Despite concerns about TV demand and falling profit margins, major South Korean and Chinese TV makers are expected to stock up on display panels in the third quarter to prepare for the seasonal year-end shopping spree by consumers.

Already carrying inventories from prior stocking, these TV makers will have factored in the risk of a correction in panel demand in the fourth quarter, according to IHS Markit.

South Korean TV brands’ panel purchasing volume is forecast to increase to 20.4 million units in the third quarter of 2018, up 18% from the previous quarter and 3% from the previous year. This is indicative of a recovery in panel purchasing, from a decline of 3% quarter-on-quarter and 1% year-on-year during the second quarter.

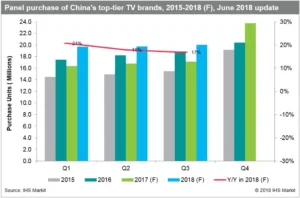

China’s top-five TV brands, which bought more panels than expected in the first quarter, again increased their panel purchasing in the second quarter to meet their sales target by 0.4% quarter-on-quarter and 18% year-on-year, to 19.8 million units.

In the third quarter, these Chinese brands are likely to keep their purchasing volumes at a similar growth level of 1% quarter-on-quarter and 17% year-on-year. However, the erosion of profit margins caused by fast-falling ASPs of TV sets is a concern.

IHS Markit’s Deborah Yang commented:

“Although the panel demand outlook from South Korean and Chinese TV makers for the third quarter looks positive, the TV brands are still anxious about uncertainty in market demand in the second half of the year while carrying high inventories.

The TV demand in Europe has particularly been weaker than expected, and the depreciation of local currencies in the emerging markets against the US Dollar has led to a higher price tag in local currencies.

As TV makers, particularly the Chinese brands, keep high inventories on hand, they end up cutting TV prices to manage their inventories, leading to lower margins – even for larger and premium TVs. If their inventory clearance strategies and upcoming seasonal demand fall short of the expectations, these TV brands will eventually have to cut panel purchasing later in the year to lower the inventory burden”.