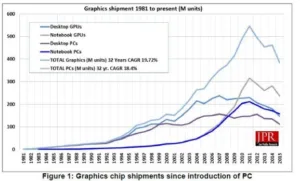

Despite the relative stability of the desktop PC market, and the growth of the technology sector in general, Jon Peddie Research reports an 11% QoQ fall in Q2 GPU shipments.

Embedded and integrated GPUs are having an impact on sales of discrete GPUs. Total GPU shipments were down 18.8% YoY, combining the 21.7% desktop contraction with a 16.7% decline in discrete notebook GPUs.

GPU shipments were down 16.2% QoQ at Nvidia, 25.8% at AMD and 7.4% at Intel. These are below the 10-year average of a 6.86% decline – in fact, they are the lowest results observed in 10 years. However, JPR has observed a heavy saturation of new GPU shipments in the past two months, which could lead to higher sales in Q3.

Delving into the results a little more closely, JPR says that AMD’s APU volume rose 25%, while deployments fell 53.3%. There was a 33.3% decline in discrete desktop GPU sales and a 9.1% decline in discrete notebook GPU sales. Meanwhile, Nvidia’s result came from 12% and 21.6% declines in discrete desktop and notebook GPU sales, respectively. However, the company enjoyed strong performance in the Western Europe and Chinese gaming sectors.

The attach rate for GPUs to PCs for the quarter was 137%: down 10.8% QoQ. 26.4% of PCs had discrete GPUs, down 4.2%. In 2001, there were around 1.2 GPUs per PC – that figure has now grown to around 1.55 GPUs.

Q3 will begin to see the results from Intel’s new Skylake architecture, as well as AMD’s Fiji architecture. It is possible that the Q2 results were low due to delayed purchases; if so, a high Q3 should be expected.

| Total Graphics Chip Market Shares, Q2’15 | ||||

|---|---|---|---|---|

| Vendor | Q2’15 Units | Q2’14 Units | QoQ Change | YoY Change |

| AMD | 10.7% | 12.9% | -2.1% | -5.8% |

| Intel | 75.2% | 72.2% | 3.0% | 5.3% |

| Nvidia | 14.1% | 14.9% | -0.86% | 0.5% |

| Others | 0.01% | 0.01% | 0.0% | 0.0% |

| Source: Jon Peddie Research | ||||