This week I spotted an interesting looking forecast that suggested that the top three US Smart TV brands (Samsung, LG and Vizio) would see a big growth in revenues from advertising over the next few years. That got me thinking.

I’ve been looking at SmartTV for some time. I gave a keynote speech for Panasonic at a launch of its Viera Cast system in February 2009 about what I then called ‘Internet TV’ (to differentiate between the unmanaged content provided over the internet rather than IPTV which used much of the same technology, but had a guarantee of a certain level of service). Looking back, a lot of what I said has came to pass (I have added what I wrote in our newsletter after the talk below). It was around this time that broadband started to roll out and start to allow reasonable quality TV delivered over the internet.

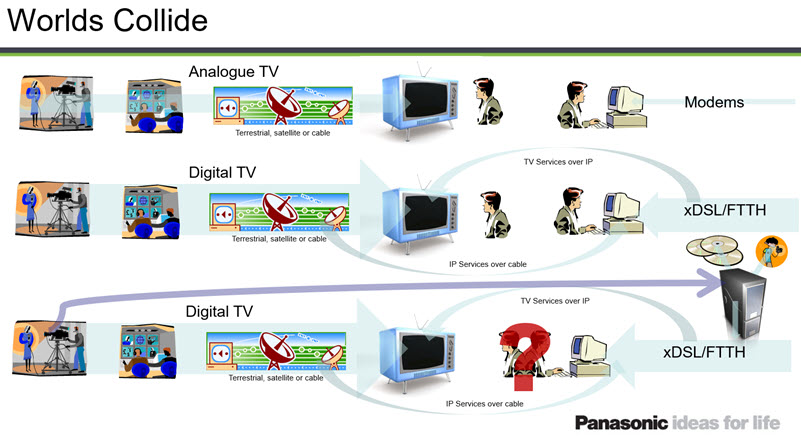

Worlds Collide – one of my slides from 2009

Worlds Collide – one of my slides from 2009

It was clear that this was a big opportunity for TV set makers. Up to then, the relationship between a TV set maker and a customer (as long as there were no warranty issues) ended once the set was installed and was working. After that, although the viewer had a relationship with broadcasters or PayTV providers, the set maker was no longer in the picture (sorry for that!). However, internet TV changed that and gave the chance for a set maker to have a continuing relationship with the user. That was a big incentive for set makers to develop what we now call a SmartTV, but it has never been simple or easy.

The reality of the TV market is that although reviewers and technologists talk about premium and high end sets, the vast majority of the market buys cheap sets. As Stephen Baker of NPD pointed out during the Display Week Business Conference in June, it can be argued that the premium TV market starts at $700 now even in the wealthy US. So, to make the development of a SmartTV ecosystem worthwhile for a set maker, you have to get the platform into most or nearly all of your sets, including the cheaper ones. You want it in as standard, rather than as an option or add-on, so that someone not planning to use it still buys the set. That means that the technology for the control of the SmartTV functions must be cheap. As a result, it was said that ‘Your SmartTV is only as smart as a three year old PC’ as the chips would then be cheap enough.

We’ve finally got to the point that cheap SmartTV chips are fast and cheap enough to provide a ‘good enough’ level of performance that means that you can have a pretty good TV experience without having to have an STB or streaming dongle. After a dozen years there is also enough fast broadband for a good experience. As a result, the brands that have been investing for such a long time are finally going to be able to cash in on the platforms that they have built. However, it’s only in the last three years or so that the smarts have really got smart enough. That means it will take quite a while for the installed base to get to the level that will provide a really good base of users as it takes eight to ten years to replace all the TVs.

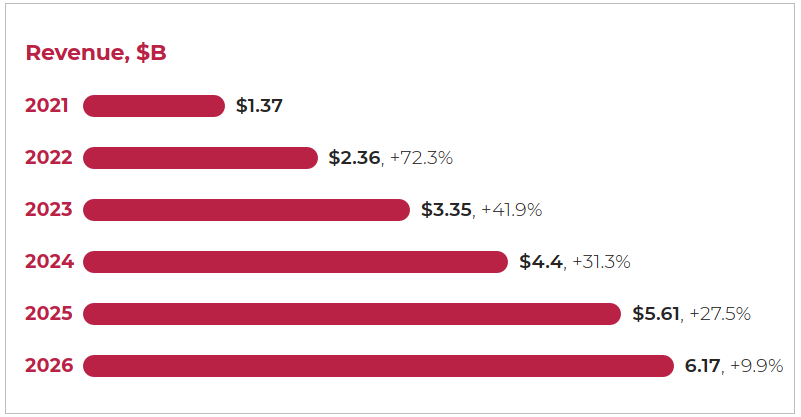

The forecast that I referenced at the start of this article was from a report from TV[R]EV that I downloaded. It’s freely available to download (with registration) here. Among the nuggets in the report was the statment that ‘as recently as 2015, only half of smartTV owners actually bothered to connect their sets to the internet’. The report also said that now ‘Samsung reports that 90% of their user base does not use a streaming device’.

The three brands that the report covers all now have their own ‘FASTs’ – Free Ad-Support TV services with hundreds of channels which are mostly syndicated TV network channels. However, they also enable set makers to sell advertising themselves. With the growth in the installed base, TV[R]EV predicts that there will be notable growth over the next five years, , with a 116% increase in the number of users and a 76% increase in the number of hours streamed, which will lead to a 4.5X increase in total revenue.

Also in the report is an interesting view and graphic on the ‘CTVerse’ that maps connected TVs and created by Evan Shapiro. I couldn’t resist including it here, but it’s worth a look at the report as it includes six pages of comments from him on his view of developments. It also includes interviews with LG, Samsung and Vizio about their advertising plans.(BR)

What I said in 2009…..

So, will TV brands replace broadcasters? Clearly this will not happen. Broadcasters understand a lot about content, viewers, rights and developing packages that consumers want to buy. On the other hand, as it always does, the internet will ‘disintermediate’ the industry to some extent. Some content will go directly from the creator to the set, without a traditional broadcaster in between.

Will TV set makers improve the experience of viewers by adding extra content? Certainly, this is already happening and it will change the relationship between TV set makers and their customers.

The most exciting area will be new applications that are developed for the new platform. It was hard to imagine Skype, Twitter or Facebook until they happened. The new TV platform will also allow the development of new applications that will surprise us. (Will the integration of Skype and cameras into TVs finally enable the video conferencing revolution that has been promised for so long?).

In preparing this talk, I spent quite a lot of time trying to get beyond the detail to look at the ‘big picture’. It has taken me a while to understand the significance of the development of this technology. For a long time, it seemed to me that companies were putting internet connections on their TVs, but, frankly, most didn’t seem to know what to do with those connections. A couple of years ago, at a CeBIT if I remember correctly, I came up with the phrase ‘the end of geography for TV’ to try to highlight the importance of IPTV, the ‘managed service’ of TV. However, rolling out IPTV is still tied up very strongly with the provision of cabling infrastructures, so although IPTV is growing well, particularly in some regions, it really hasn’t changed things the way it might. The complexities of delivering good quality, reliable TV over IP connections makes the IPTV closer to the cable TV industry. However, I think the moment has now arrived for the concept of getting a significant proportion of your TV viewing over the internet to really blossom and take shape.

Over time, it seems to me that the development of Internet TV through TV set makers will have a massive effect on the TV industry. I would equate the importance in my own mind almost to the impact of PCs or even the internet. The development certainly has the same ‘smell’ to it for me. After this, nothing will be quite the same, ever again.

It seems to me that there are two massive effects immediately and over the longer term. First, let’s consider that TV brands will, over the next few years, continue to consolidate pretty strongly. There are only half a dozen important brands in the developed world in flat TVs and we don’t see that number growing. Rather, it may even reduce. Over the next eight to ten years, the internet TV technology which is in the top of the range TV sets today will rapidly migrate to pretty well all but the very cheapest sets. Moore’s Law will see to that. In addition, broadband will become pervasive through fibre, cable and increasingly through wireless technologies, whether based on the WiMax or 3G or its successors. Whatever the technology, fast connectivity will get everywhere.

What that means is that over the next ten years or so, the TV set makers will have established massive and pervasive platforms for delivering video content directly to their consumers. Each of the top brands will have tens or hundreds of millions of customers that it can give video access to, on a global basis. Imagine if Disney wants to launch a movie all around the world on the same day, or Mercedes wants to launch a car. Instead of having to deal with dozens of national or regional broadcasters, they simply talk to Panasonic or its competitors and make available the video.

Imagine that Panasonic sponsors the 2020 Olympics. How would its customers feel if they had access to special, unique or free content available on their sets? What if an electronics brand tried to negotiate major rights to such an event? The broadcast industry is bound to resist this, but content owners and aggregators such as Eurosport, which are not nationally focused could achieve world-wide distribution of their content.

The key is that the internet causes a process that has one of my favourite words as its name, ‘disintermediation’. The internet takes away the ‘middle men’ and allows direct dealing. As Dell has found out, not everybody wants to go direct and intermediaries often have a real benefit, but there is usually some segment of a market or audience that does want to deal direct. Internet TV enables this for the first time in the TV world.

There are bound to be political, legal and economic barriers and battles, but it seems to me that, like PCs or the internet, the Internet TV technology is unstoppable.

The second big effect that this technology will enable is a step change in the relationship between the TV set vendor and the viewer. At the moment, there is no direct relationship. The viewer buys from a retailer and, unless there is a problem, the only contact that the user may have with the set maker is to look at the logo. No more. With Internet TV, potentially the viewer will interact hugely with the maker. If the development of Internet TV becomes as popular as I think it might, then TV brands will be interacting electronically with their viewers every day. They will know what kind of content the viewer is watching, how much they watch and what set they have. They can update firmware and help sort out technical issues. They could even send advice to the viewer. Is the viewer watching a movie on one of the new Panasonic THX-certified set, but without the option enabled? Why not send a small ‘alert’ to recommend the setting? Why not use metadata to automatically optimise the picture?

These developments will pose questions that have yet to be answered. Should the platforms be open or closed? Will brands that have access to their own content, and of course I’m thinking of Sony now, have a real advantage? How can you make money from it? How can you cover the costs?