Despite better-than-expected first-quarter demand for TFT-LCD TV sets and panels, market players would be well-advised to adopt a more conservative outlook in demand growth for the coming quarters, according to IHS Markit.

Earlier market expectations assumed that demand would slow in the first quarter, prompted by the observation that TV set makers would put a hold on panel purchases, based on hopes that prices would drop further. Such a view was largely attributed by the development of Chinese panel makers planning aggressive investments over the next two to three years.

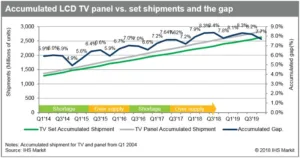

As it turned out, panel makers managed to sell more panels than originally forecast in the first quarter because panel prices declined much faster than expected. According to IHS Markit, TV panel unit shipments increased by 13.3% in the first quarter compared to a year ago, while TV set shipments rose 7.9% during the same period. Research director Ricky Park commented:

“LCD TV panel shipments are expected to grow faster than the LCD TV set shipments, expanding the accumulated gap between the two even further”.

According to the report, the accumulated gap between LCD TV panel and set shipments in the second and third quarters of 2018 is expected to be higher than it has been in the past 10 years, reaching 8.3% and 8.4% respectively, up from 7.9% in the first quarter. Furthermore, the gap is expected to remain high until 2019. Park continued:

“The main reason for the higher gap is the aggressive investment in 10.5G fabs. TFT-LCD capacity, in terms of area, will soar in the next four years. As capacity is expected to increase more than demand, panel suppliers will likely push to sell panels at lower prices while set makers are to hesitate buying panels, expecting the price to drop even further”.

However, when the accumulated gap in panel and set shipments is high, an inventory correction should always follow. Park concluded:

“TV makers should narrow the gap for healthy inventory control and reducing panel orders is a step in that direction. If TV set makers’ panel purchasing drops, it will likely cause a cash flow issue to panel suppliers and they would need to reduce the utilisation rate to control the supply”.