Preliminary results from the IDC Worldwide Quarterly Personal Computing Device Tracker reveal a discouraging trend for the global PC market. During Q2’23, PC shipments experienced a significant decline of 13.4% compared to the previous year. This marks the sixth consecutive quarter of contraction, highlighting the enduring impact of macroeconomic headwinds, weak demand from both consumer and commercial sectors, and a shift in IT budgets away from device purchases. However, despite the overall poor performance, the market fared slightly better than initially projected for the quarter.

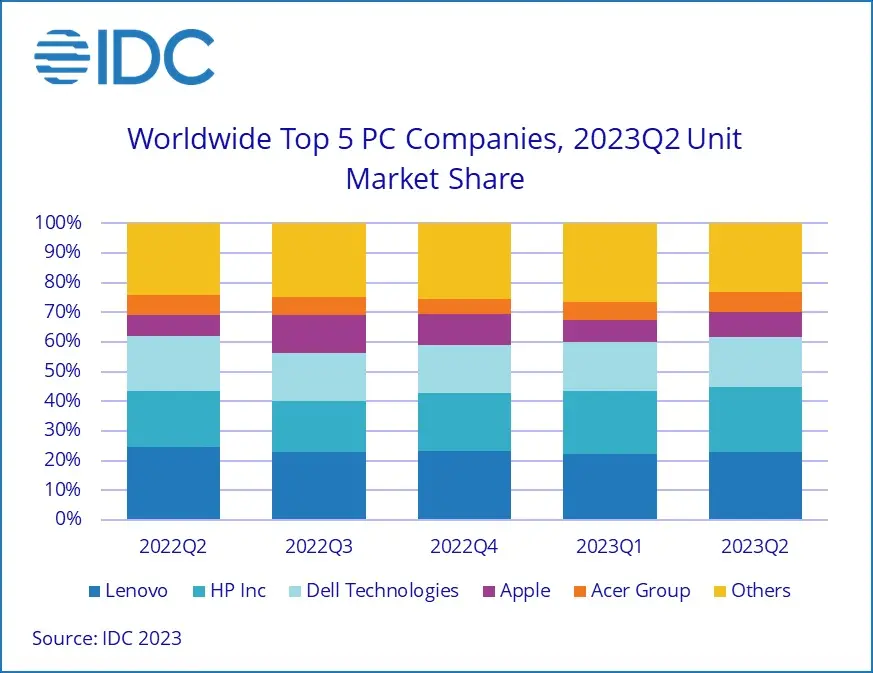

One prominent factor exacerbating the downturn is the prolonged presence of elevated inventory levels, exceeding normal thresholds. This surplus encompasses finished systems at the channel level, as well as within the broader supply chain. None of the leading PC manufacturers have remained immune to these challenges, with all companies, except for Apple and HP, experiencing double-digit declines in shipments during the quarter.

Apple enjoyed a comparative advantage due to a favorable year-over-year (YoY) comparison, benefiting from its recovery after supply chain disruptions caused by COVID-related shutdowns in Q2’22. Conversely, HP struggled with an oversupply of inventory over the past year but is now approaching normalized levels, enabling the company to showcase a growth rate amidst the ongoing market downturn.

| Company | Q2’23 Shipments | Q2′23 Market Share | Q2′22 Shipments | Q2′22 Market Share | Growth |

| 1. Lenovo | 14.2 | 23.1% | 17.4 | 24.5% | -18.4% |

| 2. HP | 13.4 | 21.8% | 13.5 | 19.1% | -0.8% |

| 3. Dell | 10.3 | 16.8% | 13.2 | 18.6% | -22.0% |

| 4. Apple | 5.3 | 8.6% | 4.8 | 6.8% | 10.3% |

| 5. Acer | 4.0 | 6.4% | 4.9 | 6.9% | -19.2% |

| Others | 14.4 | 23.3% | 17.2 | 24.2% | -16.5% |

| Total | 61.6 | 100.0% | 71.1 | 100.0% | -13.4% |