Many years ago a Japanese company named Sony set out to revolutionize the world with a new take on consumer electronics products. They invented new product categories and created stellar devices that to this day are often used by analysts to show how new products can capture the imagination of the consumer. Just remember the Walkman as the forerunner of mobile devices when we think of some Apple advertisements, with dancing Apple users, as the grandfather of the iPod/iPhone today.

Since then Sony’s rise has given way to a more subdued and sometimes less-fortunate corporate development. Some of that may have to do with the changes in the TV market and decline of the personal imaging market. This was/is in stark contrast to the strong corporate development of Apple based on their development of mobile music/phone/computing devices.

Source: Fromedome.com

The chart from FromeDome.com compares Apple and Sony during a 20 year time span starting in 1990. This means the chart is already 6 years old and by no means representative of today’s conditions, but it shows so clearly how the direction of the business development differed significantly back then. It also shows that Sony was always more holiday-sales-dependent than Apple. On the other hand, it also shows how the business of Apple was more dependent on the success of the iPhone, while Sony had a much broader revenue distribution among its products.

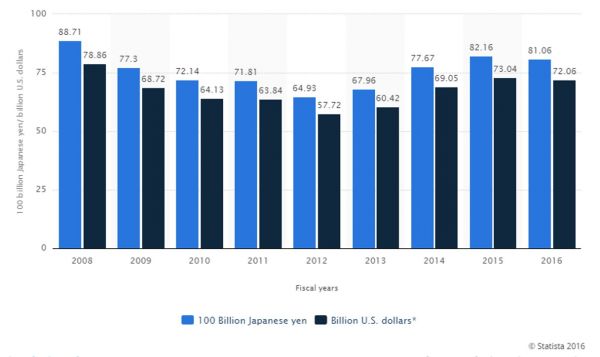

Coming back to today, we are seeing that Sony revenue has rebounded somewhat in recent years, compared to their lowest level in 2012. Today the Sony revenue is on the same level as for most of the early 2000’s. The worst one can say about this is that Sony appears to be stagnant in revenue development.

Source: Statista – Sony Sales 2008 – 2016

Source: Statista – Sony Sales 2008 – 2016

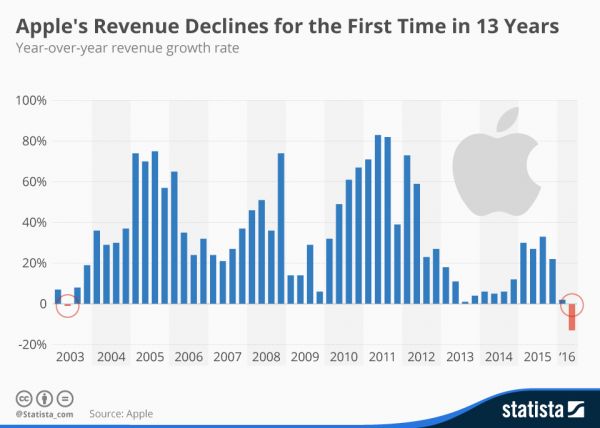

Now let us compare this to the development of Apple. In recent quarters the Apple success story has come to a somewhat unexpected slowdown. First, growth margins slowed down, then turned negative for the first time in 13 years. It seems the ‘can do no wrong’ darling of the US technology industry has done something wrong, and that something was related to people not buying enough iPhones – the most dominant device in the Apple arsenal. As we all know from many years already, there is always a decline in revenue growth in the quarters leading up to the new iPhone release, but when we look at the chart, we can see that the Apple growth was never the same after its low point in 2013.

Source: Statista – Apple Revenue Growth

Source: Statista – Apple Revenue Growth

Large companies like Sony and Apple are, to a large degree, affected by the overall economic conditions, but this is not the whole story. As the world population grows, more demand is generated for consumer electronics. However, this demand is not divided equally among the industry players. There are always winners and losers in this industrial game of Chance (Monopoly may be a better comparison). By pure analogy I would guess that the strong Apple growth years are over for the moment, unless they come out with a new product category that will help them to establish new revenue growth.

On a more generic note, consumer electronics brands seem to have a limited timespan during which they are hot and growing. After this period, they have to renew themselves and come out with a new product category that captures the imagination of the next generation; and the cycle starts all over again.

Looking at the latest statements from Apple executives, I would guess that augmented or virtual reality is one potential area Apple may push to become the next winner. Nevertheless, the success of Apple is strongly related to making products right and not to be first in the market. So far nobody has got the AR and VR hardware right, including the latest entries from Oculus, HTC, Samsung and others. I am not trying to bash any of the existing hardware solutions; I am just saying that the mix of expected entertainment value, performance, and price has not inspired the average consumer to buy a headset. Maybe that will change with the success of Pokémon Go, but for now we are just not there yet.

It seems that the upcoming iPhone release will be another point in time where Apple has to prove whether they are still the market leader or just playing catch up. We will see at the end of the year if Apple is really following in the footsteps of Sony. With the new iPhone in the market for at least one quarter, revenue growth should return strongly. Otherwise, Apple should take a good look at the annual reports from Sony after 2007.

– Norbert Hildebrand