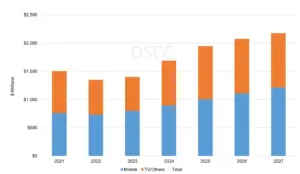

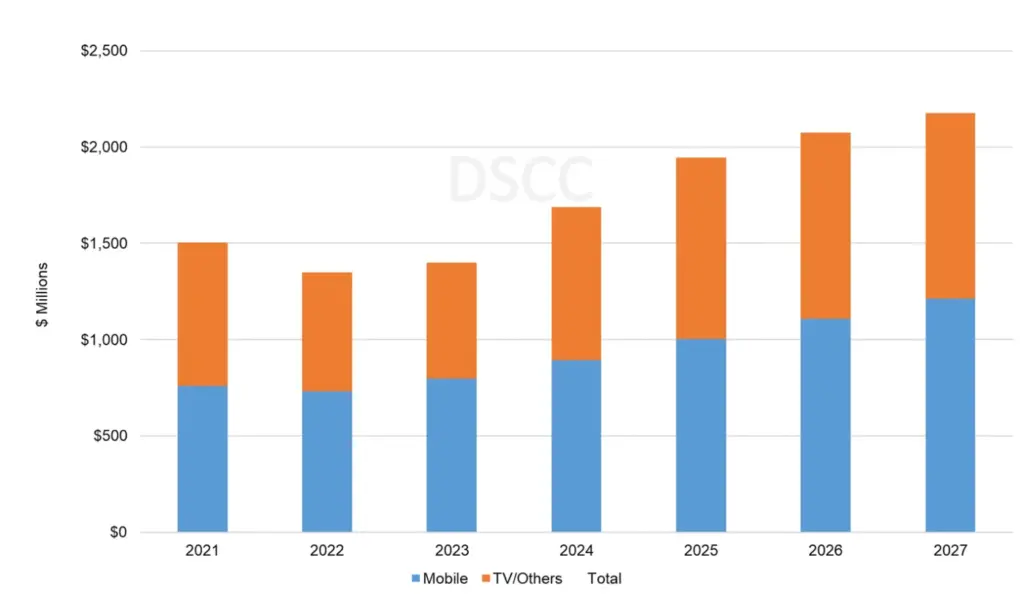

The latest update of DSCC’s Biannual AMOLED Materials Report reveals that after experiencing a 10% decline in 2022, revenue for AMOLED stack materials for all applications is projected to grow by 4% year-over-year (YoY) to reach $1.40 billion in 2023. Revenues are expected to reach $2.18 billion in 2027, representing a compound annual growth rate (CAGR) of 12% between 2023 and 2027.

An important factor that could significantly impact these revenue projections is the successful commercialization of a blue phosphorescent emitter dopant by Universal Display Corporation (UDC). If UDC achieves this milestone, the revenues in 2027 could be even higher, amounting to hundreds of millions of dollars.

Revenues from TV and other large screen applications declined by 17% YoY in 2022 and are expected to decline by another 3% YoY in 2023 before returning to growth in 2024. Subsequently, TV revenues are projected to achieve a 13% CAGR from 2023 to 2027, reaching nearly $1 billion. On the other hand, mobile applications will continue to dominate OLED material sales, with an estimated 11% CAGR leading to $1.2 billion in revenues.

The upcoming addition of new capacity for vacuum thermal evaporation (VTE) red-green-blue (RGB) OLED fabs in G8.7, targeting the IT sector. This new capacity will benefit UDC and other VTE materials suppliers, as they can utilize the same materials. Further details on capacity additions can be found in DSCC’s Quarterly Display Capex and Equipment Market Share Report.

In terms of material costs, LG Display’s White OLED panels should experience a steady decrease in unyielded stack costs. It anticipates incremental improvements in material utilization and price, leading to a reduction in the unyielded stack cost of LGD’s standard WOLED panels from $62 per square meter in 2023 to $51 per square meter in 2027, averaging a 5% annual decrease. Additionally, with increased experience, improved yields are expected, further enhancing the cost declines of yielded OLED stack materials.

However, LGD’s OLED EX panels introduce changes that enhance brightness but also increase the cost of the OLED stack. These changes involve an additional green emitting layer and the use of deuterium in the host materials of the blue emitting layers, extending panel lifetime. DSCC estimates that the OLED Evo panel’s unyielded stack cost adds nearly $40 per square meter in 2023. Although this figure is expected to decline over time, it is projected to remain above $30 per square meter in 2026. Consequently, OLED EX panels will continue to be positioned as premium products, directly competing with Samsung’s QD-OLED.

Material costs for QD-OLED will be lower than those for WOLED. However, the cost advantage of the QD-OLED stack over standard WOLED panels is relatively modest due to QD-OLED’s requirement of three blue emitting layers and an additional green emitting layer to boost brightness. While the unyielded stack costs for QD-OLED are predicted to be around 20% lower than those for standard WOLED in 2023, the overall total product cost of QD-OLED is expected to be higher. This is mainly attributed to higher costs associated with the front end of the QD-OLED display, which includes a color converter and a color filter compared to the simpler color filter used in WOLED.

Analyzing the supplier landscape, UDC continues to hold the top position in terms of revenue contribution. Other major materials suppliers include Novaled, Merck, and LG Chem, occupying the second to fourth positions, respectively. Together, these four companies are projected to capture 57% of the industry’s revenues in 2023. However, a diverse range of companies contributes to the materials supply chain, as depicted in the supplier matrix.