There weren’t any really big stories this week, but lots of data on the smartphone market in MDM as well as forecasts for computing devices. All of the forecasts are conservative even though they don’t take account of any ‘black swan’ moments like the financial meltdown of 2008 (although some are starting to get twitchy about the build up of debt in China and in ‘informal/shadow banking’ – the companies that lend to finance car leases etc and are not part of the formal, regulated, banking sector).

If I look at the numbers, there is little excitement in terms of growth. Elsewhere in MDM, we have an expected roadmap for Apple’s iPhones that shows no real changes in the type of display or resolutions. Now, that is only informed speculation, but it’s hard to imagine what Apple would do. In TV, there is a bit of a lull in innovation in the near future, I suspect. In a Display Daily that should be published by the time this is published, but didn’t make it into this week’s PDF, Pete Putman points out that large parts of the A/V industry are heading for commoditisation partly because of the switch to OP for the transmission of audio and video. He also sees TV display hardware as reaching a bit of a lull.

The outlook is conservative and I was reminded of an article in the Washington Post that I read a few weeks ago that showed how the music instrument business is down. There are few ‘guitar gods’ among the young and young people are not buying guitars. (Famously, somebody sprayed a paint slogan that “Clapton is god” on a bridge in London around 1968. I think he was just in a hurry and meant to say “Clapton is good”!)

Those that have been propping up the market for the last few years are the baby boomers, who had seen the children leave home (at least for a while) and might have paid off the mortgage. They have had money to splash out on the instruments they always wanted. However, more and more of them are moving to older age, with fixed incomes, so less money for instruments. So, the music industry is well down and will probably see some significant restructuring.

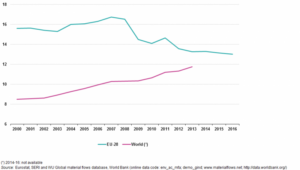

Then, there has been much discussion of the slow down in car ownership and lots of talk of “peak stuff”, that is to say a feeling that we all have enough material goods and so are switching to an experience economy. As Pete says in his article, much of the interest in the latest TVs is in the software and services that are available, rather than the hardware.

On the other hand, I’m reminded of the time when 42″ FullHD TVs seemed to have become very affordable and broadcasting was supporting it. The display industry seemed to have got to a peak in performance. However, it turned out that the period was just a lull before UltraHD, HDR, OLED and QD TVs and other technologies came along to upgrade the experience and drive on demand. That’s probably where we are now. In ten or twenty, we’ll probably be looking back and amazed that we thought that what we had now was “good enough”!

Bob

The EU publishes data on the ‘Material Flow Accounts’ which measure the flow of materials in the economies. These suggest that advanced economies have reached “peak stuff”.