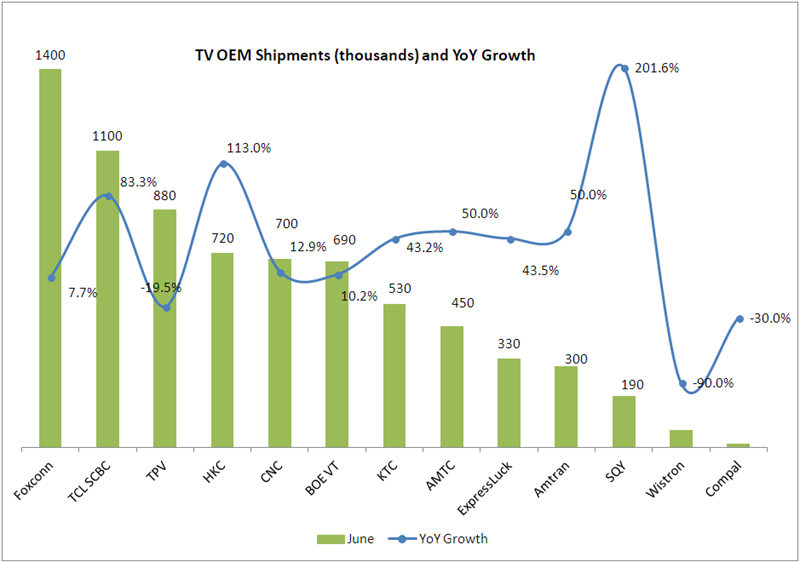

Sigmaintell of China has updated its data on shipments by TV OEMs and reported that the top 13 shipped 7.37 million units in June, an increase of 22.3% over 2017 and 5.7% down on May. The big change is the move by TCL to second place, based on the growth of the Mi brand as well as a high level of exports. HKC has also made it into the top five for the first time.

- Foxconn was top, up 7.7% on 2017 with Sony shipments increasing significantly

- TCL shipped a lot to North America, Southeast Asia and India and about 30% of its shipments are going to Mi.

- TPV saw a drop in shipments after strong peaks for the Philips brand in Europe and Latin America

- HKC is mainly shipping smaller sets

- CNC has boosted its sales in Latin America and has been changing its size mix to deal with panel price rises

- BOE VT has maintained business in MEA and Eastern Europe, but has seen other regions decline.

Sigmaintell TV OEM Data. Image:Meko

Sigmaintell TV OEM Data. Image:Meko

Over the first half of the year, sales of the top 13 were 42.9 million sets as inventories increased to meet world cup promotion demand. The company didn’t release full data, but did include this chart.

Sigmaintell TV OEMs 1H 2018

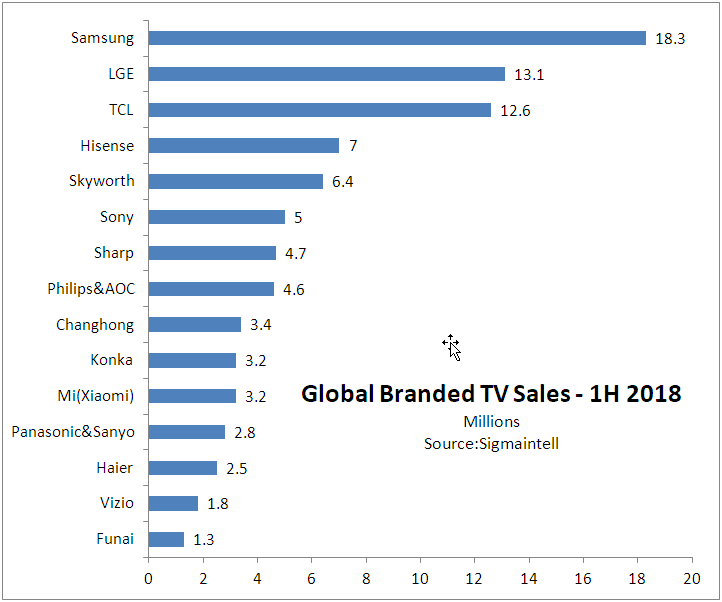

The company also looked at branded shipments and saw volumes at 106.41 million in total in the first half and volumes increased by 7.3% over last year. Sigmaintell expects Q3 to be 3% to 4% up on last year although there is some uncertainty over inventory.

- Samsung was down 1.5% as it has changed its focus from share to profits. Although volume declined, the area increased by 5.5%.

- LG was up 6.3% over last year and included 730K OLED TVs, 5.5% of the firm’s business. Sigmaintell expects the volume of OLED TVs to reach 1.7 million.

- TCL was up by 34.1% over last year by actively promoting 55″ and 65″. It is actively selling 32″ and 43″ and other smaller products in Southeast Asia.

- Hisense grew by 10.1% and made some big World Cup and 618 promotions. Q3 inventory ‘digestion’ might affect sales in Q4

- Sharp sold 26.7% more sets in 2018 after a price war in China and is increasing volume in Europe and Southeast Asia

- Mi was the big winner, up 400% over last year and becoming a big brand in China and India. 32″ and 43″ are 50% of the volume.