As acquisition and consolidation activity takes hold of the cinema exhibition sector, nearly one-third (31 percent) of new screen growth still comes from building new cinemas and screens, according to new research from business information provider IHS Markit (Nasdaq: INFO).

In fact, when the record-breaking acquisition of 7,400 screens from Regal by Cineworld is not included in the total, that percentage share rises to 77 percent.

“Organic growth is possible in regions where screen density has not reached its mature level,” said Pablo Carrera, principal research analyst, IHS Markit. “In a mature bricks-and-mortar industry like cinema, the current level of organic growth sustained by the largest and most international companies is a positive sign for the sector.”

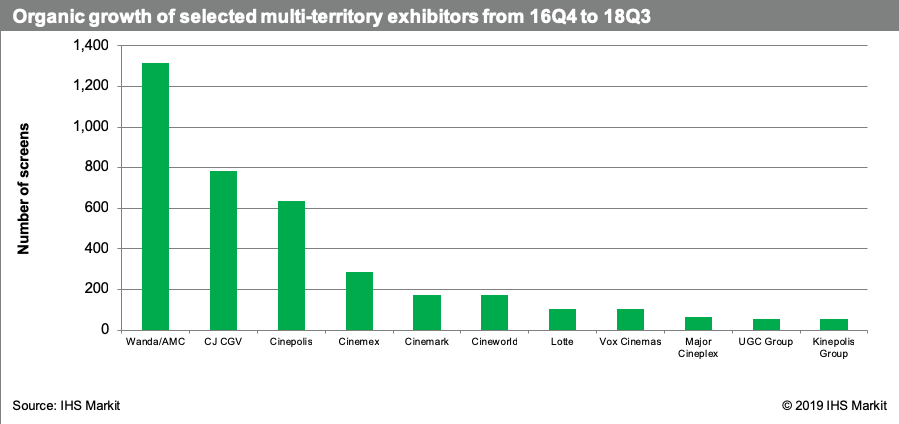

Of 21 multi-territory exhibitor groups tracked by IHS Markit, each with a presence in more than one territory, all used organic growth to expand their footprints by building a combined 3,945 new screens. Most of these new builds occurred in Asia, Eastern Europe and Latin America.

Although acquisition has proven the most popular way (by screen count) to enter new geographical markets, only 6 out of the 21 exhibitor groups have undertaken that route. These companies purchased 8,594 new screens since the beginning of 2016, with 7,400 occurring in the extraordinary single acquisition of Cineworld by Regal. They did so primarily to access markets with high screen density and limited room for new cinemas, such as Cineworld in the United States, Kinepolis in Canada, and AMC and Vue in Europe. Only Cinemex and Pathe used acquisitions to acquire market share where they already had a presence, namely the U.S. and the Netherlands, respectively.

Overall cinema exhibition concentration has increased among the 10 largest exhibitor groups worldwide, which combined now represent 36 percent of all screens, up from 26 percent two years ago. “Consolidation is being used to spread risk across geographical markets, in case of a poor year at the box office in one country,” Carrera said. “Other reasons include creating a volume of screens to achieve better deals for new technology and traditional cinema supplies, like popcorn and seats, and to create a larger subscriber base for customer analytics and loyalty programs.”

The Cinema Operators Strategic Intelligence Service from IHS Markit provides a granular analysis of cinema sites, screens and premium technology choices across more than 80 of the largest cinema exhibitors in the world, not including China.

About IHS Markit

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions. Headquartered in London, IHS Markit is committed to sustainable, profitable growth.