MicroLED display is making steady progress towards commercialization with rapid development of prototypes and introduction of first commercial products. The technology is still facing several manufacturing challenges, yield issues and high costs, making it difficult to enter high volume consumer applications. DisplayWeek 2023 gave a glimpse of current status and path to commercialization through exhibition of prototypes and discussions through seminars, symposiums and Business Conference. At the conference several prototypes were shown in different sizes, pixel densities, form factors for broad ranges of applications including AR, wearables, laptops, automobiles and others. MicroLED has the potential to be the next generation display technology outperforming LCD and OLED in terms of color reproducibility, brightness, reliability and low power consumption.

Production Capacity: Starting

MicroLED is a self-emitting display consisting of arrays of microscopic LEDs each forming a pixel. Display integration of MicroLED can be heterogeneous or monolithic integration. In the heterogeneous type, chips are transferred from an epiwafer or carriers to the display backplane (LTPS or Oxide TFT on a glass or flexible PI substrate). The monolithic integration process involves microLED array and integrated circuit (IC) backplane. MicroLED display is improving on all key areas including chip efficiency, mass transfer yields and manufacturing capabilities. There has been increasing investment in technology development and manufacturing with multiple partnerships within the supply chain from brands to display makers to LED suppliers.

According to Yole Research, Apple and partners are planning to invest more than $2 billion to set up smartwatch display production with 8” MicroLED chip fab at ams-Osram with target date of completion by the end of 2024. Epistar with support from AUO will build a 6” MicroLED foundry leveraging PlayNitride technology. AUO is planning to start production of a smart watch display 1.39” in Q4 23. Jade Bird Display has started its production line in Hefei, with the total capacity of 120 million 0.13” MicroLED panels. Many other companies have set up pilot lines for production. Samsung is hoping to ramp up manufacturing of microLED TV in 2023.

Equipment companies are starting to provide MicroLED specific tools for manufacturing including mass transfer, testing, repairs and others. These tools will help to reduce development cycles and increase production capabilities. Toray is developing “Laser Direct Transfer” for large size substrate (Gen 4.5 or Gen 6) with high throughput for cost reductions. According to the company it will reduce repair process and increase productivity. Toray and Advantest collaborating to develop test and inspection tools to improve process yield. InZiv is focusing on high-throughput EL inspection tool for MicroLED wafers. According to the company high-throughput for 1st gen product in 2023 will be 6M chips/hour and for 2nd gen in 2024 will be 12M chips/hour.

Color Conversion: Increasing

The mass transfer process that requires bonding RGB (Red Green Blue) MicroLED to the display backplane accurately and efficiently is very challenging. Different colors of LED also need slightly different voltage and drive currents. Color conversion by Quantum Dots (QDs) (QDCC) or by phosphor provides another alternative. Using single-color (blue) MicroLED chips and color converting them with QD layers can help in the manufacturing process.

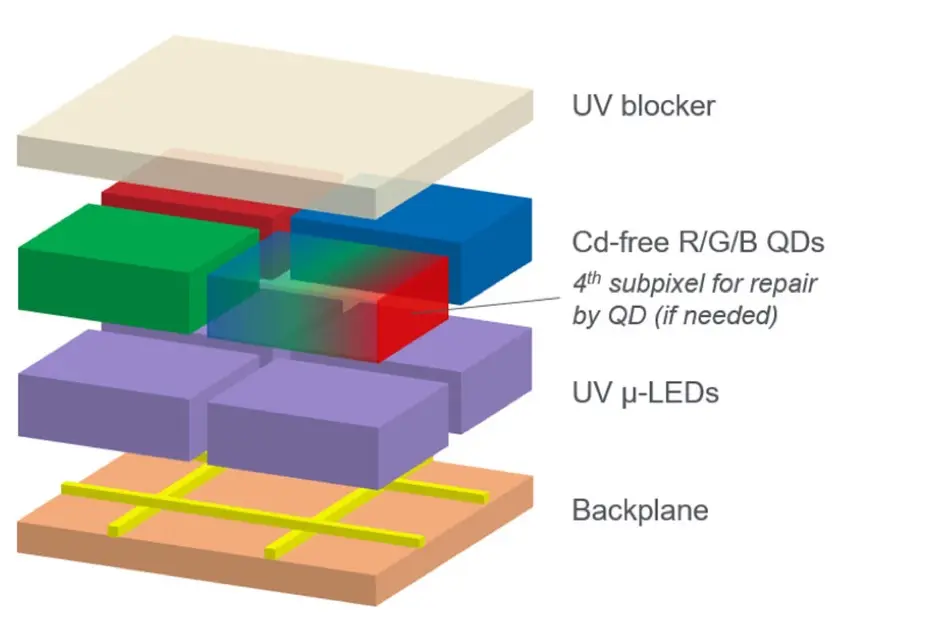

According to Nanosys’ presentation at Business Conference, “QDCC on UV MicroLED enables high brightness, superior color quality, and high resolution with cost-effective manufacturing”. Applied Materials has introduced a novel and scalable approach to fabricate MicroLED displays using high efficiency UV MicroLEDs with 4-subpixel layout, and in-situ curing Cd-free R/G/B quantum dot formulation. The company has developed a prototype of a 1.37” smart watch display UV-A microLED with LTPS backplane. Applied Material’s UV-A microLEDs and Cd-free RGB QDs with high-EQE, high-efficiency, simplified mass transfer and pixel repair scheme by 4th subpixel can improve manufacturing yield and reduce production cost.

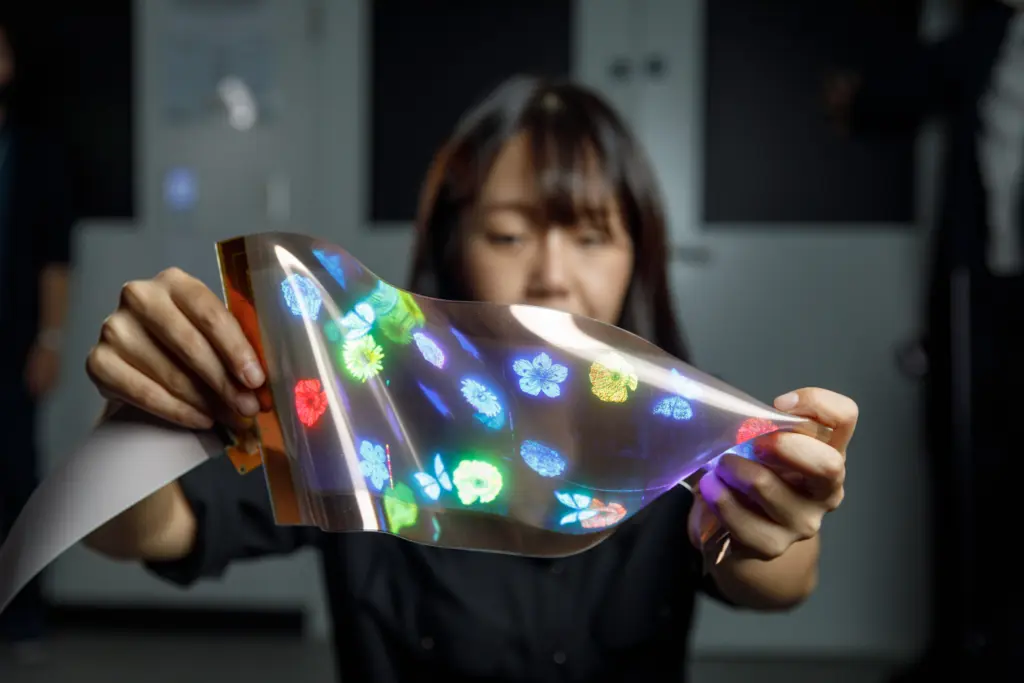

AUO has also developed its rollable MicroLED display using color conversion technology. According to AUO’s paper at Display Week, “Thermal effect of emitting efficiency is still a critical issue for MicroLEDs. Red MicroLEDs have significant characteristics of thermal drop relative to the green and blue MicroLEDs”. AUO introduced a color conversion layer to form the red sub-pixels. Through the color conversion material, the blue light is converted into red light. As per the company information, “Blue MicroLEDs have better thermal stability than red MicroLEDs. Therefore, the reliability of displays will be improved even at high ambience temperature. The efficiency of red sub-pixels was also increased by using the color conversion technique with blue MicroLEDs”.

Microdisplay: AR Solution Developing

With increased focus on metaverse, more companies are focusing on AR as a next gen computing platform. AR glass needs to be light weight, and should render bright and high contrast contents and longer battery life. MicroLED microdisplay is considered to be most promising solution for AR. Enterprise oriented AR products with monolithic monochrome MicroLED display has been introduced in 2022. For AR application with near eye microdisplay the PPI needs to be very high, pixel pitch needs to be at sub-5micron level. At small pitch it is difficult to achieve high efficiency and high brightness. For full color AR display application, the monolithic monochrome panels need to be combined in a compact fashion with higher efficiency. Jade Bird Display (JBD) has developed monolithic monochrome displays as well as very compact polychrome projector to combine 3 individual monochrome panels. JBD has recently announced that it has developed a new red microLED emitter with up to 750Knits brightness at 2micron sizes. The company is also developing native full color (RGB).

Porotech showed its 0.26, 1280x 720 MicroLED microdisplay single panel for full color for AR at Display week 2023. PlayNitride has introduced a novel R/G/B Chip-on-Carrier step to improve the transfer yield, process time for AR/MR. Its μ-PixeLED, a single device 0.49- inch FHD full-color MicroLED micro-display has 4,536ppi and >150,000nits brightness was shown at the conference.

Pixelligent presentation at the Business Conference showed that its component material can enhance MicroLED display especially for XR, “Pixelligent’s materials enables HRI optical structures that reduce index mismatch, increased critical angle allows for increased light transmission and vastly improved light extraction efficiency and reduction in total internal reflection.”

According to Qiming Li, CEO of JBD, “Full color (RGB) MicroLED micro displays will take 2 to 5 years for real commercialization for AR glass application. Yields need to improve and costs need to reduce to $20 per eye level to meet the cost requirements of a $500 AR glass”. In the Bay Area SID seminar in June, he presented that single panel RGB with 5micron pixel pitch prototype is expected in 2024 and production in 2026. For 4micron pixel pitch single panel RGB prototype is expected in 2025 and production in 2027.

Application Market: Prototypes Growing

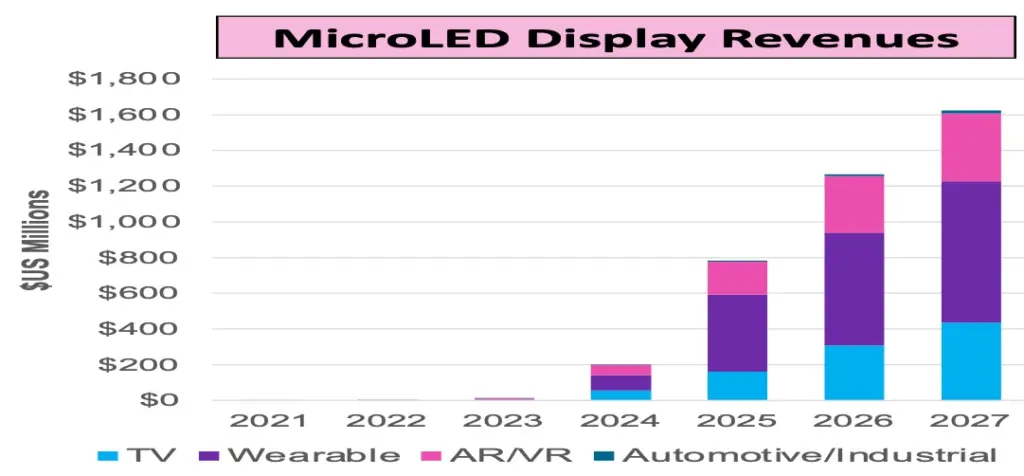

According to DSCC presentation at Business Conference, “For MicroLED displays manufactured by mass transfer, only three applications are likely to emerge: Smart watches, TV and automotive. DSCC does not currently expect MicroLED to get any market share in the smartphone market. Smartphones require a lot more pixels than smart watches so the cost of LED chips will be much higher”.

VuReal paper at the DisplayWeek showed: “To reduce the cost of frontplane for MicroLED smartphones or smartwatches down, the MicroLED size needs to be reduced. VueReal has developed new pixel and MicroLED structures that allow a reduction of the size of MicroLEDs to less than 10um without a major impact on the EQE. VueReal MicroSolid Printing has high wafer utilization (>80%) without affecting the throughput. In addition to fewer wafer requirements, VueReal transfer also allows production scale up using fewer transfer tools”. Through the process VueReal showed their solution offers lower cost and scalability for smart watches and smartphones.MicroLED display is making steady progress towards commercialization with rapid development of prototypes and introduction of first commercial products.

Broad ranges of prototypes were shown at Display Week 2023 exhibitions. Some protypes of MicroLED display at the conference are listed below.

- LG Display: 12-inch Stretchable display, stretched up to 20%, RGB color, 100ppi, 1000nits, based on LTPS TFT, 39% transparency (long lifetime at high luminance without encapsulation layer)

- AUO: 14.6-inch 202-ppi, rollable, flexible LTPS TFT backplanes, color conversion. The tiny MicroLEDs, contrast ratio of >1,000,000:1, 1000nits brightness. Starting production of a 1.39” display in Q4’23

- PlayNitride: 0.49, 4536PPI, FHD MicroLED microdisplay for full color AR glass, 9.38 transparent(>65% transparency) 114 PPI display, 27” PixeLED Matrix modular display, 1.58 MicroLED+QD HDR display 228PPI,

- Porotech: 0.26, 1280x 720 MicroLED microdisplay single panel for full color for AR

- JBD: 0.13” Monolithic MicroLED microdisplay for AR, VGA, with polychrome projector (in production)

- Tianma: 8.7” transparent MicroLED (>65% transparency) for auto motive application

- Innolux: 1.1” RGB (LTPS backplane) display for wearable, 9.6” RGB MicroLED for IT, 12.3”and a 26.4” MicroLED display with color conversion for public display or museum application

High-speed transfer, assembly technologies, yield and defect management need to improve and supply chains need to be established before large volume commercialization in consumer products can be done. The success of commercialization and mass production of MicroLED display will depend on the ability to scale up for volume production with competitive price performance.

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected].