This session consisted of a panel moderated by Peter Lude of Mission Rock Digital. Speakers included Nancy Bennett of Two Bit Circus, Books Brown of Starbreeze Studios and Alexis Macklin of Greenlight Insights.

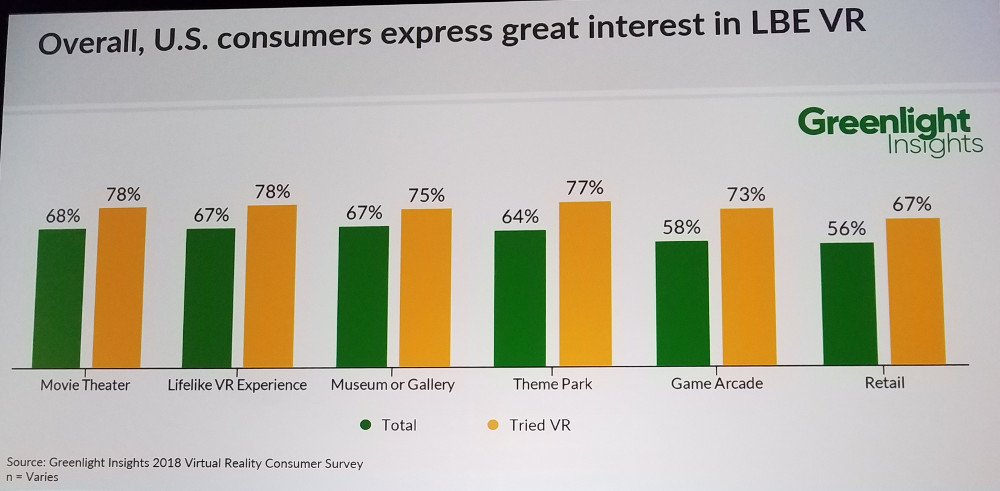

Macklin noted that Location Based Entertainment (LBE) is not just arcade parlors but also includes mixed reality facilities, cinema, museums, theme parks and family entertainment centers. Big players like AMC, Disney, Six Flags, IMax and Sony Pictures are engaged today, to name a few. Content is expensive to create, so creators are looking to multiple platforms for revenue.

According to Macklin, direct licensing is expected to be the most important source of revenue, which mainly represents the LBE segment. As a result, the LBE VR segment will grow from $1B in 2018 (7% of total VR market) to $23B in 2023 (representing 11% of the total VR market).

Recent consumer survey data from Greenlight shows that 71% of the 2,720 respondents are interested in entertainment from a major brand, the top category. Further, consumers have high interest and engagement in VR LBE across all venue types. Asian (78%) and Latino (78%) customers show the highest interest in movie-theme VR experiences, followed by African-America ((72%) and Caucasian (64%).

Macklin concluded by noting that major brands are investing in LBE VR and the content creators are adjusting to this demand and high interest from consumers.

Brook Brown noted that his company, Starbreeze, is focused on the B2B and LBE VR segment in particular. They have done a number of installs already featuring their very wide 210º FOV headset. The latest is the Dubai VR Park where there are more than 100 VR stations with over 75 StarVR headsets.

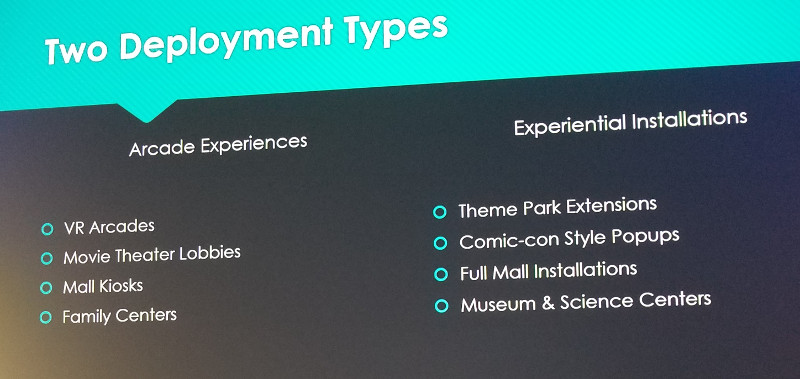

He sees two sides of the LBE VR market. The Arcade VR segment has a smaller footprint with 1-4 players and a five minute experience. It is more of an impulse buy, priced at around $1 per minute. The goal is to have the customer want to do it again.

The Experiential VR segment features medium to large spaces for 1-8 players and no established duration. There are deep 4D effects with a price tag of over $25. It is more of a destination and is expected to be “world class”. Deployment is different too.

Brown said that in the Arcade segment, all the operators are running with the same mindset: That business VR leads the market; We should schedule based on engagements and build experiences based on for movies and games for enthusiasts to enjoy.

Brown then described a unique project he worked on called Hero, which is an experience in Syria just after a bombing and that draws out all kinds of deep reactions and emotions from people.

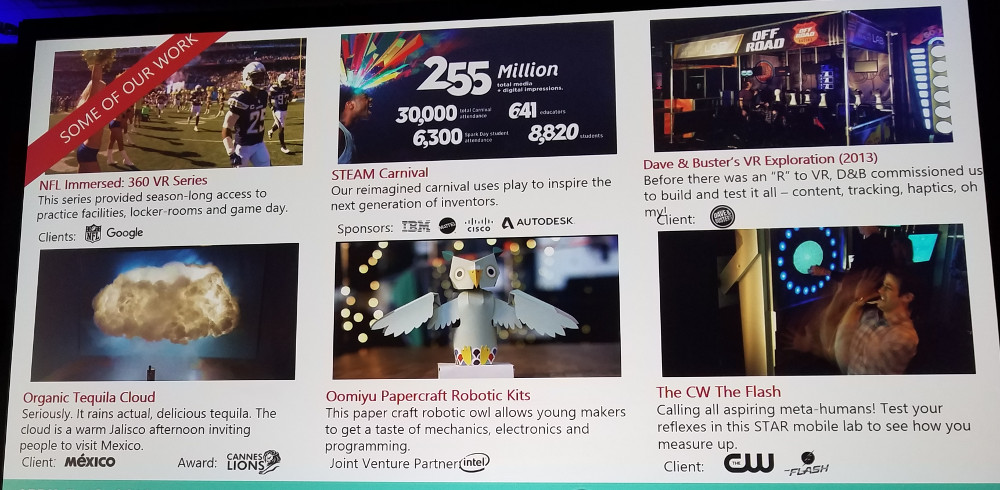

Bennett’s company focuses on developing the LBE experiences. Her presentation then profiled a number of immersive architectures that they have put together.

Her big news was that they are launching a micro Amusement Park this summer in LA which will house 50,000 sq ft (4,650 m²) of a variety of VR LBE experiences. It will include a midway, indie arcade, robot bartender, story rooms and several types of VR experiences.

In the panel discussion, there were some questions about cost, but this was hard to answer as nearly every set up is unique so there is a wide range of floor space, equipment and content costs. Some venues are closing already, so they are not meeting financial goals, it would seem. It is too early to know if venues are getting repeat customers – a clear goal of many set ups.

Bennett sees eSports as being a major driver of VR in the future. VR let’s player hone their skills, but not all agree that VR will help.

Fresh content will continue to be a costly concern for all parties. But the bigger brands are definitely investing in the medium. Eye tracking data is being used to see what consumers are looking at – including ads. – CC