We caught up with Sid Stanley, General Manager, Europe – Visual Solutions, of Sharp to get an update on the Sharp/Foxconn deal. Stanley, who is always very upbeat about the business, was positive about the move. One of the reasons for this is that the deal between the companies has been described in detail. He encouraged us to have a look at the document. (go to http://www.sharp.co.uk/capital-alliance and click on the button “Investment Update”). We did that.

We caught up with Sid Stanley, General Manager, Europe – Visual Solutions, of Sharp to get an update on the Sharp/Foxconn deal. Stanley, who is always very upbeat about the business, was positive about the move. One of the reasons for this is that the deal between the companies has been described in detail. He encouraged us to have a look at the document. (go to http://www.sharp.co.uk/capital-alliance and click on the button “Investment Update”). We did that.

The plan is unusually candid in explaining how Sharp got into the trouble it found itself in and is also very concrete in setting out the company’s plans for investment. We were surprised with the detail given of the plans to get into OLED production, especially. However, the plan also covers investment into the Business Solutions Company (which includes the Multi-function Printer business which is currently 90% of the business in Europe and North America and which we reported on from the event the company ran last year (Sharp Explains its Reorganisation and Restructuring in Europe.)).

We were also surprised that the document clearly states that there is an agreement with Foxconn to maintain “Sharp’s research and development and manufacturing functions in Japan” and to cooperate “to prevent leakage of Sharp’s core technology”, specifying specifically that such technology should not suffer from ‘leakage of such technology to outside of Japan’. It also specifies that the “unity” of Sharp’s business (and their subsidiaries) would be maintained.

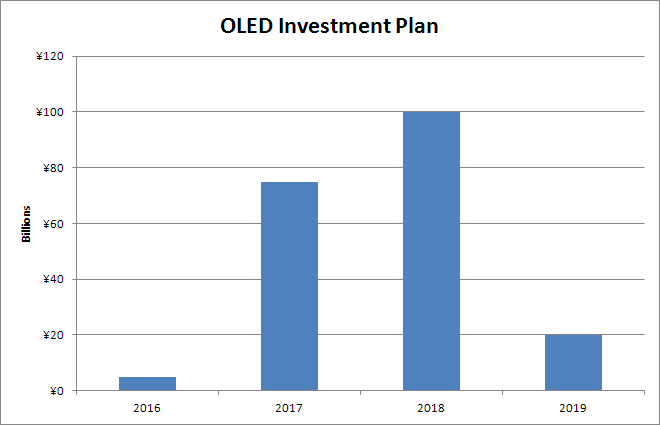

OLED Investments

The plan sets out that Sharp will spend ¥5 billion ($45.9 million) in 2016, ¥75 billion ($688.9 million) in 2017, ¥100 billion ($918.6 million) in 2018 and ¥20 billion ($229.6 million) in 2019 to build capacity for the monthly production of 10 million 5.5″ displays equivalent by the end of the period (with a plan to produce 90 million over the year, valued at ¥260 billion ($2.4 billion).

The report suggests that LCD will be pushed to the low and mid-level of smartphones and tablets and says that flexible OLEDs will be important ‘with rounding and folding capability (as if it were paper)’.

Sharp said that the R&D lines will use G4.5 substrates using FMM and FHM (Fine Hybrid Mask made of metal and plastic), with actual production by the second half of 2017. Full production will eventually use G6 substrates (half size used).

In LCD, the plan details a shift to medium-sized products for tablets and PCs. The company will also invest in colour filter production and further developments in its ‘Free Form’ displays.

Consumer Business & Business Solutions

The consumer business will be moved into Sharp’s ‘Digital Information’ business and will move to try to focus on IoT opportunities.

Sharp foresees that there will be slowing growth in the MFP business, but money will be spent on boosting channels in North America and Europe as well as boosting software and developing new digital signage business. Stanley told us that office automation, exploiting Sharp’s combination of display and MFPs, will be a priority.

The Sharp Brand

Sharp’s plan also includes a boost in spending on advertising of the brand.

Analyst Comment

We rarely see such detailed plans. It’s clear that while Foxconn may have played ‘hard ball’ on the pricing of the deal, Sharp’s management has done the same in coming to terms over the deal, so the course for the next 3-5 years seems set. (BR)