TV panel prices started to decline in early- to mid-2Q20, according to TrendForce’s latest investigations. In an effort to clear inventory and alleviate pressure from falling TV panel prices, some panel manufacturers decided to either lower their capacity utilization or shift their production capacities to IT panels, which saw greater demand at the time.

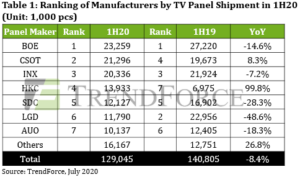

When the pandemic slowed down in late-2Q20, however, a wave of urgent orders for TV panels emerged as well. Given panel manufacturers’ inability to completely fulfill the spiking demand from TV brands, TV panel prices rebounded into an upswing. On the whole, under the dual influences of production capacity shifts and the COVID-19 pandemic, global TV panel shipment reached a modest figure of 129.05 million pieces in 1H20, an 8.4% decrease YoY.

TrendForce analyst Jeanette Chan indicates that, as the pandemic stabilized in May, governments eased national lockdowns, and the U.S. governments started distributing stimulus payments, TV brands saw the perfect opportunity to stimulate consumer demand by engaging in discount pricing strategies. As TV manufacturers intensified their stock-up demand for TV panels, TV panel shipment reached 64.79 million pieces in 2Q20, a minor QoQ increase of 0.8%.

BOE led the industry in TV panel shipment in 1H20 while CSOT and INX trailed closely

BOE began adjusting its allocation of Gen 8.5 products in 2Q20 in order to capture the leftover display panel orders that emerged in the market following SDC’s exit from the LCD manufacturing business. Furthermore, since BOE maintained its past strategy of specializing in large-sized TV panels, BOE’s slight dip in TV panel manufacturing did not change its leadership position in the market, thanks to BOE’s enormous production capacity. BOE led the industry in TV panel shipment in 1H20 by shipping 23.26 million pieces, a 14.6% decrease YoY.

CSOT was the first panel manufacturer to resume operations following the outbreak-induced work stoppage, and the company registered its highest-ever performance in TV panel shipment in 1Q20 as a result. In 2Q20, CSOT’s TV panel shipment underwent a slight decline since the company increased its allocation of monitor panel and ultra-large-sized 85-inch TV panel manufacturing. However, CSOT was still able to increase its TV panel shipment in 1H20 by 8.3% YoY by reaching 21.3 million pieces due to its T6 fab reaching maximum capacity utilization this year, ranking the company number two in terms of TV panel shipment. INX recorded sluggish shipment in 1Q20 because of pandemic-induced issues in back-end module capacity. But the company saw its demand for mid- and small-sized TV panels recover in 2Q20 owing to momentum from the stay-at-home economy. Third-ranked INX’s TV panel shipment reached 20.34 million pieces in 1H20, a 7.2% decrease YoY.

HKC astonished with excellent YoY shipment growth in 1H20 with rising panel capacity

HKC’s TV panel shipment reached 13.93 million pieces in 1H20, a 99.8% increase YoY, which was by far the highest YoY increase among all panel manufacturers. In addition to increasing the panel capacity and shipment of the Gen 8.6 production lines at its Chuzhou and Mianyang fabs, HKC decided to eschew its past focus on small-sized panel manufacturing. These factors enabled HKC to score its excellent YoY growth.

Rising panel prices in 3Q20 means panel manufacturers are projected to make a recovery in their profitability

TrendForce believes that the panel manufacturers’ production capacities have now reached maximum utilization rates, driven by the simultaneous increase in panel demand and prices. Total TV panel shipment is likely to reach 67.8 million pieces in 3Q20, a 4.6% increase QoQ. In spite of this quarterly growth, the pandemic has caused a slowdown in new fabs’ capacity expansion. This, combined with the consistently high demand for IT panels, is expected to compress the shipment of TV panels, meaning TV panel shipment is still projected to show a 6.3% decrease YoY. Nevertheless, the reduction of TV panel supply is accompanied by strong demand from downstream clients. Therefore, TV panel prices are projected to undergo skyrocketing growth in 3Q20.