In an exclusive interview with Display Daily, Jen Cheh, Senior Vice President of Display Marketing and Product Management at Sharp Business USA, shed light on the company’s strategic direction, recent developments, and the future of its display technology business. This comes after the boss ruffled feathers by saying that Sharp was out of the display business. He had his points, but that’s not what this interview is about. It is to give voice to one part of Sharp’s display businesses. Cheh’s insights reveal a clear distinction between Sharp’s display product business and its panel manufacturing operations, offering a nuanced understanding of the company’s market positioning and growth strategies.

Cheh emphasized that Sharp’s display technology business, which focuses on selling end products such as large format displays, desktop monitors, and projection technology, operates independently of the company’s panel manufacturing division. This distinction is crucial, especially following the closure of Sharp’s Sakai plant, which had been a significant component manufacturer. Cheh clarified, “None of the products we are currently selling in the US market are sourced from the Sakai factory that is being shut down.”

Instead, Sharp sources its display panels from a variety of locations, emphasizing the importance of its engineering, research, and development capabilities. “We procure products from various organizations, develop and manufacture them, and then deliver the final products,” Cheh explained, highlighting Sharp’s role as an OEM (Original Equipment Manufacturer).

Sharp’s decision to shutter the Sakai factory, according to Cheh, has had no adverse impact on their current or future product plans. In fact, she sees it as a strategic move that reduces exposure to unprofitable operations, allowing for reinvestment in core business areas such as R&D. “This move allows us to focus on our core business and reinvest in continued R&D development, driving greater innovation and growth,” she stated.

Sharp boasts one of the most extensive portfolios in the display market, offering solutions for a variety of verticals, from corporate offices to public spaces and retail environments. The company is making significant strides in direct view LED technology, which, although not new, is experiencing tremendous growth. As the price points for fine pixel pitch LEDs decline, Sharp sees substantial opportunities in this area.

Cheh also highlighted the company’s robust presence in the education sector, office solutions, and corporate lobbies. “We have solutions for different price points and vertical markets, from 43-inch displays to 98-inch wide formats, and a strong presence with direct view LED technology,” she noted.

A key element of Sharp’s strategy is its channel-centric approach, leveraging distribution partners, integrators, and resellers to serve end customers. Despite the consolidation within the distribution sector, which has seen a reduction in the number of major distributors, Sharp remains committed to this model. “Sharp has been and will continue to be a channel-friendly organization,” Cheh affirmed.

However, Cheh wanted to insist that innovation remains at the heart of Sharp’s strategy. The company is in the process of transitioning new products to the Sharp brand, having introduced its first co-developed large format displays last year and set to announce new 4K UHD projectors at Infocomm 2024. “We’re starting to convert our projector lineup to the Sharp brand, continuing to invest in innovative technologies that propel the display industry forward,” Cheh explained.

Sharp’s global footprint allows it to offer consistent products and services worldwide, catering to multinational corporations with uniform standards in product quality, pricing, and support. “We can offer a single program with a global account manager, providing best-in-class service and support worldwide,” she stated.

Looking ahead, Sharp is keenly focused on expanding its presence in public spaces and retail, where digital signage and e-paper technology are seen as growth areas. The company is also exploring the integration of analytics and AI to enhance customer experiences, particularly in sectors like transportation.

As Sharp navigates the evolving landscape of the display industry, its commitment to innovation, quality, and customer-centric solutions positions it as a formidable player. Cheh’s insights underscore the company’s strategic agility and dedication to leveraging technology to meet the diverse needs of its global clientele.

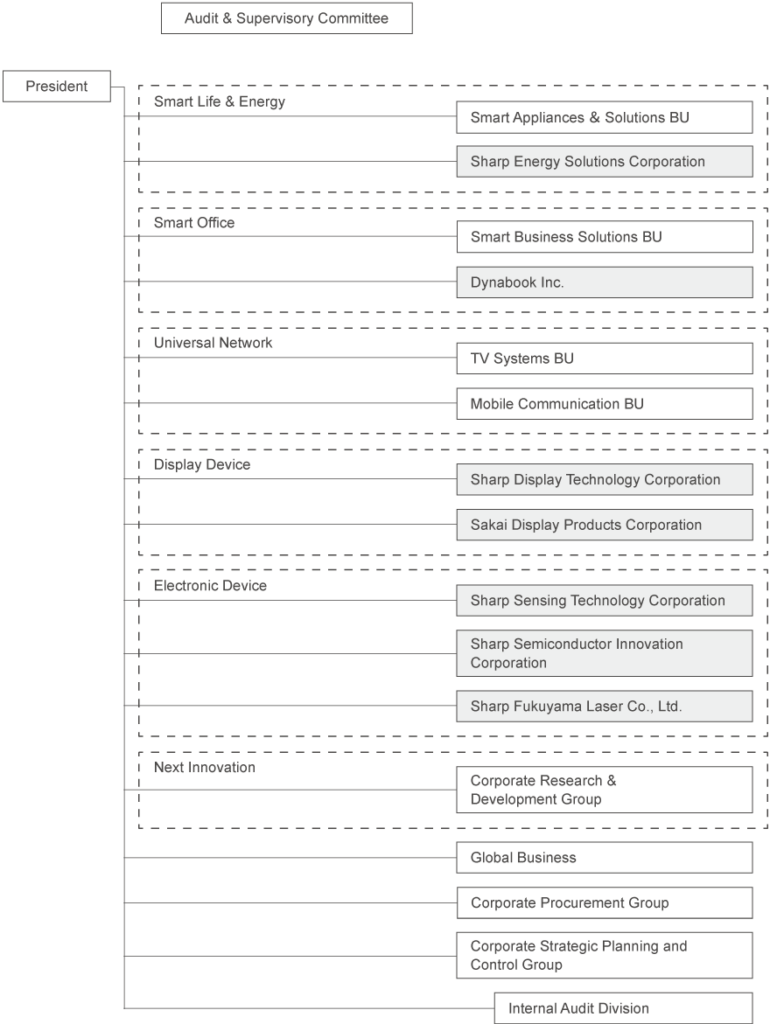

As for Sharp Business USA, Cheh’s company, it falls under the Smart Business Solution Business Unit at Sharp, a subset of its Smart Office division. The clarity for Sharp may be clear but it is not an easy get for anyone who hasn’t taken a deep dive into investor relations materials at Sharp.

Be that as it may, Sharp Business USA is active and successful in selling displays, and where the panels come from is wherever they need to come from. Sharp continues to have a different research and development groups that are working on display and panel technologies but they dovetail with different business units. Each business unit is big enough to warrant their own product development, and each has its own unique configuration of companies by region, and by channel.

Sharp, the conglomerate, is a lot of things. Sharp Business USA is a fabless display company, much the same as its TV Systems Business Unit is a fabless TV manufacturer. Maybe the boss shouldn’t have been so black and white in labeling the company. The setup and organization of Sharp means that it is structured around well-established distribution and supply chains. It has kind of grown out of those channels because of its long history in developing them. It may not be pretty, and like most conglomerates, it probably only makes sense to the people on the inside, but the company doesn’t stand for just one thing. Maybe the Display Devices division seems like it needs to be absorbed into other business units, maybe there is too much duplication of effort within different divisions. That’s above my pay grade to analyze and discuss.