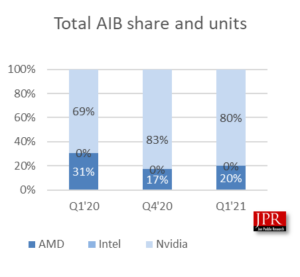

Quarter-to-quarter graphics add-in board shipments increased by 7.1% and increased significantly by 24.4% year-to-year. According to a new research report from the analyst firm Jon Peddie Research, unit shipments of add-in boards increased by 7% from last quarter, while AMD gained market share.

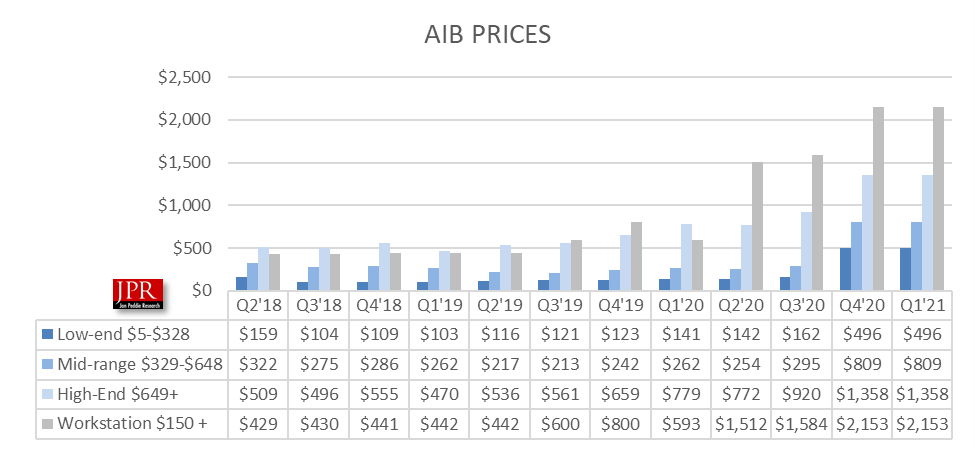

Over $12.5 billion of AIBs shipped in the quarter—an increase of 370% due to inflated average selling prices (ASPs)—a reaction to troubles with the supply chain and shortages created by speculators.

Price increases of AIBs over past two years

Add-in boards (AIBs) use discrete GPUs (dGPU) with dedicated memory. Desktop PCs, workstations, servers, rendering and mining farms, and scientific instruments use AIBs. Consumers and enterprises buy AIBs from resellers or OEMs. They can be part of a new system or installed as an upgrade to an existing system. Systems with AIBs represent the higher end of the graphics industry. Entry-level systems use integrated GPUs (iGPU) in CPUs that share slower system memory.

The PC AIB market currently has two dGPU suppliers, which also build and sell AIBs. The primary suppliers of GPUs are AMD and Nvidia. There are 54 AIB suppliers. They are the AIB OEM customers of the two major GPU suppliers, which they call “partners.” Some of the AIB suppliers offer AMD and Nvidia-based products, and others provide only one or the other.

Pricing and availability

Jon Peddie Research’s AIB Report is available now in both electronic and hard copy editions and sells for $2,750. The annual subscription price for JPR’s AIB Report is $5,500 and includes four quarterly issues, and four hours of consulting. Subscribers to JPR’s TechWatch are eligible for a 10% discount. Bundle packages are also available. For information about purchasing the AIB Report, please call 415/435-9368 or visit the Jon Peddie Research website at www.jonpeddie.com.

There are private branded AIBs offered worldwide. Also, about a dozen PC suppliers offer AIBs as part of a system and/or as an option. Many OEMs offer AIBs as aftermarket products. We have been tracking quarterly AIB shipments since 1987. Those boards’ volume peaked in 1999, reaching 114 million units when every PC had a graphics AIB in it. This quarter 11.8 million units shipped. The AIB market reached $23.6 billion last year. We forecast it to be $54 billion by 2025. Intel AIBs were scheduled to ship in Q1’20, now we do not expect Intel units to ship in volume until Q4’21 or Q1’22.

Since 1981, 2,089 million AIBs have been shipped.

Q1 is normally flat to down from the previous quarters. This quarter it was up 7.1% from the last quarter. That is way above the ten-year average of -4.9% which is unusually high when compared to the desktop CPU market, which decreased -23.1% from the last quarter.

We believe the stay-at-home orders created demand in 2020 and in the first quarter of 2021. Home PCs and workstations became the center of professional life and often the main source of entertainment during the lockdowns. Gaming added to the pressure on the supply chain as it continued to grow in popularity. But, as we said, this is also an anomalous period in graphics history. Prices are high as a result of shortages and so is demand in response to cryptocurrency prices.

JPR also publishes a series of reports on the PC Gaming Hardware Market, which covers the total market including system and accessories, and looks at 31 countries.