OLED technology is poised to capture more than 50% of the smartphone market share by 2023, according to the latest report from TrendForce. The increasing affordability of OLED panels is driving this significant growth. However, the adoption of OLEDs in other sectors such as TV, laptops, and tablets remains relatively low, standing at less than 3%. To expand the market penetration of OLEDs, panel manufacturers face the challenge of overcoming technical hurdles while improving specifications and reducing costs to meet market demands.

Japan Display Inc. (JDI) has introduced a promising solution called eLEAP technology to tackle key obstacles in high-generation OLED development. This approach employs a maskless technique, resulting in lower power consumption, higher brightness, and an extended lifespan. By addressing issues such as RGB evaporation interference and uneven film thickness caused by gravity-induced sag of the fine metal mask (FMM), eLEAP paves the way for the production of higher-generation OLED panels and enhances overall production efficiency through mass production.

Another significant advancement comes from Visionox, which showcased its maskless ViP technology at Display Week 2023. By combining lithographic pixel isolation with advanced evaporation technology, Visionox has successfully reduced the gap between pixels. At a resolution of 800 ppi, the distance between pixel layers decreases to 10µm, resulting in a 31.9% increase in the opening rate and effectively extending the lifespan of OLEDs. However, several challenges, including the production of guide pillars for isolation, controlling the evaporation angle using line-source evaporation, reducing electrode impedance through the connection of the cathode and isolation pillars, and managing yield loss from repeated processes, need to be addressed for further advancements.

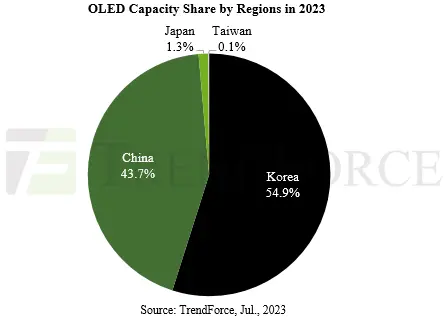

Currently, China’s AMOLED production capacity holds 43.7% of the global market, slightly trailing South Korean panel manufacturers. This capacity is divided among 4 to 5 Chinese panel factories. As the current AMOLED capacity is oversupplied and future production capacity is projected to increase, companies exclusively focused on OLED production may face financial pressures. It remains to be seen if these companies will adopt a collaborative approach similar to JDI and HKC, given their varying technical capabilities. Through the development of new technologies and strategic alliances or integrations, they aim to enhance their overall international competitiveness, making this a development worth monitoring over the next 3 to 5 years.