In the recent article ‘Apple: A semiconductor superpower in the making‘ Nikkei Asian Review discussed the direction Apple is using in terms of semiconductor supply and design. They were reviewing how the recent Apple acquisitions show a strategy of building a semiconductor design house that is already in the top five worldwide.

Apple’s position as a top semiconductor developer

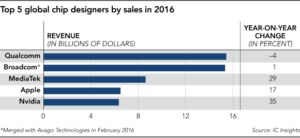

Their data show Apple just ahead of Nvidia in the number 4 spot. In addition, Apple has joined the the consortium led by U.S. private equity firm Bain Capital that is paying 2 trillion yen ($17.7 billion) for the memory chip unit of embattled Japanese conglomerate,Toshiba. (Bain Consortium Acquires Toshiba Memory Corporation) This makes sense since Toshiba is a supplier to Apple for memory chips and they certainly do not want to have Samsung taking even more supply share than they already have.

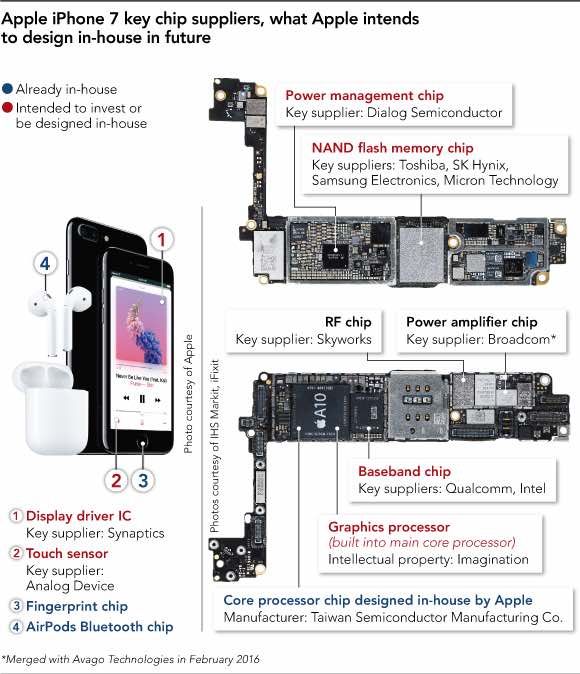

Their recent acquisitions and investment in engineering (partially sourced form existing semiconductor firms) suggest that Apple will develop even more chips in house. Overall,Nikkei foresees more components being made or designed in house by Apple. The following chart shows which components they believe Apple wants to bring in house.

Components Nikkei believes will be in-house Apple chips

Components Nikkei believes will be in-house Apple chips

Besides some key technologies that could be key differentiators for Apple there are also very basic chips, such as the baseband chip, that may or may not give them a competitive edge.

In addition, the article also discusses the interest Apple has in controlling the display technology including the drivers. Again, this makes a lot of sense as the display is one of the main differentiators that most consumers will look at when deciding on the next smartphone. Since the actual display panel is more or less accessible to all competitors as well, driver chips together with the software gives them the best way of having a better display in testing and every day usage. (and increasingly the touch and display drivers are being integrated – Man. Ed.)

Apple seems to be going the right way to outrun their competitors in the semiconductor arena, but we have to remember that it takes a high number of chips to make a phone and it is very unlikely that Apple tries to develop all chips for their phones. This business model would most likely not make sense.

Analyst Comment

Given the fact that Apple is getting burnt with buying a very expensive OLED panel from Samsung, it seems clear that Apple wants to get away from competitor-controlled components to create a larger hurdle for their competitors to develop a smartphone that actually performs on the iPhone level or better.

In addition, several analysts have been pointing out that Apple is paying a severe penalty for buying the Samsung OLED panels for their iPhone X. To add insult to injury, in a wide range of publications the Samsung display is being viewed as being superior to the Apple display. While these assessments are mainly based on the spec sheet and real comparison measurements by independent reviewers are not available today, I wouldn’t be surprised if the Samsung phone beats the iPhone X in the display aspect.

The analysts assume that the OLED panels will cost Apple about $120 per phone a threefold increase over the top notch LCD panels they are using in the iPhone 8. Even with the assumption that is way more expensive to make OLED panels compared to LCDs, one cannot shake the feeling that Apple is actually increasing the profitability of Samsung and strengthening this way their main competitor and that’s a strong motivator to change this situation as fast as they can. While LG is their best bet for OLED supply in the near term it is questionable if LG can produce a really competitive OLED display panel within a year. This would make Apple dependent on Samsung for some time to come. A very interesting situation indeed. (NH)

We haven’t been tracking the Toshiba deal for its memory in detail, but I was interested to see an article that explained that Bain will not actually have a controlling interest, but just under 50%. Hoya of Japan (an optical company) has taken a very small stake that keeps the majority and control in ‘Japan Inc’. (Bain Consortium Acquires Toshiba Memory Corporation) BR