I’ve been thinking quite a lot recently about 5G and how it will roll out. A couple of things have jumped out at me that are concerns about how fast it will roll out.

Rolling out 5G is going to cost a lot of money. IDC has forecast that investments in infrastructure are going to rise to as much as $26 billion per year by 2022. That’s a lot of money and would mean around $40 billion cumulatively by then. It’s a lot of cash, when it doesn’t take into account the cost of spectrum licences. McKinsey published an interesting article that covers the reasons that 5G will, inevitably, http://tinyurl.com/y9lcluwu cost a lot more, with as much as a 300% increase in overall costs (capital and operational) for European operators by 2022. Even the most conservative of the company’s models shows 60% growth in costs by 2025.

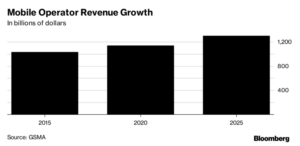

Those numbers may even be conservative; Bloomberg estimates that “it’s going to cost the mobile-phone companies, chipmakers, device manufacturers and software developers about $200 billion a year in research and capital spending” to get to the point that makes the services usable for everything that has been promised. Bloomberg pointed out that GSMA revenue growth is forecast (by GSMA) to increase at only around 2.5% per year from 2020 to 2025 (against around 2% per year between 2015 and 2020).

It seems unlikely to me that consumers will want to spend 60% more on their network services. They will want the benefits of 5G performance – the demos I have seen at MWC and CES have been compelling and there are new use cases, but few of them look really mass market to me. My feeling is that handsets have reached the limit of their pricing to consumers. That seems to have been the lesson of the recent iPhones. Some operators believe that they will be able to win some of the fixed broadband market, and, given huge capacity, that might be the case, if the services can be made reliable enough.

One of the use cases that has been talked of being a big one and one where consumers may be prepared to spend more cash is in autonomous vehicles. However, a wireless consultant quoted by Bloomberg has pointed out that the reliability needed for these vehicles may mean the use of other technologies, rather than cellular. Autonomous vehicles will also need very widespread connectivity and even with 3G and 4G, there are areas that do not have a good signal. 5G, because of the higher frequencies being used will suffer even more from the difficulty of getting complete coverage. (my office is just 50km from the centre of London in a suburban residential area, and only around a km from a motorway and we have pretty terrible mobile coverage).

I don’t doubt that 5G will arrive, there is a lot of momentum and some carriers need to do something, otherwise they will soon start to run out of capacity to keep up with the demands for data. In that sense, it’s a little like the TV LCD business, there are reasons why some will invest that are not purely based on ROI and that will drive competition. If you want to stay in the business, you’ll really have little choice but to invest, but with little realistic prospect of an ROI, let alone an improved ROI. It’s the cost of staying in the game.

All of this suggests to me that while 5G is really exciting as a prospect, the financial realities of the roll out will mean that it’s likely to be slow, with network operators mainly dragging their heels to try to slow down the speed of investment.

Bob