Oxide thin-film transistor (TFT) liquid crystal display (LCD) panels are increasingly adopted in mobile PCs due to their feature of high resolution while consuming low power.

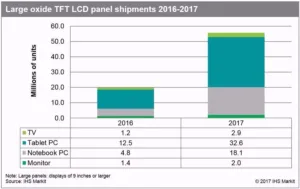

Global shipments of large oxide TFT LCD panels of 9 inches or larger are expected to grow from 20 million units in 2016 to 55.6 million units in 2017, according to new analysis from IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions. Of those, 51 million units are estimated to be applied to mobile PCs, which include notebook PCs and tablet PCs, up 200 percent from 17 million units in 2016.

“Demand for high-resolution panels has increased as media content for mobile PCs became available in higher resolutions,” said David Hsieh, senior director at IHS Markit. “Apple’ and Microsoft’s use of oxide TFT LCD panels for products – iPad, iPad Pro, and Surface, respectively – helped increase the oxide mobile PC panel market and encouraged other PC brands to follow suit.”

Low-temperature polysilicon (LTPS) and oxide TFT LCD solutions are major candidates for displaying high-resolution images, and they are expected to account for more than 19 percent of the entire mobile PC display market in 2017, according to the Large Area Display Market Tracker by IHS Markit.

While LTPS can deliver higher resolution images and consume less power than oxide TFT LCD or a-Si TFT LCD, it has its own limits: its production cost is high and the yield rate is low. In addition, it is less efficient to produce large panels. Albeit not as high resolution as LTPS, oxide TFT LCD panels still display high-resolution images better than the a-Si solution, and they are suitable to produce large panels at lower production cost than LTPS.

LG Display and Sharp have expanded their oxide mobile PC panel shipments aggressively by 180 percent and 370 percent, respectively. CEC Panda in China is estimated to increase its shipments from about 600,000 units in 2016 to 4.2 million in 2017. As some oxide panel suppliers are reducing their focus on the mobile PC display business, display makers in China and Taiwan, such as BOE and Innolux, are expected to produce more oxide panels in future, IHS Markit said.

The latest Large Area Display Market Tracker by IHS Markit provides information about the entire range of large display panels shipped worldwide and regionally, including monthly and quarterly revenues and shipments by display area, application, size and aspect ratio for each supplier.