DSCC recently ran an event in Tokyo under the title “Roadmap to Display OLEDisation” and kindly sent us some information from the event.

DSCC recently ran an event in Tokyo under the title “Roadmap to Display OLEDisation” and kindly sent us some information from the event.

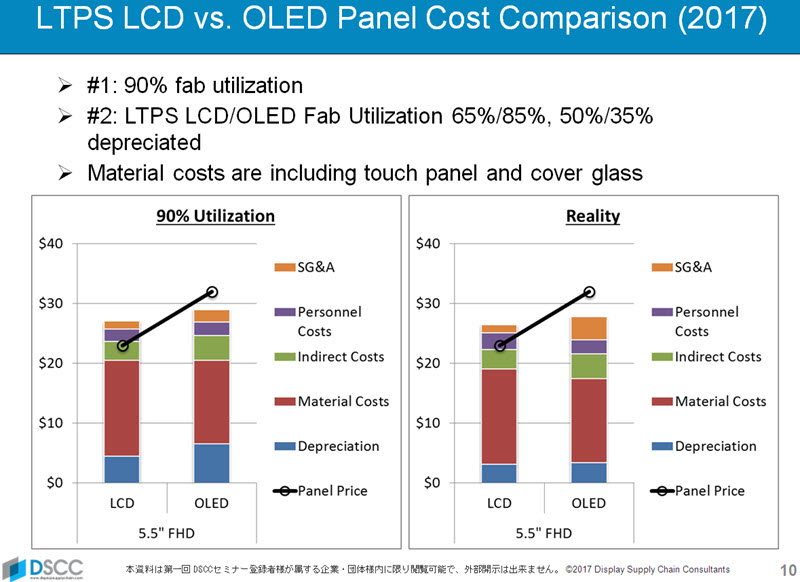

One of the topics that analyst, Yoshio Tamura, talked about was the cost difference between OLED and LTPS LCD in smartphone applications. If you take a theoretical model based on 90% utilisation, then the cost advantage is a couple of dollars. However, OLED fabs are running at higher utilisation than LTPS at around 85%, rather than the 65% of the LCD business because of over-supply. On the other hand, LTPS fabs have been around longer and are likely to be more depreciated at 50%, rather than just 30% for OLED. In the end, real costs are a bit lower for both technologies.

Given that there is a good premium for OLED, this means that OLED can be quite profitable at the moment, but LTPS prices are below the full cost and close to the marginal cost of production.

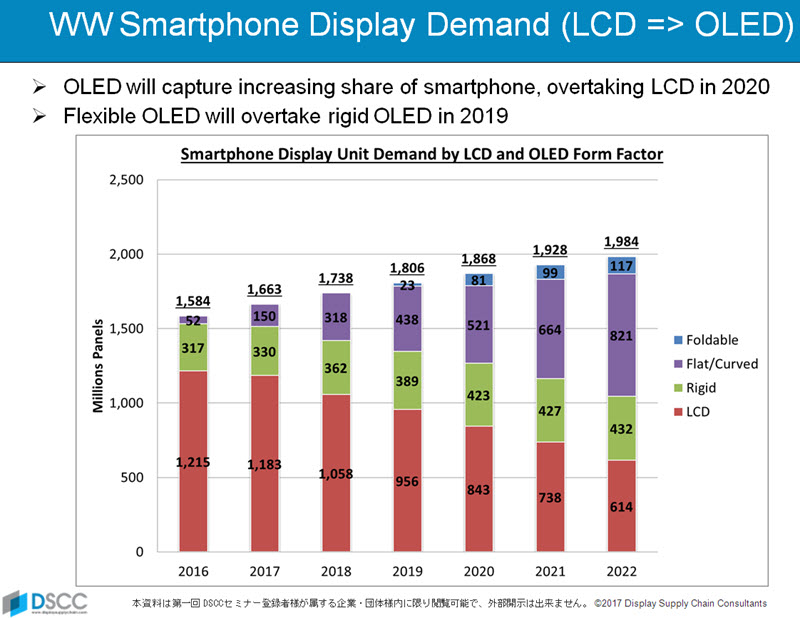

Tamura also looked at the demand side of the market for smartphones. The company has an expectation that smartphone demand will continue to grow, but expects to see a big increase in flexible displays from just 150 million pieces in 2017 to 821 million in 2022. The firm also expects foldable form factors to come into the market by 2019, but only in small volumes and still at around 5.5% of the market by 2022.

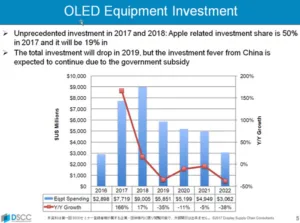

To meet the need for this level of OLED demand, there will be a lot of investment. Investment will peak next year at $9 billlion, but will remain strong until 2021, when it will drop back. Tamura said that 50% of the investment this year is just to support demand from Apple. The period from 2019 to 2021 will be supported by government subsidies in China and that country will account for around 45% of the total in 2018, 73% in 2019 and then dropping, but staying above half of the total until 2022.