A couple of weeks ago, I read an editorial from DSCC’s Bob O’Brien that talked about OLED vs LCD. He pointed out that when his firm started in 2016, it focused on OLED research because it was clearly the coming technology. In the article, he looked at why OLED had grown more slowly than expected at that time.

He set out the factors involved in why OLED had been slower in growth than hoped for

-

OLEDs are really hard to make. (I would argue that the reason the Koreans prioritised OLED development precisely because it was so hard. In fact, when writing up my report on the SID keynote when Samsung Display announced that it was going to make RGB OLEDs based on polysilicon for TVs, I made the point that the reason was to put ‘clear water’ between themselves and the Chinese. It turned out that making them that was was even too difficult for Samsung, despite its great display technologists!)

-

OLEDs are expensive to make. O’Brien points to the capital cost of OLED fabs and the high number of process steps means extra cost. For years, OLED supporters argued that OLEDs would be cheaper because of the lower material costs than LCD. Again, it could be argued that this was to the advantage to the Koreans, as it made the business more like the semiconductor fabs, where material costs are low, but processes and capital costs are high.

-

LCDs keep getting better and better, while prices have continued to fall because of oversupply. Further, image quality has got better because of miniLED and other technologies. Given that the US market has moved away from premium-priced TVs and towards low cost but large TVs (as pointed out by Stephen Baker at the DSCC/SID Business Conference Pricing Reality in the Display Market), OLED has found it harder to compete.

He concluded that OLED still looks best, and, at the same price, would win, but that OLED can’t sweep away LCD.

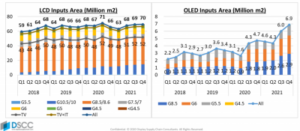

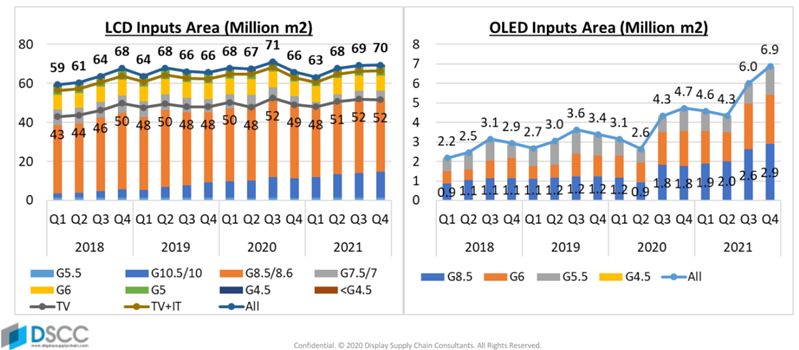

Tamura-san of DSCC presented this slide at the DSCC/SID Business Conference in June. It highlights the big difference in scale between the LCD & OLED supply chains. It would probably need $50 billion or more of investment to replace the LCD capacity currently built. Click for higher resolution.

Tamura-san of DSCC presented this slide at the DSCC/SID Business Conference in June. It highlights the big difference in scale between the LCD & OLED supply chains. It would probably need $50 billion or more of investment to replace the LCD capacity currently built. Click for higher resolution.

I don’t disagree with any of that, but I think that there is another issue and that’s the weight of capital. Over the years, there has been a vast amount of accumulated capital investment in the LCD business and its supply chains. While a proportion of the capacity that the investment paid for has been lost in earlier generation of fabs that have been closed, there is also a big portion of the industry that has written off its fab investments, but still has useful capacity. Now, that kind of business can carry on for a long time. After all, those fabs have no ‘cost of capital’ any more and just have to cover their direct costs for materials, labour, energy and overheads. Look at Hannstar. Despite having a 15 year old fab and a couple of years of horrible panel pricing, it is still alive.

In order to replace all of that capacity with OLED, you would have to find a lot of capital. That would be hard enough at any time, but given that Samsung has shown how hard it is to make large OLEDs, and LG has struggled with its new OLED fab in China, it might be hard to persuade investors it would be worth the risk. Further, Samsung Display has been talking up QD-OLED and, now, QNED. If I was an investor, I’d think twice about investing in large OLED given these known risks.

Of course, there is a lot of talk about microLED, which may have the potential to allow capacity to be built with (relatively) very low capital costs. That’s why everybody is looking at that technology. There are lots of challenges in cost and production technology, but if those in the area are to be believed (here’s one, but there are plenty iBeam Gets Help to Be Disruptive from a Tech Giant), the technology could turn out to be genuinely disruptive.

So, in conclusion, I wouldn’t expect LCD to be displaced until there is a much cheaper technology in capital cost and in materials than LCD. However, the LCD business has had an unbelievable job over many years in continuously pushing costs down, while performance continually goes up. (BR)