Yesterday, DSCC’s Bob O’Brien published a blog article that revealed that Samsung has told all its business groups to suspend purchases and control their inventory status. Samsung has informed flat panel display makers in smartphone and TV markets that panel purchases will be halted.

As Samsung makes more TVs and smartphones than anybody else, that’s a big deal. The move reflects the difficult trading conditions for consumer electronics brands who have been on a roller coaster ride over the last three years. First, supply chains were hit as China went into Covid lockdown in late 2019 and early 2020. However, Covid then provided a huge boost to demand as people moved to a work from home model and schools and colleges moved to a learn from home model, driving huge demand for notebooks and monitors. Consumers stuck at home invested in their home entertainment with new and better and bigger TVs. Life was good, although everyone was busy in the supply chain.

Then several panel makers failed to resist the temptation to make the most of what might have been new conditions in the market and expanded their capacity. However, the Russian attack on the Ukraine has triggered high inflation and rising energy prices have hit global demand. Consumers are spending their money on travel after the last couple of years of lockdown, rather than on new TVs and smartphones. Cautious about the future, consumers are opting to cut their spending on consumer durables.

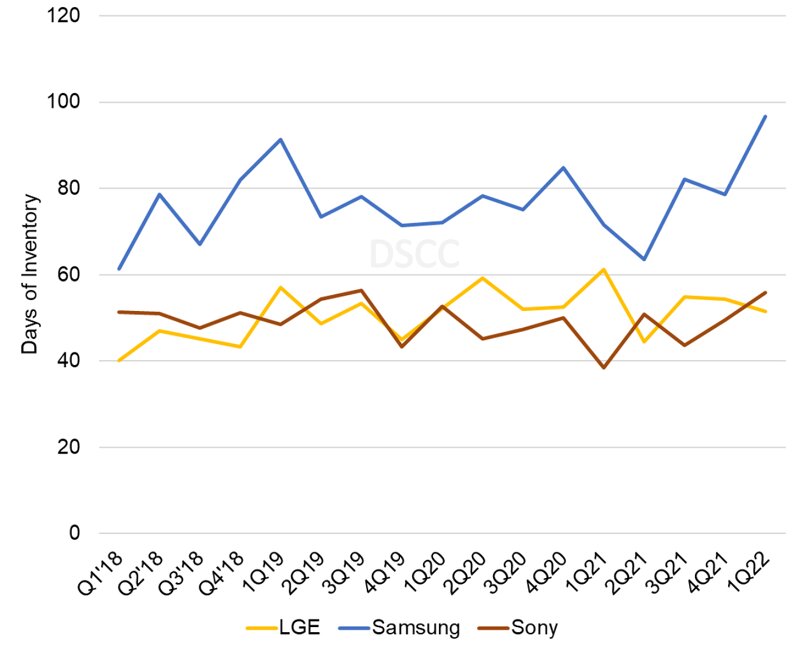

The result has been a build up in inventory throughout the supply chain. DSCC analysed the financial results of the top global TV brands, LGE, Samsung and Sony and found that Samsung, in particular has seen a big boost in its inventory value to close to 100 days. That’s a lot in a fickle market. Overall, DSCC believes that there is around 4.7 weeks of excess inventory in the supply chain.

Source: Company financial statements, DSCC analysis

Source: Company financial statements, DSCC analysis

There was a time, in the days of CRTs when long lead times and difficult logistics were the norm, when inventory was real power. Product life cycles were long and if you had inventory you could react to demand. But with the switch to flat panels and digital circuitry, things changed. I came from the world of monitors where it had been learned that in the flat panel display business, inventory needed to be really tightly controlled – a lesson from the PC world. In that world, the prices of components such as CPUs, memory, and of course, displays could come down sharply or you could be left with the last generation of technology when buyers had moved on. It was a shock to me when I got into researching and analysing the TV market that retailers and brands still saw big inventories as an asset.

To see Samsung have such large inventories has also surprised me. In the past, I have complained that the Korean ‘balli balli’ – hurry, hurry culture sometimes made it hard for the firm to launch new products. Markets take time to develop, but sometimes the inventory pressures at Samsung’s sales companies meant that if inventory of a new category of product seemed to be going slowly, the firm would dump it to clear that slow moving stock. Seeing that behaviour from Samsung could trigger other firms to make the assumption that ‘there’s no market’ and reduce their efforts.

The classic cure for the kind of oversupply in the display supply chain is to reduce capacity or the share of the capacity that is actually used, the ‘utilization level’. Although panel makers have reduced their utilization somewhat, DSCC reports, the LCD industry has grown in capacity by 16% from 2020. Samsung Display is closing its last LCD fab this month, which will help a bit, but Chinese makers have continued to be optimistic.

Sigmaintell Updates on TV, too

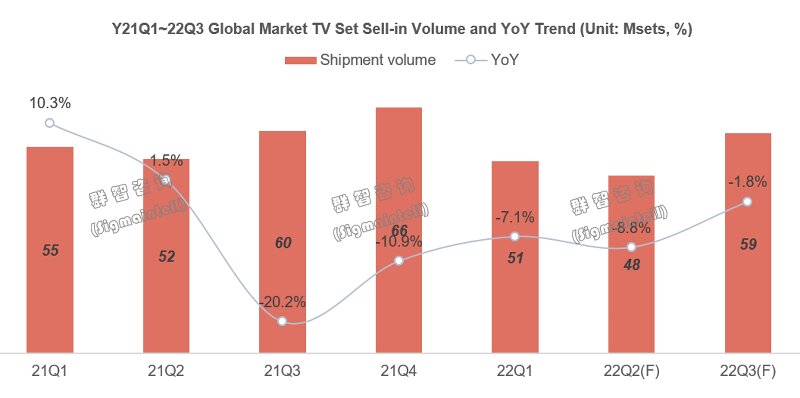

Separately, a few days ago, Sigmaintell Research of China also had a look at TV demand and confirmed that it expects global TV market sell-in volume (i.e. the sets that brands sell into retail) to reduce by 8.8% in this quarter compared to last year, reducing to 48 million sets. This year is expected to be the worst in a decade with a 4.9% drop to 222 million units.

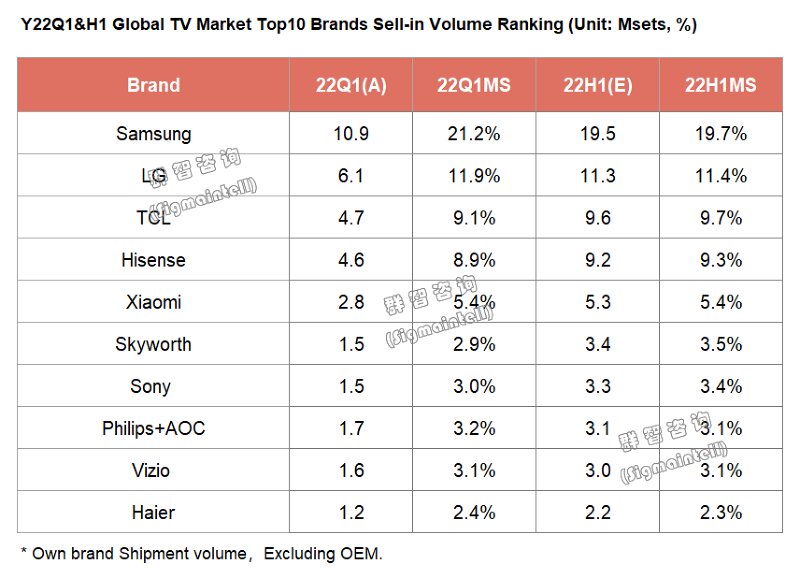

Sigmaintell looked at TV brands and also identified Samsung as focusing on inventory control. LGE and Sony are also being cautious as demand in Europe for high end sets has been weaker than hoped for. Hisense’s Vidda brand has done well in China, but shipments outside its home market are down – but overall its volume should increase this year.

TCL, said Sigmaintell, has not got too much inventory at the moment, with a ‘healthy level’ and the firm will be able to buy new inventory at lower prices than its competitors. (BR)