We met at CES with three of the quantum dot companies, Nanosys, Nanoco and Quantum Materials Corp. It was interesting to see their different points of view. All of them were, of course, very happy to see the amount of marketing effort being put into the technology by Samsung.

Nanoco Sees Supply Limiting QD Filters

The first we spoke to was Nanoco which is very positive about its developments and the company helped us to understand some of the issues that will be challenges going forward. The company thinks that some of the developments in QD usage may be limited by production capacity of dots. The firm explained to us that if, as we expect, QDs move to the front of LCDs to replace the filter assembly, there will need to be a big boost in capacity. When the QDs are put into the backlight, the concentration doesn’t have to be high as the light passing between dots and not changed by the dots is blue and forms part of the image. However, if you move the QDs to the front, you need pure primaries to convert all the light in each sub-pixel area and that means up to 10 times the quantity of dots being needed to ensure no leakage of blue light.

The first we spoke to was Nanoco which is very positive about its developments and the company helped us to understand some of the issues that will be challenges going forward. The company thinks that some of the developments in QD usage may be limited by production capacity of dots. The firm explained to us that if, as we expect, QDs move to the front of LCDs to replace the filter assembly, there will need to be a big boost in capacity. When the QDs are put into the backlight, the concentration doesn’t have to be high as the light passing between dots and not changed by the dots is blue and forms part of the image. However, if you move the QDs to the front, you need pure primaries to convert all the light in each sub-pixel area and that means up to 10 times the quantity of dots being needed to ensure no leakage of blue light.

Nanoco told us that it thinks that 20 million TVs can be sold with 20 tonnes of QDs, but this would need 200 tonnes with the change. Nanoco has its own supply, together with deals with Dow and Merck (Connecting the Quantum Dotters) but thinks that it could take several years to get to that level of capacity.

Nanoco’s technology is now being used by TCL, TPV and Hisense in production TVs. We asked about cadmium issues in Europe and Michael Edelman, CEO of Nanoco, told us that the situation still unclear as the new regulations have not been passed. Of course, QD Vision, which was one of the companies that was pushing for an exemption, is no longer in the picture.

Nanosys Begs to Differ

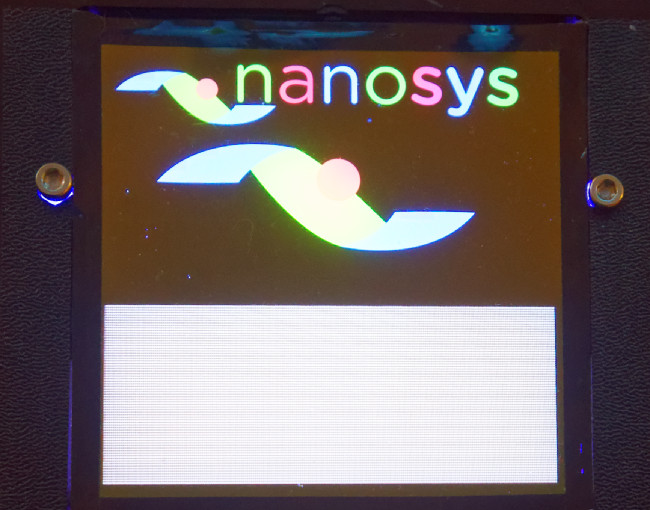

Nanosys was in the Westgate hotel and had some good demonstrations. Jeff Yurek of Nanosys confirmed the issues that we had talked about with Nanoco in terms of the need for thicker QDs in the filter. However, he does not see a supply issue limiting the development and suggested that the QD in the filter concept might even be in the market as early as 2018. He showed us a sample display filter that Nanosys has made in its own fab as a proof of concept. It looked pretty good for a ‘hand made’ display.

Nanosys QD Filter sample. Image:Meko

Nanosys QD Filter sample. Image:Meko

Nanosys was also highlighting the colour volume argument that Samsung is propagating to counter the performance of LG’s OLED.

QMC Has ‘Secret Sauce’

We met with Toshi Ando of Quantum Materials Corp during the show, the first time that this reporter has met with the firm, so we got a bit of background.

The company was started in 2007 by Steve Squire, who recently returned as CEO. It started developing quantum dots in Texas for solar applications and these were based on a tetrapod shape which was very efficient for solar applications. Unfortunately, the solar panel industry started to suffer because of the issues of oversupply from China, so the firm started to look at changing to address the display business. Unfortunately, the tetrapod shape is not optimum for display applications, which need spherical QDs, so the company ‘pivoted’ in 2013 to make that kind of QD. It believes it has a solid ip portfolio for its QDs and competitive performance. The company also confirmed that it has ip for air-processable and cadmium free solutions.

However, the firm’s ‘secret sauce’ is that it has a continuous process to make the dots. This differs from other makers who ‘grow’ the dots in batches. QMC claims that its continuous process has a big advantage in that once the process is stabilised, it can produce a lot of material in a small space and with high consistency. In fact, the company claims that a ‘fridge-sized’ micro process system that it has developed can create 300 kg and that a space of 2-4 m² could produce as much as two tonnes of QDs annually.

We carried a Display Daily article (Quantum Materials Ships Quantum Dot Sample Sets) about QMC that featured comments from display industry specialist, Sri Peruvemba, who was CEO at that time, having joined in the summer of 2016. In that article, we reported that the firm had a deal to raise money to bring the materials to market. However, just before the holidays, the company parted company with Peruvemba and Squire returned to take the reins at the company, again.

The company is still keen to develop its business in the sale of materials, but is also open to other business models including licensing of its production technology.

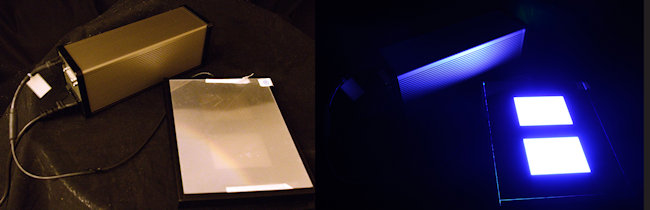

Quantum Materials Heavy Metal-Free Quantum Dot Display Thin Film on top of frame as compared to Major Manufacturer QD Display Film on bottom, both through polarizing filter. Image:QMC

Quantum Materials Heavy Metal-Free Quantum Dot Display Thin Film on top of frame as compared to Major Manufacturer QD Display Film on bottom, both through polarizing filter. Image:QMC

Analyst Comment

It strikes me that the quantum dot in the filter architecture is most likely to come into the market at the high end. Panels with this architecture should be capable of very high brightness, or low power, which would be a big advantage for the kind of ‘two box’ TVs that are now at the top of the TV ranges of Samsung and LG. The lower power could be a big advantage in shifting these designs to wireless power which might be very attractive for buyers. It will then migrate down to the mainstream market. That could mean that both Nanosys and Nanoco could be right. High end products might start by 2018, as Nanosys suggests, but not take over the main market until some years later as Nanoco believes.

On the other hand, maybe Nanaco should look at licensing manufacturing from QMC if it really can scale up very quickly? (BR)