OLED panel revenues will increase by 14% in 2020 to $31.8 billion, and will grow to $51.2 billion by 2025, according to the latest update of the DSCC Quarterly OLED Shipment Report for Q2 2020, as OLED continues to take a larger share of smartphone and TV shipments. We described the historical results in this report last month, so this article will focus on DSCC’s updated forecast for OLED shipments extended out to 2025.

The Q2 update of this report gives DSCC’s revised forecast for 2020-2025 for eleven different applications for OLED panels, with detailed figures for units, revenue, area, average selling price (ASP), and other parameters with splits by application, panel supplier, substrate (rigid/flexible/foldable) and brand. The report also provides final figures for Q1’20 with the same detail.

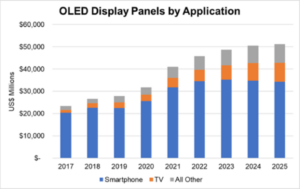

We’ll start with the outlook for OLED panel revenues by application. The first chart shows smartphone, TV, and all other applications grouped together, and the second chart breaks out those other applications. We expect smartphone to continue to dominate the revenue picture for OLED panels, but the revenue share to slowly erode as other applications pick up. We expect smartphone revenues to plateau after 2022, with a peak in 2023 of $35.2 billion and slight declines thereafter. Smartphone represented 81% of OLED panel revenues in 2019, but we expect that share to decline to 67% in 2025.

TV revenues will increase steadily, though, as we expect innovation to push OLED TV to continued success in the premium TV space. LGD’s expansion of their White OLED products, Samsung’s introduction of QD OLED, and CSOT’s launch of inkjet printed OLED are expected to lead revenues to grow from $2.5 billion in 2019 to $8.5 billion in 2025.

OLED Display Panel Revenues by Application, 2017-2025

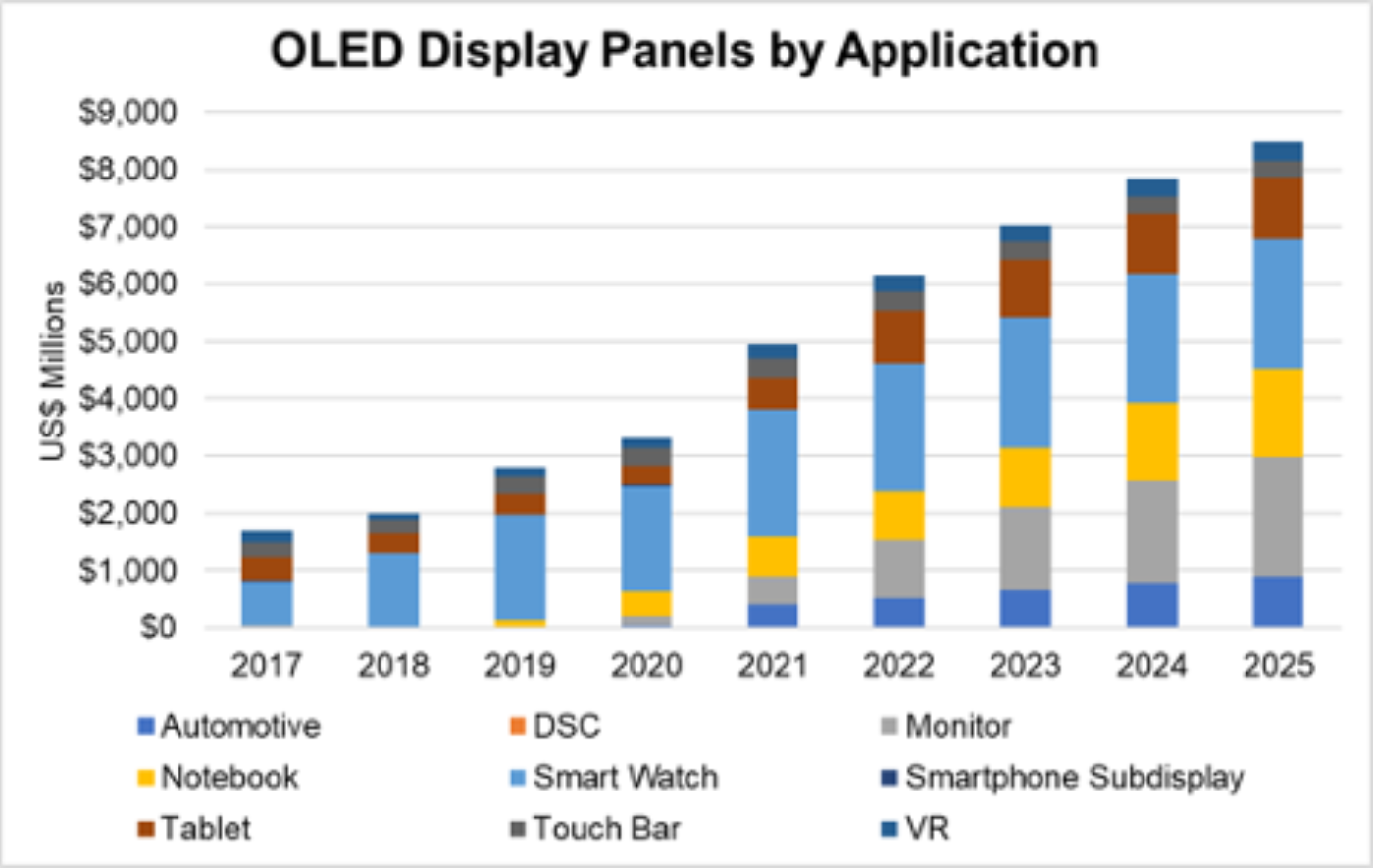

The second chart shows the proliferation of OLED across other applications. We have already seen dramatic revenue growth in smartwatch, with $1.8 billion in OLED panel revenues in 2019. While we do not expect much more growth in the smartwatch application, we expect that monitors, notebooks, and tablets all to exceed $1 billion in revenues by 2025, with automotive displays likely to reach that milestone soon thereafter.

OLED Display Panel Revenues by Application, 2017-2025

In unit terms, we expect the OLED industry to be even more dominated by smartphones, as we expect that smartphones will continue to represent 80% of OLED panel unit shipments through 2025, growing from 466 million in 2019 to 941 million in 2025. After smartphones, smartwatch also represents the largest application in unit terms, growing from 88 million in 2019 to 152 million in 2025, which will represent 13% of all shipments. We expect TV panel shipments to increase from 3.4 million in 2019 to 16.8 million in 2025.

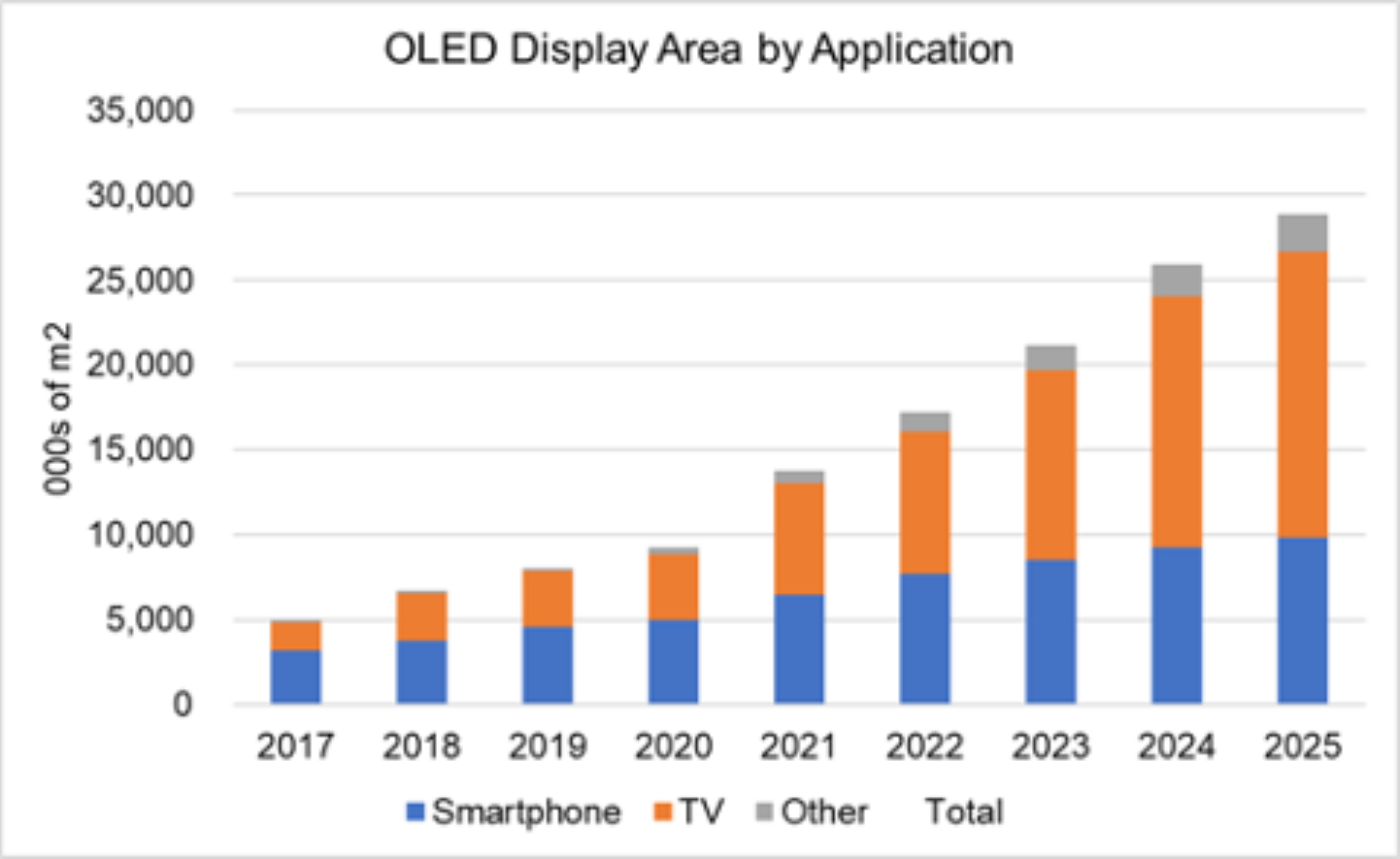

In area terms, we expect OLED TV will surpass smartphones in 2021 and will continue to grow to represent 58% of all OLED panel area by 2025, as shown in the next chart. Note that while we don’t expect revenue growth for OLED smartphones after 2022, we expect OLED smartphone area to continue to increase in the out years of the forecast, so that area doubles from 2020 to 2025 and reaches nearly 10 million square meters, and smartphone will still represent 34% of OLED area in that year.

OLED Display Panel Area by Application, 2017-2025

As noted above, the DSCC Quarterly OLED Shipment Report provides a comprehensive listing of historical panels shipments for all applications, plus a forecast of units, ASPs, screen sizes, resolutions, and revenues for each application. Readers interested in subscribing to the DSCC Quarterly OLED Shipment Report should contact [email protected].