The other day, Norbert pointed out in an article in our subscription newsletter that Apple appears to be trying to develop a display technology, microLED, basically on its own. That’s a very hard thing to do and there are very few examples of success.

Having a unique technology, especially one that is visibly distinctive and obvious to users, can be a real advantage in consumer electronics. The classic example is Sony, which had its Trintron CRTs that were more expensive to make and difficult to engineer, but produced a level of contrast that other technologies couldn’t match for TVs. As a result, Sony built a huge advantage in the TV market over many years. The quality of the image on a Trinitron was one of the factors that contributed to the Sony brand.

Sony tried many technologies to replace the Trinitron including, but not limited to,

- PALC – Plasma-addressed Liquid Crystal (who remembers that one?)

- FED (a kind of flat CRT made using semiconductor-like techniques),

- GLV (Gating Light Valve – a kind of MEMs architecture not dissimilar to DLP in some ways

- LCOS (which persists in projection

- LTPS LCD

- Big and small OLEDs

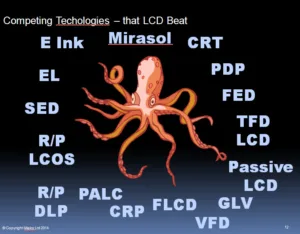

I’ve probably forgotten some, but you get the idea. Then, of course, outside Sony we saw the TFD (Thin film diode, which lost out to the TFT) – supported at one point by Philips and Epson, ferroelectric LCDs (Canon among others), SED (Canon again – and similar to FED). Then, of course, there was Mirasol that Qualcomm bought, and Pixtronix, also bought by Qualcomm. There was the wonderfully named Cathode Ray Panel (or CRaP as it was quickly named) from Philips, oh, and TFEL from Canada….

You get the picture.

I showed this slide of the technologies beaten by the ‘LCD Monster’ at the Electronic Displays conference in 2015

As long ago as 2003, on a press tour of Japan as a guest of Sony, I had the chance to ask Ando-san, then President of Sony, at the end of a press conference, whether the display industry wasn’t already too big for a single company to develop a technology on its own? He answered a completely different question and I wondered if I had asked it clearly (I was composing it on the fly as I hadn’t expected the chance to ask a second question, having prepared the first!). Anyway, afterwards as we exchanged business cards, he said to me “Good question!”.

Arguably the only mass-market technologies so far are DLP (and that is largely the result of the huge investment TI put in with the hope or expectation that it could take over the TV business using rear projection) and E Ink. I have met analysts who believe that TI invested so much early on that it has never made the money back. E Ink has pretty well dominated the EPD technology and has consolidated work from a number of companies. E Ink is having to pivot as eReaders go ‘off the boil’, but seems to be doing that successfully.

One of the key reasons that LCD has been so dominant is that so much of the technology, materials and equipment has been shared by all the makers. On the other hand, that has made it impossible to make good profits. In switching to OLED, Samsung and LG have developed their own technology approaches and we’ve heard many times from independent analysts and staff from companies involved, that Samsung puts tough restrictions on its suppliers to try to get exclusive access to technology, materials and equipment.

On the one hand, this has enabled Samsung to own the small OLED market, but was unable to make large OLEDs economically. LG, on the other hand, has made large OLEDs (although not yet with real profits), but has struggled to develop a business in small OLEDs.

It seems to me, then, that the question I asked back in 2003 still has some validity.

Bob

(By the way, I wrote most of this article when I was stuck on a plane, with no access to my databases, so if I have missed a company a) please forgive me and b) feel free to let me know by contacting me by clicking here or by adding a comment).