The world of monitors is very interested in the development of the way that gamers choose and buy their monitors. As Display Daily’s friend, Dr Jon Peddie (himself a keen gamer), pointed out many years ago, there are millions of keen gamers who care a lot about their systems as good hardware can make a real difference to their performance. They are prepared to spend real money to get better systems.

He made that point long before (as far as I am aware) there were professional gamers. These days, it could be said, careers depend on good hardware and the display monitor is a key part of their rigs.

Monitor makers are very interested in gaming monitors because after the arrival of LCD technology to the monitor market, it became quite commoditised, with 90% or thereabouts, of the market buying 17″ or 19″ 1280 x 1024 monitors with little brightness or performance differentiation. That kind of market tends to see fierce competition and declining prices. So as gaming became a clearly differentiated application, monitor makers have focused more and more on the segment as a way to add value and improve their profitability. The Covid pandemic has added to the importance of gaming as more people looked for entertainment at home.

Now Sigmaintell of China has done some interesting market research that looks at the views of gamers in a number of regions and has released some information on its results.

According to Sigmaintell’s data, global gaming monitor panel shipments reached 18.9 million units in 2020, an increase of 78% YoY. That’s a big boost.

(Gaming monitors are typically defined on the basis of having higher refresh rates than the typical 60Hz of desktop monitors for other applications. Sigmaintell didn’t clarify that in its release, but we have reached out to the firm and will add that information if we get it – Update – Sigmaintell told us it used the the standard industry definition of monitors with ?100Hz refresh rate)

The firm expects that the market will continue to grow to 24.3 million in 2021, bringing the market penetration rate to 15% of all the monitors sold. The global shipments of high refresh rate notebook panels is expected to exceed 17.6 million pieces this year, and that will mean a market penetration rate of 7%. At the same time, global shipments of high refresh TV panels in 2021 are expected to be 21.3 million units, a significant increase of 60% YoY, and the market penetration rate will climb to 8.1%. Many of those TVs will be chosen by keen gamers.

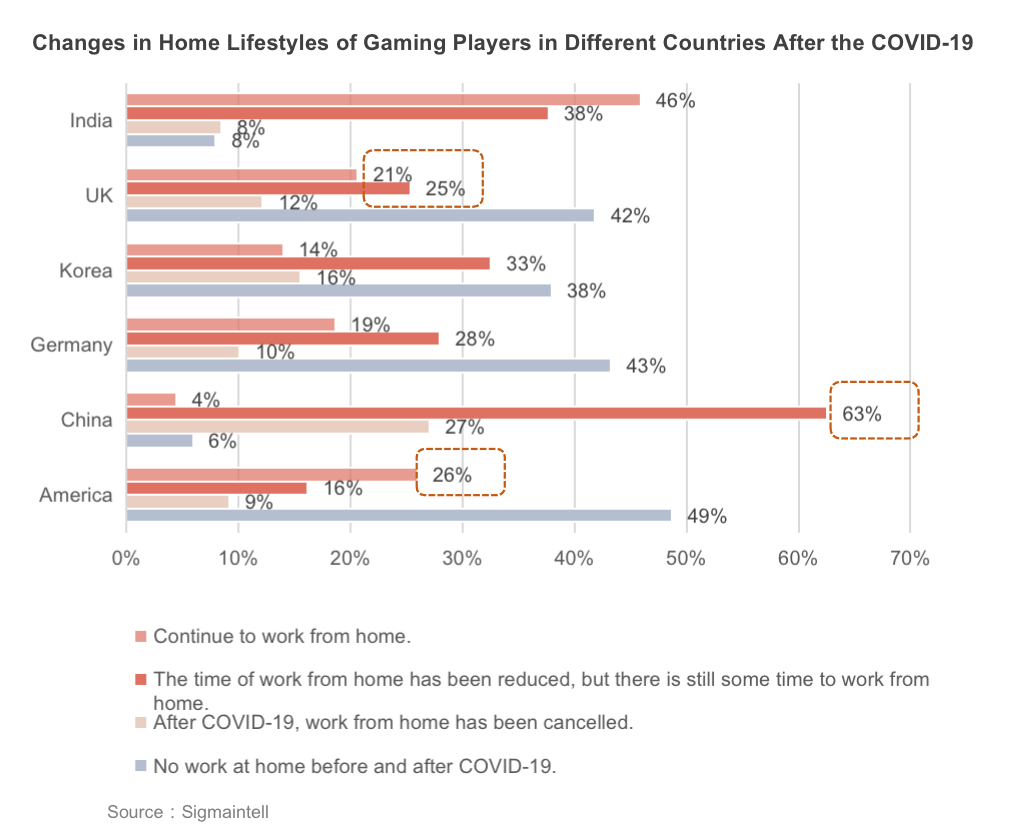

To get a better understanding of what gaming users are looking for, Sigmaintell researched the views of gamers from a range of geographies in China, USA, India, Germany, the UK and Korea. There are interesting differences in the results in different parts of the world. They shed light on changes in working practices from the pandemic as well as on gaming.

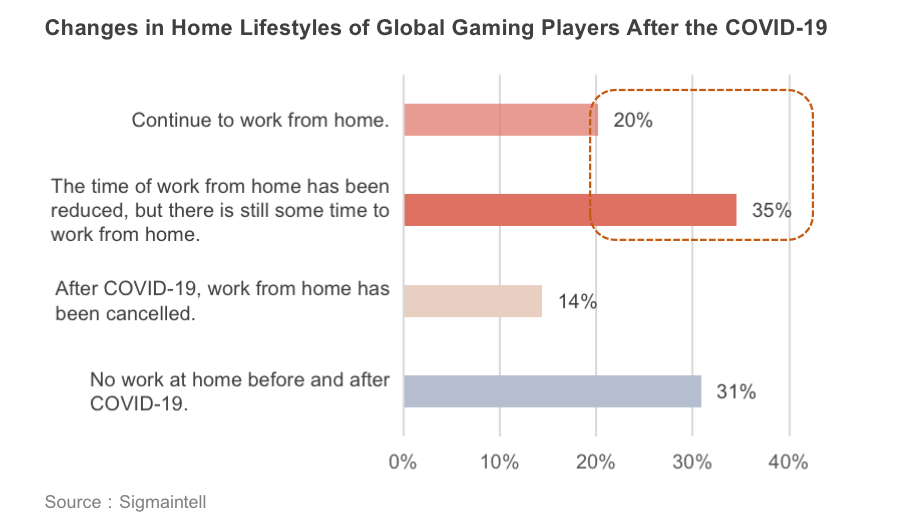

Looking at all respondents, after the peak of Covid, 55% of game players are still doing at least some work from home.

However, there are significant differences in the impact of Covid between the regions. For example, while 63% of Chinese respondents said that there is still some work from home, US respondents in that situation were just 16%. 46% of Indian respondents are continuing to work from home, but this drops to just 4% in China.

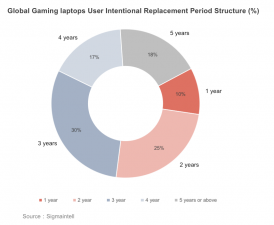

Of course, Covid has had a significant impact on the global economy and while some have seen reduced income because of the pandemic, others have found that they have had much more income to spend on hardware and goods when their spending on services was reduced by disease-related restrictions. Sigmaintell asked gamers that used laptops how rapidly they would plan to replace their notebooks.

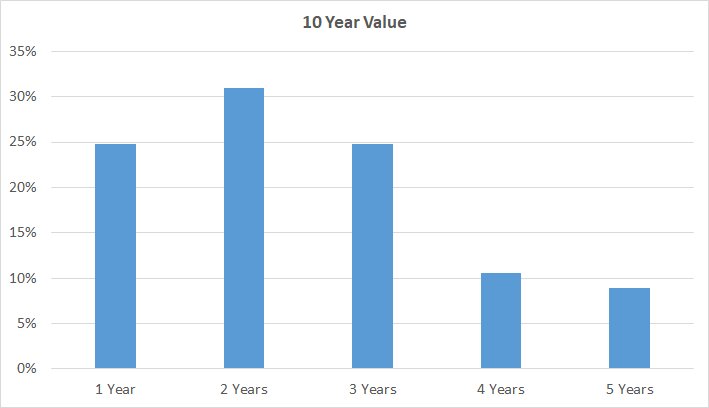

Looking at this chart made me wonder what the longer term value of different buyers would be to brands that saw repeat sales to gamers. A simple calculation showed that the focus in working out what products to bring to market really has to be on the groups that would replace in one to three years, which would make up 81% of buyers in any one ten year period (if they do actually replace their PCs that often).

Ten Year Value of customers replacing notebooks after 1 to 5 years. Image:Meko

Ten Year Value of customers replacing notebooks after 1 to 5 years. Image:Meko

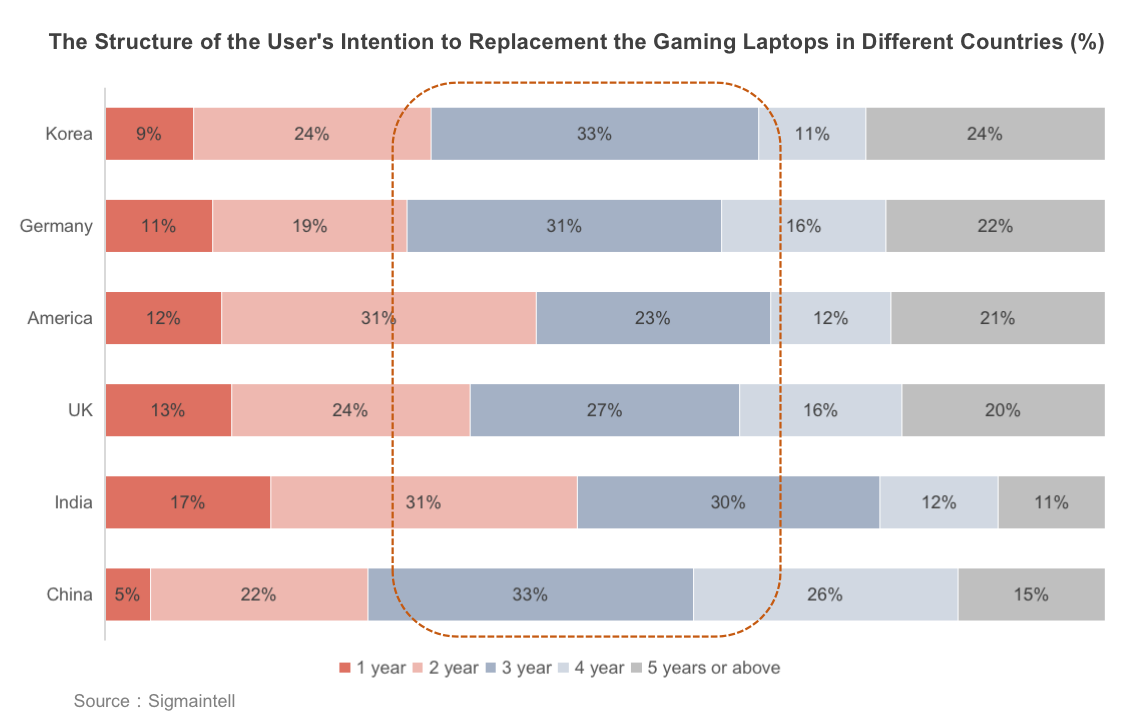

There is, again, a significant regional difference here, with Indian buyers apparently much more willing to upgrade every year than Chinese buyers. However, even in China 60% would plan to replace their systems in three years.

The second part of the survey looked at what gamers want to see in the products. That certainly produced an interesting result. As I mentioned earlier, the key metric for a ‘gaming monitor’ up to now has been refresh rate (and response time/latency). Advertisers and developers of gaming monitors have focused hard on the speed of the display. Partly that is because, early on, LCDs were very poor in comparison to the CRTs that they replaced in this regard. (anybody remember ‘mouse trails’?).

Obviously in the professional ‘twitch’ games, milliseconds are critical and one can understand why there was focus on this area. However, it’s also true to say that while higher speed wasn’t easy to produce in LCDs, from an overall supply chain cost perspective, the additional cost for higher speed has been relatively low (at least, compared to more brightness, better colours, wider aspect ratio, curved monitors etc). So, at various points in the supply chain there were better opportunities for profit. A premium product at a not so premium cost is enough of a reason on its own to encourage the industry to provide them.

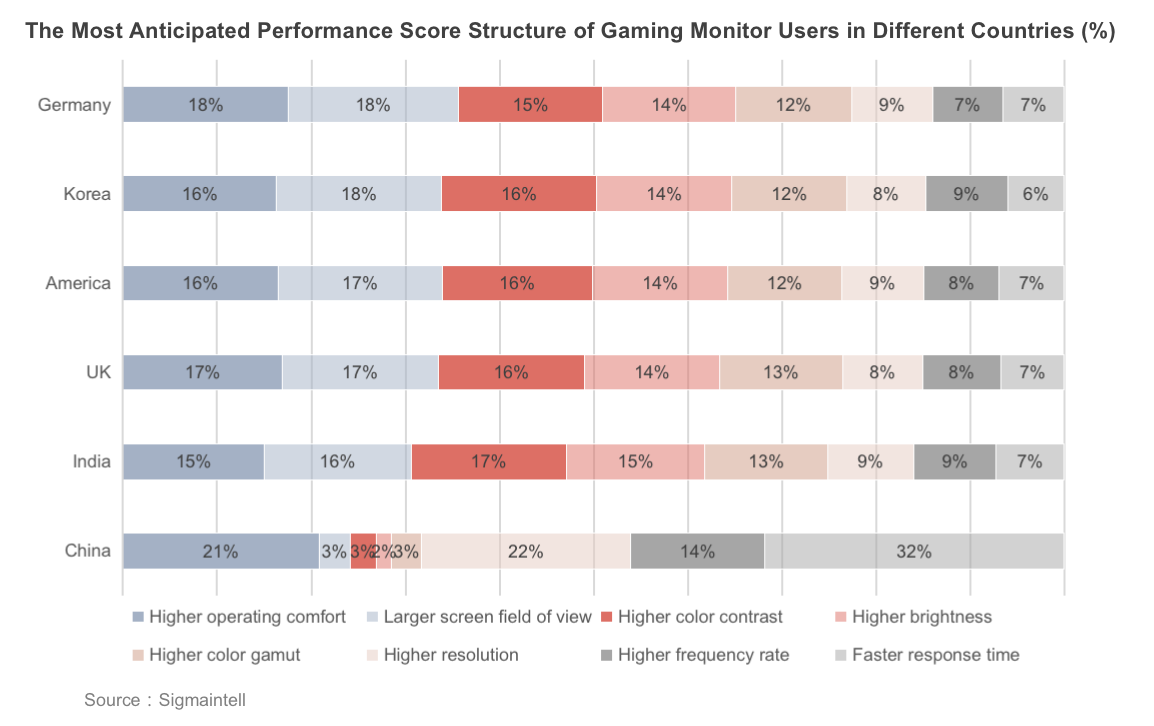

So what did the firm find when it surveyed users? It turns out that higher frequency rates and faster response times were the bottom two attributes in the ranking. At the top was ‘higher operating comfort’. I guess that that’s not really surprising. Plenty of the gamers may have been working on a display at work and others will spend long periods in front of them.

Now, it may be that part of the reason that higher refresh and response times are not higher on the ‘desired’ list is that makers have already addressed this issue, so gamers that have good monitors don’t see a need for improvement.

On this topic most countries are broadly in line but China stands out in concern over resolution, refresh rates and response times. All the other regions have a total of 59% or 60% rankings for larger screens, higher contrast, brightness and colour gamut, but Chinese buyers only give a share of 11% in total to those factors. That really is a dramatic difference and I don’t know enough about the Chinese gaming monitor buyers to make real sense of this, but it certainly would repay some investigation by brands.

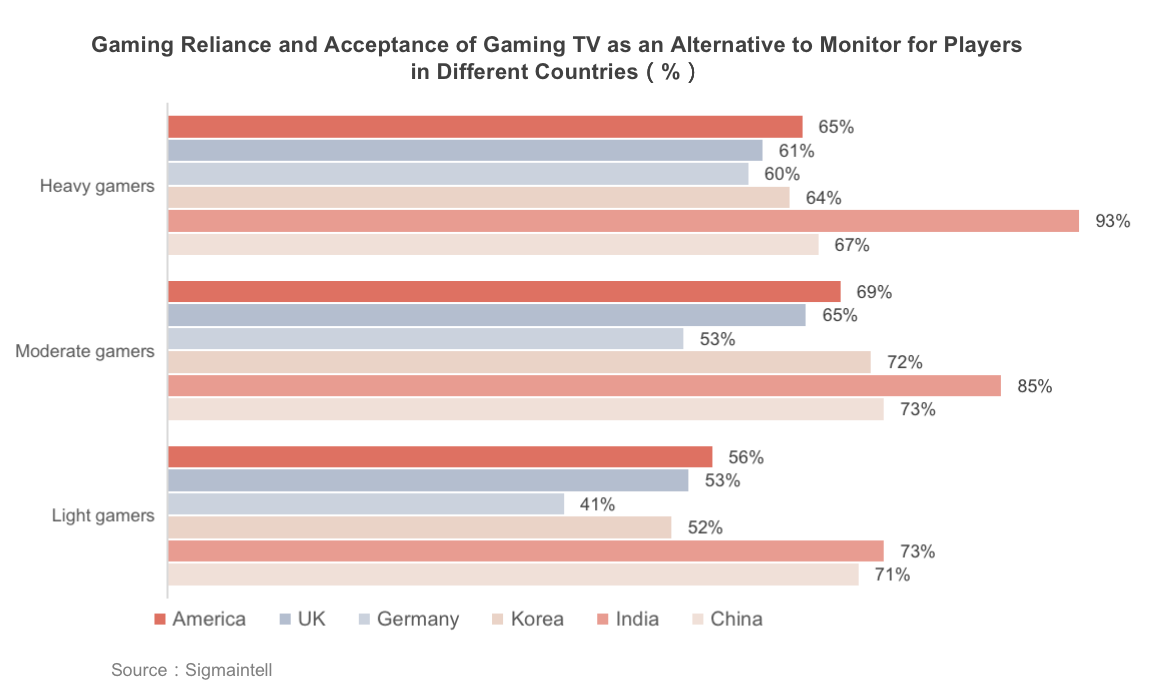

In recent years, there has been an increasing interest in using TVs for viewing. Of course, this topic also depends on factors such as the use of consoles for gaming rather than PCs, but the openness of buyers to look at TVs for gaming is interesting. There has been more emphasis on gaming performance by TVs in recent years, but if these figures are accurate, we can expect more emphasis on this from set brands. Sigmaintell highlighted that it sees this as an opportunity.

As you can expect there are differences in the acceptance of TVs for gaming in different regions. Sigmaintell said that the relatively low level of acceptance of TVs for gaming in Germany is partly because of the relatively high level of monitors that are already being used there for gaming.

It might be thought that light users might be more interested in gaming on TVs, but it’s ‘heavy gamers’ that have the high acceptance and Sigmaintell believes this is based on a desire for bigger displays with more immersion.

Of course, like most of the market research that is given away by researchers, it’s intended to whet the reader’s appetite for more and the sale of a report, so Sigmaintell has one available. (BR)