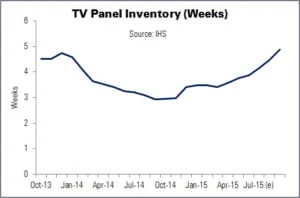

LCD TV panel inventory will be higher than normal in the second half of 2015, due to softer demand and increased output, says IHS. Peak panel inventory (4.7 weeks’ worth) was reached in December 2013. Since then, inventories have been sustained at sub-four weeks.

However, the situation changed in Q2 when panel makers did not slow production. This led the market to shift to over-supply. Therefore, a new record peak is expected to be recorded at the end of Q3: 4.9 weeks of inventory, which could cause further panel price drops.

Mass production is due to begin at three G8.5 fabs in China this year, further aggravating the over-supply, said IHS display director Ricky Park. He added, “Manufacturers maintaining current utilisation rates at existing production lines will also increase inventories”.

Utilisation rates at G7 and higher fabs have remained above 90% since April 2014. This is because TV panel shipments – in terms of area – rose more than 17% in 2014, due to high demand for larger models. Despite these higher utilisation rates, panel makers were able to control inventories at normal levels. TV makers purchased too many panels in the first half of 2015, anticipating greater consumer demand in the second half. However, due to stagnant growth, manufacturers are likely to reduce their panel purchases in the last six months of the year.

Despite this, Chinese panel output is forecast to rise further, due to the aggressive production schedules at the new G8.5 fabs owned by CEC Panda, CSOT and BOE. Additionally, some South Korean fabs have been fully depreciated, lowering production costs. Panel makers can thus offer panels at lower prices, without losing margins. Thus, their utilisation rates are likely to remain the same, despite lower demand.

“LCD TV panel prices will continue to decline through the third quarter of this year; however, some models are still profitable, so panel makers do not necessarily intend to reduce their output”, said Park.

At the end of July 2015, IHS expects panel inventory levels to have risen to 4.1 weeks, and 4.9 weeks at the end of September. These high inventory levels are likely to cause panel makers to lower prices, in response to TV makers’ demands.