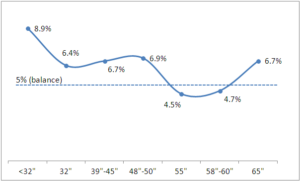

Sigmaintell of China has said that it expects LCD TV panel supply to be 6.4% ahead of demand in Q4 of 2017 as the demand to sell TVs outside China declines in Q4. Part of this is the result of traditional seasonal patterns as the peak production time for panels ready for Q4 set sales means a peak of panel production in Q3.

The company said that demand from top ‘overseas’ (outside China) TV brands such as Samsung, LG and Sony, is down 15.2% from Q3 and 7.3% down year on year. However, Chinese makers have ‘taken up the slack’ and demand is up by 18.5% on Q3 as local sales in China peak in Q4 and shorter lead times means closer alignment between panel production and TV set sales, so Chinese set makers had been cautious in their purchasing during Q3.

Turning to sizes, lower demand from outside China has reduced demand for panels below 43″, but sharp pricing on 55″ has meant bigger demand in China for that size. However, demand for 65″ sets is weak with “A” brands cautious in their 65″ panel buying.

Panel capacity is increasing by 3.1% because of new capacity from BOE in Fuqing, with Guangzhou at full capacity. HKC and Innolux have also added G8.6 capacity. Sigmaintell estimates LCD TV panel production will be 70.5 million, up 3.4%

- 32″: As export demands gradually drop, Sigmaintell estimates that in Q4, the overall supply and demand surplus for 32″ panels will be 6.4%. Prices will also decrease more rapidly.

- 40″~45″: Influenced by the increasing supply in Q4, the overall surplus is expected to be 6.7% and price declines will continue.

- 48″~50″: Supply of 49″ panels is relatively stable. However, G 8.6 product line have increased their supply of 50″ panels. Manufacturers have a lot of pressure in inventories and supply is exceeding demand, so prices of 50″ panels are showing a declining trend.

- 55″: Promotion of 55″ panels has meant constantly increasing demand. Due to earlier price declines, demands continued to rise. The surplus is 4.5% in Q4. The price of 55″ panels will also slightly decrease.

Analyst Comment

Traditionally, less than 5% surplus of supply feels like a shortage, while more than 10% feels like a glut, so 6.3% is relatively balanced, with not too much room for movement. (BR)

Q4’17 Prediction of supply and demand balance for different sizes in the global market of LCD TV panel (Unit:% – source Sigmaintell. Image:Meko)