Sigmaintell has published its results for the TV OEM market in the first half of 2017. The company said that volumes in the TV market as a whole dropped by 7.1% year on year, but OEM shipments of 33 million units were up 4.3% compared to the same period in 2016. Although OEM shipments were up by 13.5% in Q1, but this meant a decline a YoY decline of 2.4% in Q2.

Large and small sets have increased, with 32″ and below up by 5.1% and with 55″ up by 16.7%. Larger sizes of above 55″ have grown by 87.8%. However, mainstream 39″-43″ were down 2.8% and 48″ to 50″ down 13.2%. In the OEM side, sizes of 32″ and below were 46% of the total as brands prefer to keep larger size manufacturing in house.

There were some big increases in purchasing from Chinese panel makers, with CEC Panda up by 197%, CSOT up by 19.1% and BOE up 1.8%. HKC started to ship to OEMs during the first half. Foxconn OEM shipments were up 247.6% following the takeover of Sharp.

Internet TV brands were down in the first half, which hit TPV which was up only 0.1%. On the other hand, the Sharp brand was up by 109.5%, although Sigmaintell said that the company has an inventory issue for the second half. TCL’s OEM shipments were up 29.6%.

Sigmaintell’s report of OEM TV shipments in the first half of 2017

Looking at the branded TV market, shipments were just 49.4 million in Q2 as there was poor demand because of a range of macro-economic issues. Low end buyers were especially affected.

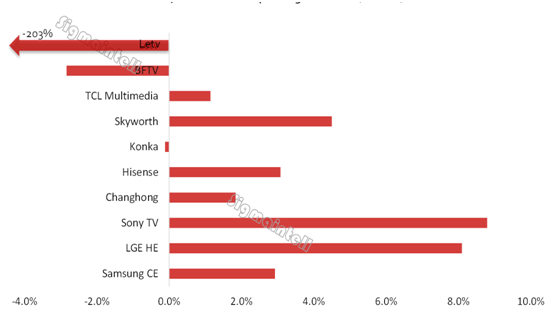

The company highlighted that Sony’s margin in Q2 was 8.8%, which the firm sees as outstanding as it actually went up year on year. This reflects some success in the premium TV market with OLED. LGE had margins of 8.8% and 8.1% in Q1 and Q2, respectively in line with its historic performance. However, Samsung saw its margin decline from 8.9% in Q2 2016 to 2.9% this year as the firm suffered from high panel prices and this impacted volumes.

Chinese makers saw their margins drop year on year and internet brands which did so well last year (Letv and StormPlayer in particular) really suffered this time, although Xiaomi is less affected than the others.

Sigmaintell expects the market to be 2% down in Q3 compared to last year with cost reductions helping to improve margins.

Operating Margins of Global TV Brands in Q2 of 2017

Operating Margins of Global TV Brands in Q2 of 2017