The EMEA traditional PC market posted solid growth in the second quarter of 2018, with the market going positive (4.1% growth year-on-year) and totalling 16.6 million units.

According to IDC, the commercial space grew 8.6% year-on-year as anticipated device renewals continued to roll out, while the consumer space posted a softer decline (0.8% year-on-year) as back-to-school sales, combined with ongoing demand for gaming devices, contributed to a more stable performance. Notebook shipments returned to positive growth (4.7% year-on-year) after recording a flattish result last quarter, thanks to a solid commercial performance.

Desktops saw growth for the second quarter in a row in the EMEA region (2% year-on-year), driven by their commercial performance and further aided by the tail-end of deal fulfillments.

In Western Europe, the overall traditional PC market grew by 2.9% year-on-year. Notebooks experienced healthy growth (4.2% year-on-year) as mobility adoption continued to drive demand in the commercial space. Thin/light and convertible devices continue to gain the most traction on the consumer side. Desktops continued to perform strongly, coming in flat for the second consecutive quarter.

Commercial traditional PC shipments in Western Europe increased by an impressive 9.2% year-on-year, with both product categories registering growth across the region. Northern Europe proved to be strongest this quarter, with Benelux, the Nordics, and the UK and Ireland recording double-digit growth following larger refresh cycles. Research analyst Liam Hall commented:

“Back-to-school and Windows 10 adoption in the enterprise space, from medium to very large businesses, are driving the commercial sector this quarter. Anticipated device renewals, following the last major refresh cycle in 2014 due to the end of Windows XP support, combined with looming security concerns, have strongly contributed to the overall performance of the market”.

The consumer PC market in Western Europe declined by 5.6% year-on-year as market saturation continued to take its toll. The increasing demand for gaming offered a pocket of growth and strong back-to-school sales contributed to the more stable consumer performance. Benelux was the only sub-region that grew to attain stability, while the rest of the sub-regions in Western Europe posted single-digit declines. Product manager Nikolina Jurisic said:

“The overall PC market in the CEMA region recorded a year-on-year increase of 6.1%, very much in line with the forecast. The CEE region continues to ramp up and over-exceed expectations, with a total year-on-year increase of 6.4%. Strong double-digit PC market growth was recorded in a few countries, including Russia, Czech Republic and Hungary.

There was an increase in both the consumer and commercial sectors, with the strongest growth in the consumer space. Poland, the Baltics and Ukraine all reported double-digit contractions. The lack of large-scale projects and inventory build-up in the consumer space inhibited the market. The MEA region performed just below expectations, reporting year-on-year growth of 5.7%. The market was driven by a commercial sector increase of 10.8% year-on-year, pushed by large deals in education”.

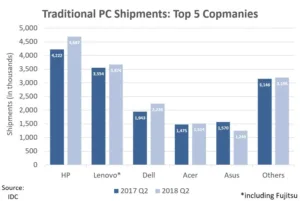

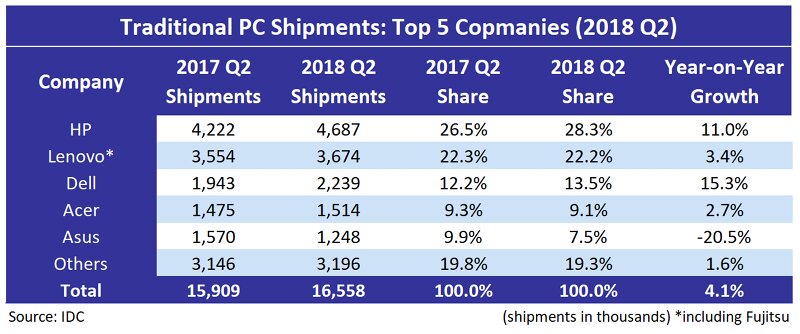

Traditional PC market consolidation has continued, and the top-three vendors’ share continued to grow in the second quarter of 2018. The top-three players accounted for 64% of total market volume, compared with 61.1% in the second quarter of 2017.

HP retained the number-one position in EMEA, gaining 1.8% year-on-year to reach 28.3% market share. Strong results in notebooks, closely followed by desktops, boosted its results.

Lenovo (including Fujitsu) secured the second spot, reporting 22.2% market share (almost flat year-on-year). Solid performance in the commercial space, in both desktops and notebooks, supported its overall results.

Dell held onto third place with a market share of 13.5% (up 1.3% year-on-year). Strong commercial results, combined with a solid consumer performance, contributed to its overall growth in the region.

Acer came fourth in the overall ranking with 9.1% market share (almost flat year-on-year). After declining for three consecutive quarters, the vendor returned to positive growth (2.7% year-on-year) thanks to the back-to-school season.

Asus finished fifth with 7.5% market share (down 2.3% year-on-year). The vendor continued to struggle, driven by weak results in Western Europe and MEA. However, in CEE, the vendor maintained positive year-on-year growth in the notebook space.