The TV business is in the doldrums (but then of course, so is more or less every CE category that uses displays at the moment). At times like this, brands start looking around at alternative business models.

The traditional TV business model was to sell a set to a consumer and then hope to forget the set. With just a few exceptions (such as Metz in Germany and its network of small TV repair dealers and, for a while Sony, which did well selling extended warranties – “I’ve finally made some money for the firm in the TV business” as one executive once put it to me), the aim of the brands was to get a set into a living room for seven to ten years and with the brand name prominent. Brands didn’t really think about ongoing relationships or getting income from buyers, except when it was time for a new set.

When the world was starting to move towards flat panel TVs with HD performance, the sets were very expensive for many consumers and I talked to a number of vendors that I was working with at the time about the idea of selling the sets with a subscription, as the mobile phone suppliers were doing. That would get around the need for a buyer to find a big chunk of cash for the latest technology. However, they were not keen as they could see that handset makers were in a relatively weak position compared to the service providers.

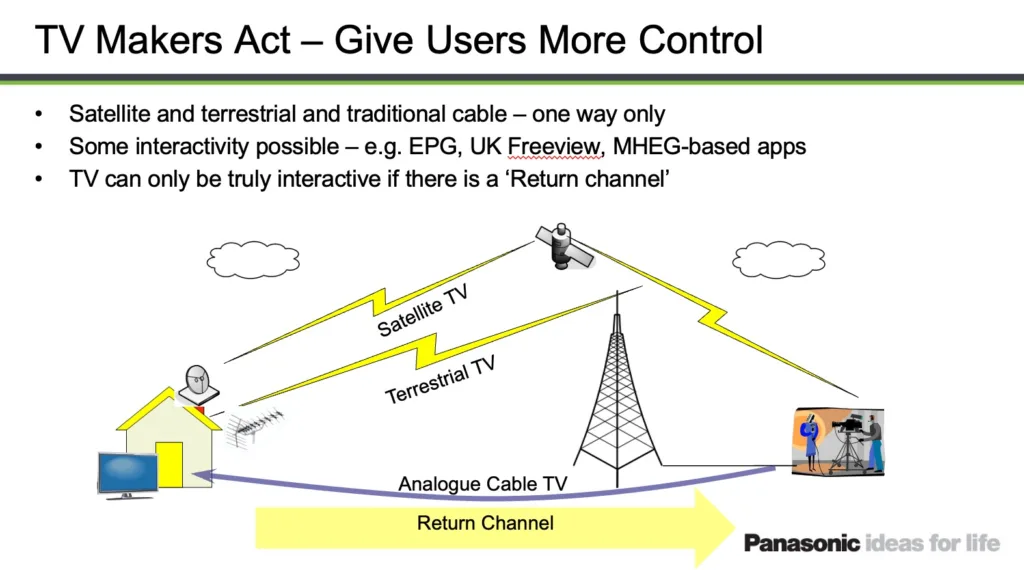

That all changed at least potentially, when Panasonic launched its VieraCast service and at the European launch, I gave the keynote speech that explained how the relationship between the set maker and the buyer could change with SmartTVs. That was in 2009. Critically, SmartTVs gave the set makers a critical feature – a return channel to connect with viewers and set-owners.

This was one of the slides I presented for my keynote in 2009.

The reality for most SmartTV set makers is that they have not really had the scale to really do a good job of exploiting their audiences. That’s not true of Samsung, which does have huge scale and may or may not be true of LG and Sony (I’m not close enough to them these days to know) but for most TV brands, the extra capabilities of SmartTVs have really been a source of cost and pain rather than opening up significant revenue streams or developing deeper understanding of their users.

However, one brand really went for this in a big way and I was triggered into thinking of this topic by a recent editorial from Bob O’Brien of DSCC, thanks, Bob! He highlighted the success that Vizio has had in staying in profit in Q4 2022 when others such as LG and Samsung made losses, because of the contribution of the firm’s service business. As he pointed out, if Vizio can do this, Samsung’s user base of 20x-30x bigger should also be a big opportunity. Vizio has been renowned since its start for its supply chain efficiency and low margin business model. If you are already good in that way, developing services makes a lot of sense. Bob’s estimates put the potential revenue, if it could match Vizio’s ARPU ($28), in the realm of $10 billion. That’s not exactly small change!

For the TV hardware business to switch to a ‘give away the hardware to win service revenue’ would be a big change in culture and thinking, but it certainly doesn’t look unreasonable. Over decades, the TV business has often looked as though it was more about brand awareness and prestige than profit, so a change in this direction wouldn’t be surprising. Consumers, at the moment, are under financial pressure and developing advertising-funded services that can at the same time generate an income for the set maker looks to me like something that could be a win/win.