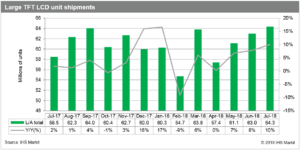

Large thin-film transistor liquid crystal display (TFT LCD) panel shipments hit a record monthly high in July 2018 in terms of unit and area shipment.

Unit shipments increased by 10 percent in July compared to a year ago to reach 64.3 million units, while area shipments jumped 19 percent during the same period to 17 million square meters, according to IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions.

“New facilities from China, such as BOE’s Gen 10.5, CHOT’s Gen 8.6 and CEC-Panda’s Gen 8.6, started mass production in the first half of this year. The production at the fabs has increased since the second quarter of 2018 as their glass inputs and production yield rates have improved,” said Robin Wu, principal analyst at IHS Markit. “Despite the growing production, panel makers have maintained the utilization rate and instead tried to push out panel shipments by lowering panel prices in the first half of 2018. That’s one of the reasons that panel shipments are continuously growing.”

The LCD TV panel contributed to the record high shipments of larger-than-9-inch LCD panels in July. Unit shipments of LCD TV panels increased by 15 percent in July year on year to 24.6 million units and area shipments jumped 21 percent to 13.3 million square meters, according to the Large Area Display Market Tracker by IHS Markit.

Panel makers suffered from high TV panel inventories in the first half of 2018 due to growing production capacities. Panel prices have been weak for a year and panel makers’ profit margins have plunged. “Therefore, panel makers wanted to clear up the inventory before the third quarter, high-demand season, when they aim to raise the panel price back again,” Wu said. “That has led to the fast growth in TV panel shipments lately, which as a result pulled the total large panel shipments to a historical high in July.” As the panel makers hoped, LCD TV panel prices rebounded in July 2018.

Chinese panel maker BOE led the large TFT LCD market in July 2018 in terms of unit shipments with a stake of 24 percent, followed by LG Display with 19 percent. However, in terms of area shipments, South Korea’s LG Display continued to lead with a 20 percent share, followed by BOE with 18 percent.

The Large Area Display Market Tracker by IHS Markit provides information about the entire range of large display panels shipped worldwide and regionally, including monthly and quarterly revenues and shipments by display area, application, size and aspect ratio for each supplier.

About IHS Markit

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions. www.ihsmarkit.com