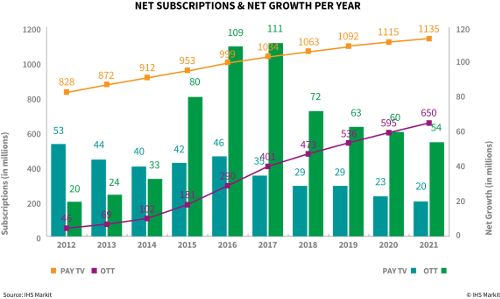

Digital pay TV subscriptions around the world, including cable, satellite and IPTV, exceeded one billion for the first time in 2017.

This global growth comes despite the continued uptake of over-the-top (OTT) subscription video services, like Netflix, Hulu and Amazon Prime Video, which added more than three times the number of subscriptions than pay TV last year, according to IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions.

“Although pay TV reached a new high, OTT net-subscriber additions outstripped net pay TV subscriptions in most regions globally,” said Fateha Begum, associate director of television media, IHS Markit. “Traditional pay TV operators have shown resilience in the face of increased competition, through continued investment in set-top functionality, exclusive content and on-demand services.”

Digital pay TV growth came largely from the Asia-Pacific region, which accounted for 83 percent of net additions, largely driven by IPTV growth in China. However, led by an increase in smartphone penetration and improvements in mobile data accessibility and affordability, there were three new OTT subscriptions for every new pay TV subscription in 2017 in the region. In comparison, Western Europe added eight OTT subscriptions for every pay TV net addition, while in Central and Eastern Europe the number of OTT and pay TV net additions were equal.

While OTT penetration remains low in the Middle East and Africa, the region will grow rapidly in the coming years, as both international and local players leverage their original content and partner with local pay TV operators and telcos. “We expect to see OTT subscriptions growing globally over the next five years, as Amazon and Netflix continue to invest in local and localized content, and as virtual pay TV operators start to appear and grow outside the US,” said Irina Kornilova, principal analyst of home entertainment, IHS Markit.

Unlike other regions, digital pay TV subscriptions in North America continued to decline, losing 3 million homes in 2017, while OTT subscriptions increased by nearly 30 million. “Pay TV services in North America continue to be affected by cord cutting, primarily due to higher average prices for pay TV subscriptions, compared to other global regions,” Begum said.

IHS Markit has prepared an interactive map, which provides even more detailed information about the global market for television and the online video market.