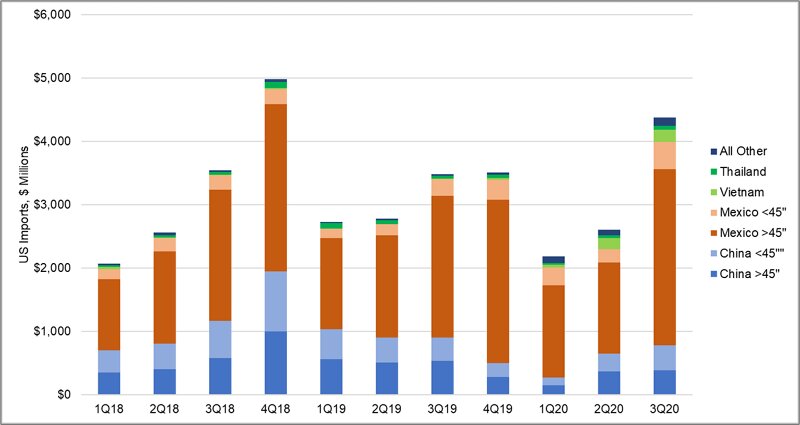

Within display industry end-products, only TVs were affected by Trump’s punitive tariffs. The initial tariff of 15% on Chinese TV imports implemented in September 2019 was reduced to 7.5% in the Phase 1 deal, but that tariff remains in effect, and adds to the 3.9% tariff on TV imports from most other countries. Mexico, under the USMCA deal which replaced NAFTA, can export TVs with no tariffs, and the Trump tariffs helped Mexico recover its share of the TV business in 2020. This pattern will continue into 2021, and we expect that TV imports from China in 2021 will be further reduced from 2020 levels.

US TV Imports by Country and Screen Size group, Revenues, Q1 2018 to Q3 2020

US TV Imports by Country and Screen Size group, Revenues, Q1 2018 to Q3 2020

While the supply chain of TVs shifted from China to Mexico, the supply chains of notebook PCs, tablets and monitors remained dominated by China. In smartphones, the share of imports from China declined, as several phone makers, especially Samsung, shifted some production to Vietnam. India became an emerging source of smartphones imported to the US. This shift away from China is likely to continue in 2021 because, in addition to concerns about the trade war, manufacturers are seeking lower-cost production in Vietnam and India as labor becomes more expensive in coastal China.

#2 Samsung Will Sell Foldable Panels with UTG to Other Brands

At the start of 2020, we predicted that Ultra-Thin Glass (UTG) would become recognized as the best cover for foldable displays. That prediction hit the target, as we estimate that 84% of foldable phone panels used UTG in 2020, but they all came from a single brand – Samsung. With the retreat of Huawei from the smartphone market and supply limitations on some other foldable models, Samsung nearly had a monopoly on foldable smartphones in 2020.

In 2021, we expect that other brands will join the UTG party. Samsung Display recognizes that it is not in its best interest to have a single company dominating the foldable market as occurred in 2019 and 2020. As a result, Samsung Display will begin offering foldable panels with UTG to other customers in 2021. We currently expect Oppo, Vivo, Xiaomi and Google to each offer at least one foldable model with Samsung Display UTG panels in 2021. In addition, we expect Xiaomi to offer all 3 types of foldables in 2021 – out-folding, in-folding and clamshell, although only the latter 2 models will use panels from SDC.

#3 LCD TV Panel Prices Will Remain Higher Than 2020 Levels Until Q4

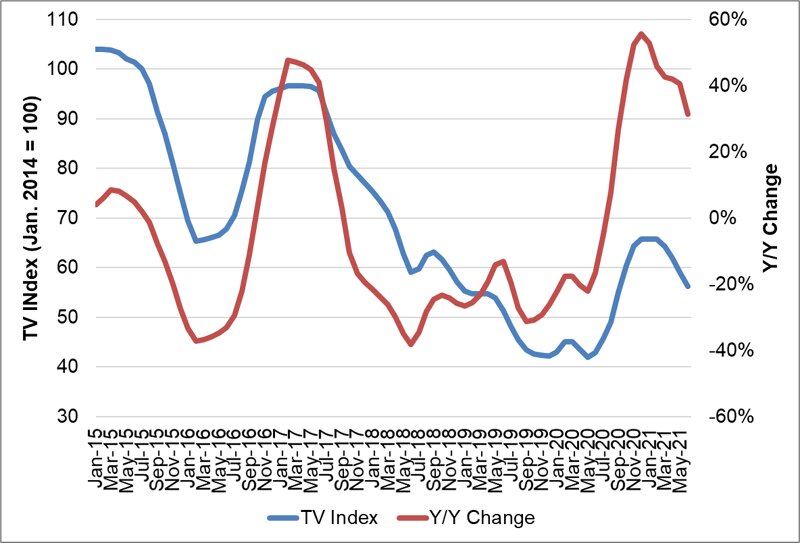

LCD TV panel prices had a roller-coaster year in 2020, with three inflection points in the first half alone followed by a huge increase in the second half. The year started with panel prices rising after Samsung and LGD announced that they would shut down LCD capacity to shift to OLED. Then the pandemic hit and led to panicked price reductions as everyone feared a global recession, until it became clear that stay-at-home orders and lockdowns resulted in increased demand for TVs. Prices started to increase in June, slowly at first and then accelerating in Q4 to end the year up more than 50%.

LCD TV Panel Price Index and Y/Y Change, 2015-2021

LCD TV Panel Price Index and Y/Y Change, 2015-2021

While Q1 would normally be the beginning of a seasonal slowdown for TV demand, we do not expect that panel prices will decline because of fears of a glass shortage resulting from a power outage at NEG coupled with Gen 10.5 glass problems at Corning. By the end of Q1, though, glass supply will be restored and the seasonal fall-off in demand in the spring and summer months will lead panel prices to fall.

The big increases in LCD TV panel prices have led SDC and LGD to change their plans and extend the life of LCD lines. These companies are making the sensible decision that they should continue to run lines that bring in cash, but the spectre of shutdown will remain hanging over the industry. Although prices will fall, they will remain above 2020 levels through the summer and panel prices are likely to stabilize in the 2nd half of 2021 at levels substantially higher than their all-time lows of Q2 2020.

#4 The Worldwide TV Market Will Decline in 2021

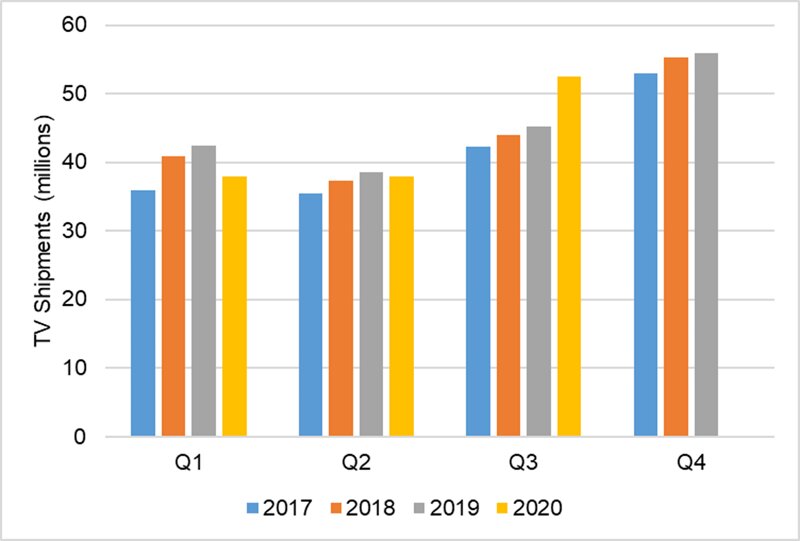

We may not be able to judge if this prediction is correct during 2021, since the data for Q4 2021 will not be available until early 2022, but I think it’s likely to be clear, based on Q1-Q3 data, that 2021 will be a down year for TV.

The Y/Y numbers for TV are likely to start the year on the positive side, since TV shipments in the first half of 2020 were hurt by supply constraints caused by the pandemic and then by fears of demand collapse. We can expect Q1 shipments to be at least up to 2019 levels and likely higher as pandemic-driven demand remains high, so a double-digit increase Y/Y in the first quarter is almost assured.

Global TV Shipments of Top 15 Brands by Quarter, 2017-2020

Global TV Shipments of Top 15 Brands by Quarter, 2017-2020

This full-year 2021 forecast is based on the hopeful expectation that vaccines will bring an end to the pandemic. Vaccines should start to become widely distributed in North America and Western Europe just in time for warmer weather to allow people to go outside. After being cooped up for more than a year, consumers in developed countries will be eager to enjoy increased freedom, and since many consumers have upgraded their TVs in 2020, they will not need another upgrade. So by the second quarter it should become clear that these developed markets will show Y/Y declines.

While TV demand has surged in developed markets during the pandemic, demand in emerging economies is much more sensitive to macroeconomics, and the economic slowdown has resulted in declines in TV demand in those regions. Because we expect the rollout of vaccines to be slower in the global south, we do not expect an economic recovery in those regions until 2022, so TV demand is not likely to improve.

On top of the macroeconomic and pandemic effects, higher LCD TV panel prices will act as a headwind on the TV market in 2021. TV makers enjoyed record profits in Q3 2020 based on low Q2 panel prices and strong demand, but higher panel prices will constrain their profits and marketing budgets and will prevent TV makers from using the aggressive pricing strategies that stimulate demand.

I would note that this prediction is not held by all at DSCC; our company forecast calls for the TV market to increase by a slight 0.5% in 2021. Personally, I feel a bit more pessimistic about emerging markets.

#5 More than 8 Million Devices with MiniLED Will Be Sold in 2021

We expect that 2021 will be a break-out year for MiniLED technology as it is introduced in multiple applications and goes head-to-head against OLED technology.

MiniLED consists of many tiny LED chips that generally range from 50 to 300µm in size, although an industry definition of MiniLED has not yet been established. MiniLEDs replace conventional LEDs in backlights and are used in a local dimming rather than edge lighting configuration.

TCL has been a pioneer in MiniLED TVs. TCL shipped the world’s first LCDs with MiniLED backlight, 8-Series, in 2019, and expanded their range with a lower-priced 6-Series in 2020, along with introducing its Vidrian MiniLED backlight TV with an active matrix backplane in their 8-Series. Sales of this product have been sluggish, as TCL has not established a high-end brand image, but in 2021 we will see the technology adopted by the rest of the leading TV brands. Samsung has established a sales target of 2 million for MiniLED TVs in 2021, and LG will introduce its first MiniLED TV at the CES Show in January (see separate story this issue).

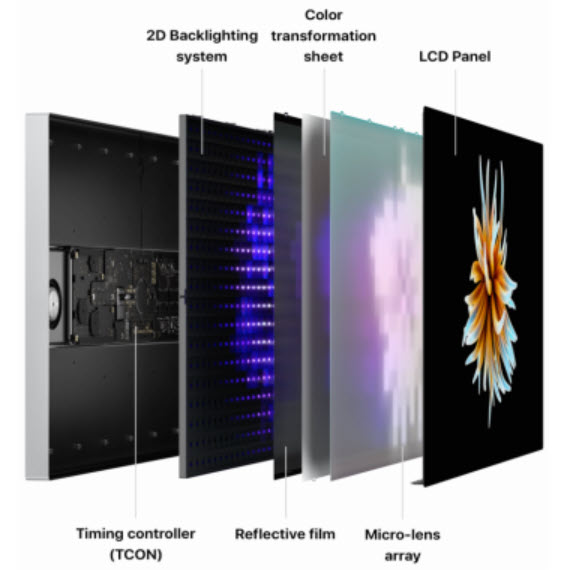

In the IT domain, Apple won a 2020 Display of the Year Award from SID for its 32” Pro Display XDR monitor; while Apple does not use the term MiniLED, the product fits within our definition. (Apple Explains the Pro XDR Monitor) Although the XDR, priced at $4999, does not sell in high volumes, in early 2021 Apple is expected to release a 12.9″ iPad Pro with a MiniLED backlight with 10,384 LED chips. Additional IT products from Asus, Dell and Samsung will drive higher volumes of this technology.

DSCC’s MiniLED Backlight Technology, Cost and Shipment Report gives our complete 5-year forecast for MiniLED shipments by application, in addition to cost models for various product architectures across a range of screen sizes from 6” to 65” and a full description of the MiniLED supply chain. We expect MiniLED sales across all applications to reach 48 million units by 2025, and the big numbers start in 2021 with Y/Y growth of 17,800%(!), including 4 million IT products (monitors, notebooks and tablets), more than 4 million TVs, and 200,000 automotive displays.

#6 More Than $2 Billion Investment in OLED Microdisplays for AR/VR

2020 was an interesting year for VR. The pandemic forced people to stay at home most of the time and some ended up buying their first VR headset to find some form of escapism. Facebook’s latest affordable headset, the Oculus Quest 2, received very favorable reviews and has quickly become the most popular VR device. Unlike the previous devices, which had OLED displays, the Quest 2 came with a 90Hz LCD panel that offered a higher resolution (1832 × 1920 per eye) and significantly reduced the screen-door effect. To stay in the race, OLED displays will need to offer pixel densities >1000 PPI but current panels manufactured with FMM only offer about 600 PPI.

MicroLED is presented as an ideal candidate for AR/VR but the technology is not fully mature. In 2021, we will see demonstration of smart glasses with microLED displays. However, we predict that they will not be available to buy, or only in small quantities.

More AR headsets are now using OLED microdisplays (on silicon backplanes) and we expect that the trend will continue. Manufacturers are also targeting VR. This year, the industry will demonstrate brightness levels above 10,000 nits.

Sony will reportedly start mass production of OLED microdisplays for a new Apple headset in the second half of 2021. It is not clear yet whether this headset will be primarily for AR or VR. However, this is a big win for OLED on silicon backplanes. Chinese manufacturers have already started investing in new fabs so we can expect a large increase in capacity. Subsidies from China will likely encourage more investment in 2021. As volumes for AR/VR are still low, there is a risk that this will rapidly create overcapacity.

#7 MicroLED TV Will Start, But Unit Sales Will be Exceeded By Its Resolution (4K)

MicroLED may be the most exciting new display technology to hit the market since OLED, and we will see the first TVs made for consumer use in 2021. The consumers who buy the first MicroLED TVs, though, will hardly be representative of the average household. Anyone who can afford the six-figure sum of a MicroLED likely has an income in the seven figures (US$) or higher.

Samsung has promised to develop and introduce MicroLED since showing a 75” model at the IFA conference in 2018. Although it has been the top-selling TV brand for fifteen years, Samsung was caught behind the curve when LG managed to industrialize OLED TV and Samsung’s efforts at large-size OLED failed. While Samsung’s marketing executives would argue otherwise, with some justification borne out by its market share, most high-end videophiles consider the picture quality of OLED TV to be superior to the best that LCD technology can offer. So, for years, Samsung has had a problem at the top end of the market, as the number one brand did not have the TV with the best picture quality.

The MicroLED TV represents Samsung Visual Display’s ultimate answer to OLED. It can match the deepest black of OLED, and offer dramatically better peak brightness. In just about every picture quality attribute, MicroLED represents the perfect display technology. The only problem is the price.

The initial price of Samsung’s 110” MicroLED TV at launch in Korea will be KRW 170 million, or about $153,000. We expect that Samsung will offer as many as three models – 88”, 99” and 110” – and that before the end of 2021 the lowest priced model will be offered at less than $100,000. Nevertheless, this is so far out of reach of the everyday consumer that sales will be limited to the tiniest fraction of the 250-million-plus TV market.

I was searching for a suitably small number to compare with MicroLED TV sales, but the prediction above overstates our expected shipments by a factor four. We expect MicroLED TV sales to be less than 1000 units in 2021.

#8 New LCD Capacity Expansions

The latest crystal cycle has been ruthless for LCD makers. The wave of Gen 10.5 capacity expansions from 2018-2020 brought three consecutive years of double-digit capacity expansion, leading to severe oversupply. As shown in the TV panel price chart above, panel prices fell more than 50% in just over two years from mid-2017 to Q4 2019 to reach all-time lows.

The price declines in turn led to severe operating losses for LCD makers, at least those outside China. AUO and LGD booked six consecutive quarters of net losses from Q1 2019 to Q2 2020, and Innolux lost money in those six plus Q4 2018.

By the beginning of 2020, it appeared that LCD was “old technology”, and while a few capacity expansion investments were still planned in China, new investment stopped after 2021. The two Korean panel makers, who once dominated the LCD industry, announced that they were withdrawing from LCD to focus on OLED. Investment in China increasingly focused on OLED.

During 2020, it became increasingly clear that this assessment was premature, and LCD has a lot of life left. Strong demand led to panel price increases, which greatly improved the profitability of LCD makers. Furthermore, LGD’s struggles with manufacturing its White OLEDs in Guangzhou, and many panel makers’ struggles with increasing yields on OLED smartphone panels, reminded the industry that OLED is difficult to make and substantially higher cost than LCD. Finally, the emergence of MiniLED backlight technology provided the incumbent LCD technology with a performance champion to challenge OLED.

The Koreans have now reversed, or at least delayed, their decision to shut down LCD, and this will help to keep supply/demand in balance for 2021, after the Q1 glass shortage is alleviated. However, capacity additions for OLED fall short of the ~5% per year area growth in demand that we expect, and LCD will be in increasingly tight supply unless new capacity is added.

We’ve seen the first stage of this next turn of the crystal cycle with CSOT’s announcement that it will build a T9 LCD fab ahead of its T8 OLED fab (see separate story in this issue). Expect to see more such moves, by BOE and possibly even by the Taiwanese panel makers before the year is over.

#9 No Commercially Acceptable Efficient Blue OLED Emitter in 2021

I started this prediction in 2019, and I’ve been right for two years, and expect to make it three.

An efficient blue OLED emitter would be a tremendous boost to the whole OLED industry, but especially to the company that develops it. The two main candidates for this are Universal Display Corporation, trying to develop a phosphorescent blue emitter, and Cynora, working on Thermally Activated Delayed Fluorescent (TADF) materials. Japan-based Kyulux and China-based Summer Sprout also target an efficient blue emitter.

UDC’s red and green emitter materials allow excellent color and lifetime with high efficiency, because phosphorescence allows 100% internal quantum efficiency, whereas the predecessor technology, fluorescence, only allows 25% internal quantum efficiency. Because blue is so much less efficient, in White OLED TV panels LGD requires two blue emitter layers, and in mobile OLED Samsung organizes its pixels with the blue sub-pixel substantially larger than red or green.

A more efficient blue would allow LGD to potentially go to a single blue emitting layer, and Samsung to re-balance its pixels, in both cases improving not only power efficiency but also brightness performance. A more efficient blue would hold even greater promise for Samsung’s QD-OLED technology, which relies on blue OLED to create all the light in the display. Samsung will use three emitter layers for QD-OLED, so an improvement in blue would provide a big improvement in cost and performance.

UDC has for years worked on developing a phosphorescent blue emitter, but each quarter the company uses identical language in its earnings call about phosphorescent blue: “we continue to make excellent progress at our ongoing development work for our commercial phosphorescent blue emissive system.” Cynora for its part has described its progress in achieving the three goals of efficiency, color point, and lifetime, but that progress seems to have stalled since 2018, and Cynora has shifted its short-term approach to an improved fluorescent blue and a TADF green.

A more efficient blue OLED material may eventually happen, and when it does it will accelerate the growth of the OLED industry, but don’t expect it in 2021.

#10 Taiwan Panel Makers Will Have Their Best Year In More Than a Decade

The two big Taiwan-based panel makers, AUO and Innolux, fared especially well in 2020. At the beginning of the year, both companies were in dire straits. Both companies were far behind in OLED technology, with little hope of competing with the Koreans, and were unable to match the cost structure of their big Chinese competitors, BOE and CSOT. As LCD appeared to be “old technology”, as stated above, these companies appeared to be increasingly irrelevant.

While Taiwan may have missed the boat on OLED, it is a center for excellence in MiniLED technology, and this along with the revived prospects for LCD have greatly improved the prospects for both companies. Both companies will continue to benefit from their diverse product mix – they both excel in IT panels which are expected to continue to see strong demand, and both have strong shares in automotive displays which should recover from a down year in 2020.

The best year for profitability in the last decade for these companies was the last peak of the crystal cycle in 2017. AUO earned a net profit of TWD 30.3 billion ($992 million) with a 9% net margin, while Innolux earned TWD 37 billion ($1.2 billion) with an 11% net margin. With robust demand supporting higher panel prices and with a lean cost structure, these two companies can exceed those levels in 2021. – Bob O’Brien

The author of this article was Bob O’Brien of DSCC

This article was first published on the DSCC blog and is re-published here with kind permission.